This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

SBRI – Small Business Recovery Index: February 2021 Update

What’s new for the SBRI in February? You can read on to find out more about SBRI February updates, but you’ll also want to read our March 2021 update to get the latest about the Small Business Recovery Index.

The U.S. economy is set up for a healthy recovery this spring after a February surge in hiring at restaurants and other hospitality businesses. While employment and payrolls remain off from pre-pandemic levels in several hard-hit services and leisure industries, the Small Business Recovery Index (SBRI) reveals positive signals in economic mobility as household incomes rose and personal savings rates approach a level not seen since WWII, leading to expectations for a large consumer-led boom.

Let’s take a look at this month’s SBRI snapshot of the health of small businesses by industry and geography.

Key SBRI takeaways of February 2021:

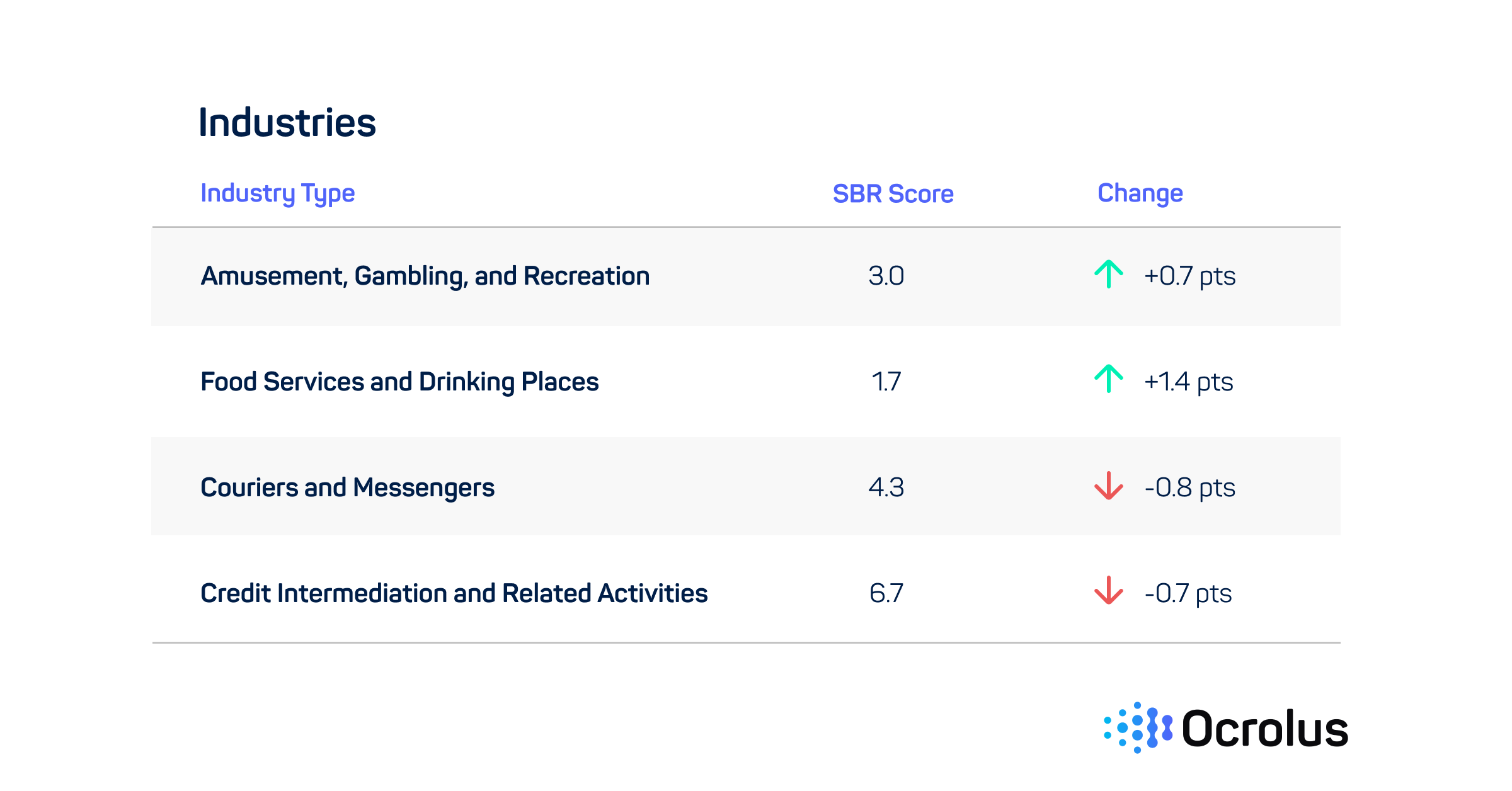

- Industry resilience indicates a reversion to the mean, where sectors of the economy that outperformed in the summer and winter months of the Pandemic, like credit intermediation and courier services, are growing at a slower pace, while foodservice and leisure industries are showing signs of nascent small business recovery.

