This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Detect empowers you to make quicker AI-driven financial services decisions and onboard more customers lending decisions and confidently approve more borrowers.

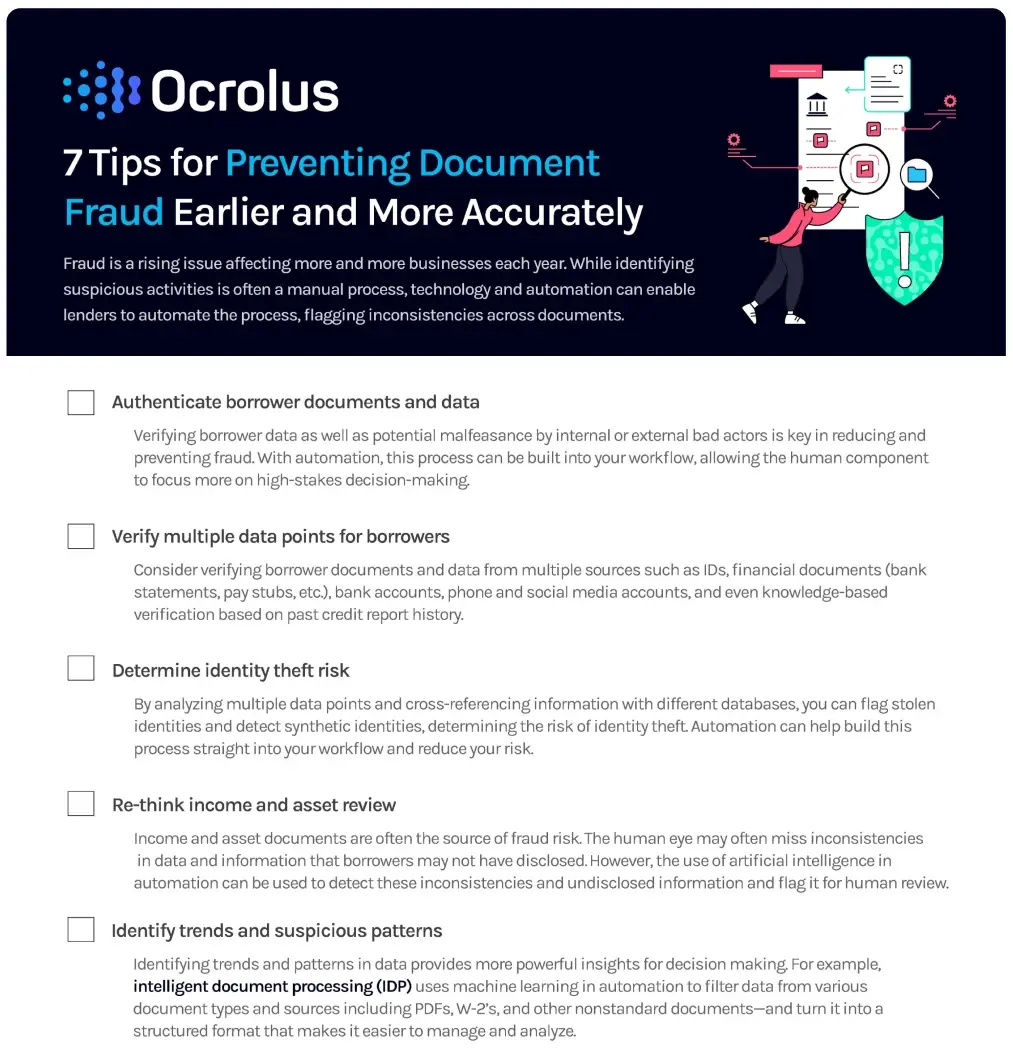

Ocrolus’ premier document fraud detection solution helps you uncover more fraud than ever before. Our algorithms have been trained on hundreds of millions of documents from thousands of financial institutions, providing you with only the highest quality data for decision making.

Stop fraud in its tracks

Detect leverages by highly accurate machine learning models, AI and an unrivaled document library to uncover fraud with ease. Spot subtle anomalies and inconsistencies that manual review often misses with robust features such as an Authenticity Score, file tampering signals and visualizations.

Avoid costly losses

Instantly learn where a document has originated from and see exactly what has been changed, helping you steer clear of suspicious actors. Detect’s detailed signals and visualizations provide you with all of the information you need to make the most informed decisions and the most impact on your bottom line.

Effortlessly streamline and automate your workflows

Detect offers everything you need to build and customize your fraud workflows to ensure the highest efficiency gains. Save countless hours on review and spend more time focusing on your customers.

Frequently Asked Questions

Document fraud detection is the process of using automation and machine learning to identify fraudulent or tampered information across documents that pose a risk to your business. Learn more here.

Ocrolus’ advanced Detect solution uses best-in-class AI and machine learning models to detect fraudulently modified or tampered documents. Detect offers specific indicators and visualizations that can be used to justify a claim of fraud.

Detect empowers lenders to make quicker lending decisions by identifying intentional document tampering. It provides visualizations and signals that highlight exactly where tampering has occurred, allowing lenders to save time on manual inspection, remove ambiguity and confidently process more loans.

Ocrolus’ Detect solution is beneficial for various industries, including financial institutions, lending companies, fintech companies, and any businesses that rely on document verification to mitigate fraud risks.

Document fraud detection is crucial for businesses to protect themselves from financial losses, reputational damage, and compliance violations. It helps ensure the authenticity and integrity of documents, enabling more secure decision-making processes.

Automated document fraud detection solutions, such as Ocrolus’ Detect, use AI and machine learning models to analyze documents quickly and accurately. This automation reduces the need for manual inspection, saving valuable time and resources for businesses.

Detect is amazing! We have been able to save millions by mitigating risk and staying ahead of potential loan buy-backs due to fraud.”