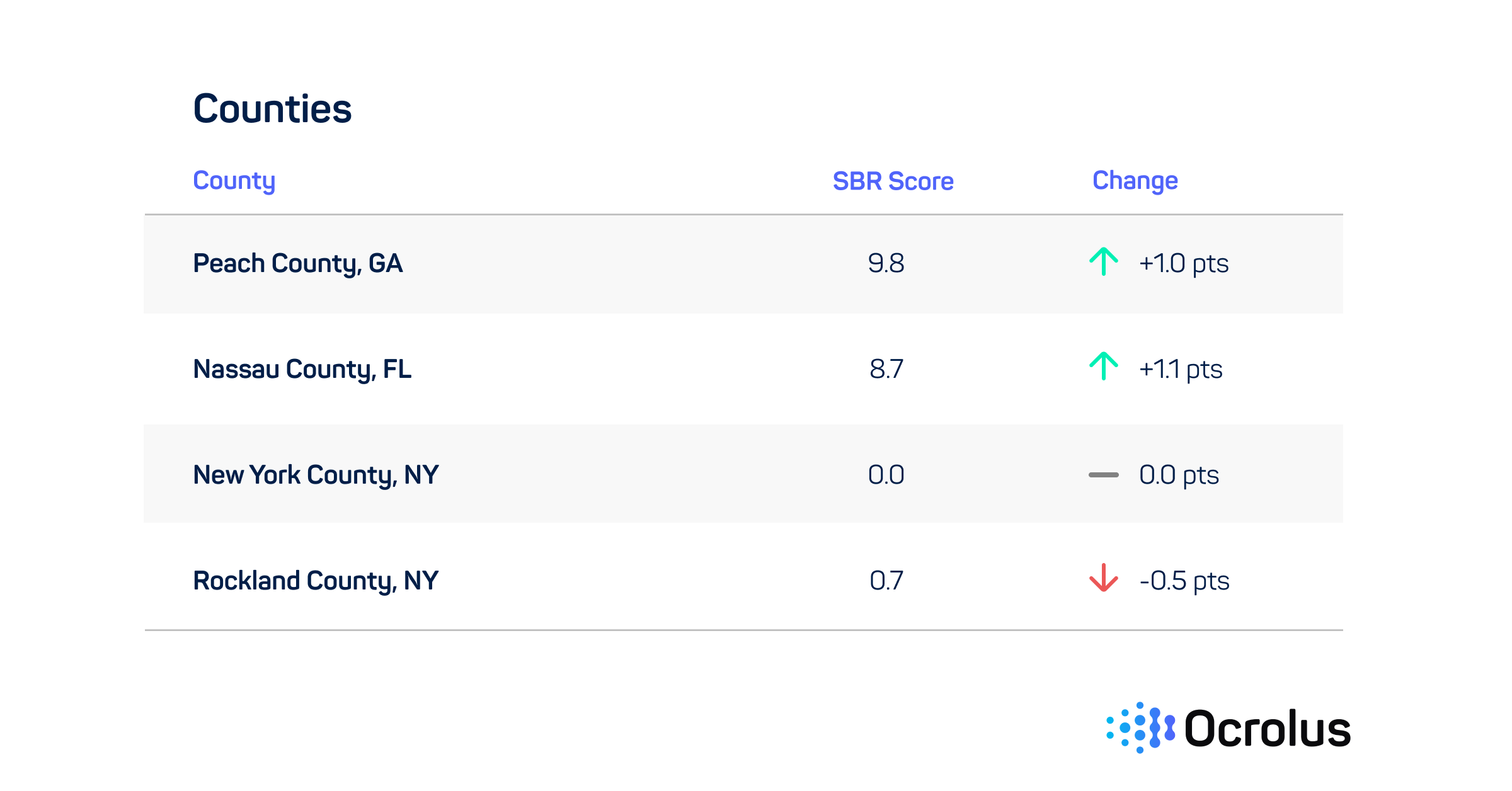

- While SBR scores by industry show signs of a reversion to the mean, SBR scores by geography continue to display the K-shaped pattern of recovery. Further, counties in the South continue to perform strongly, while counties in New York and California show weakness, reflecting the outsized impact of business restrictions in small business recovery.

MSA Region Indexed Recovery Score Chart

- Looking ahead for small business recovery, with lower levels of Covid-19 infections, greater rates of vaccination, and further government stimulus to households and small businesses, we expect to see robust recovery across the economy, albeit at differing rates of growth.

What is the Small Business Recovery Index (SBRI) by Ocrolus?

As a recap of the SBRI, Ocrolus is committed to supporting the lending community in its understanding of underlying credit risk with real-time income and cash flow analytics derived from bank account data and other sources. The amalgamation of highly relevant external data at the regional level, combined with proprietary Ocrolus insights at the borrower level, provides a window into the resilience and prospects for recovery for millions of businesses in the U.S. This is what the Small Business Recovery Index (SBRI) seeks to capture — a real-time snapshot of the health of small businesses by industry and geography.

Interested in learning more about the SBRI and small business health recovery in general? Check out our Q1 2022 research report on the Small Business Health Index.

Sign up for our Ocrolus Insights Newsletter and receive the latest insights from the Ocrolus blog.