Income calculations have always been fairly laborious. However, they’ve become even more time-consuming thanks to the increase in non-traditional borrowers using cash flow rather than credit scores to qualify for a loan. This means mortgage lenders are looking for ways to efficiently and accurately process 6, 12, or even 24 months worth of bank statements.

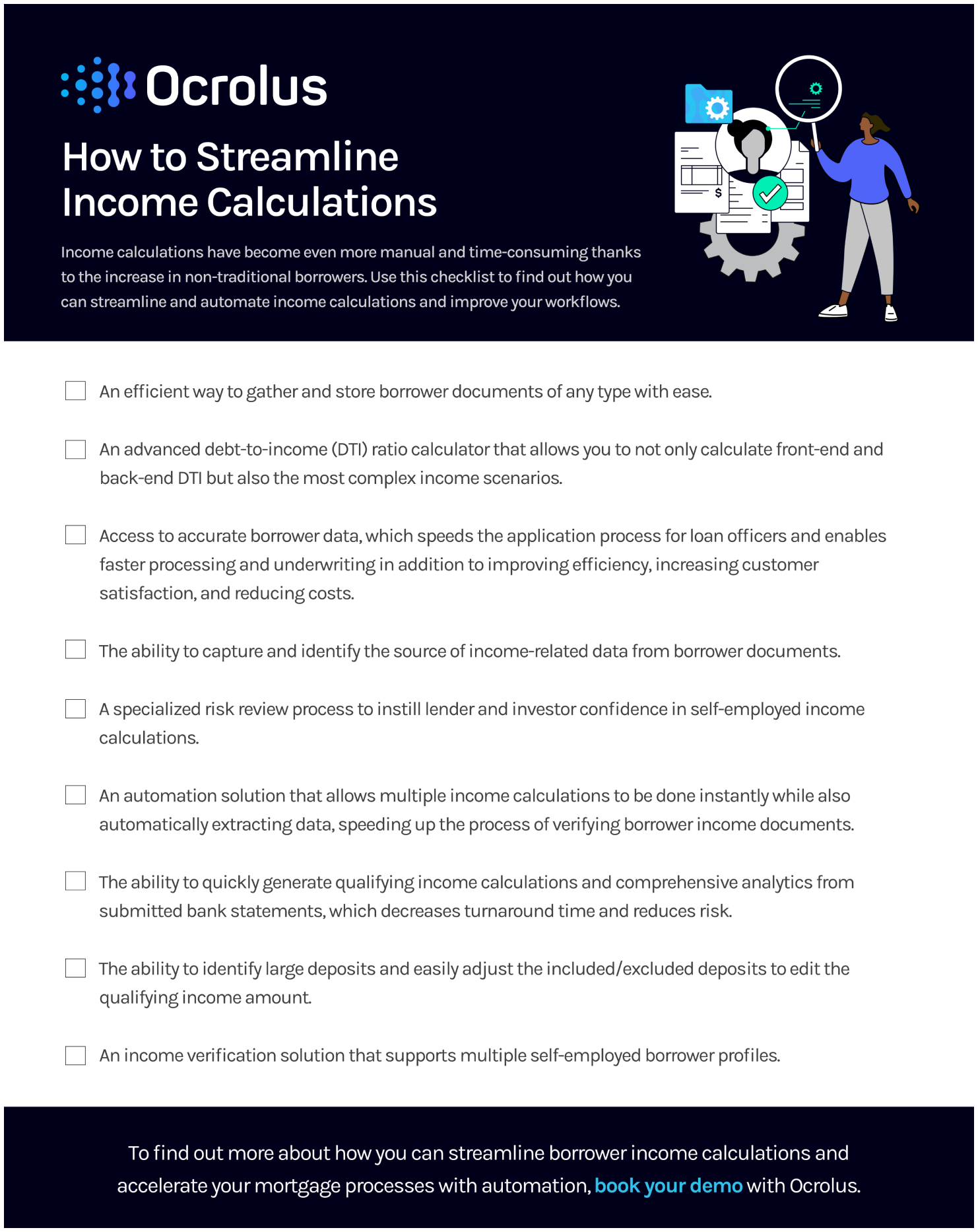

What do you need to streamline and automate borrower income calculations, improve process efficiency, and make faster and more accurate lending decisions? We’ll tell you in our free checklist.

Here’s a preview of the first three tips:

- An efficient way to gather and store borrower documents of any type with ease.

- An advanced debt-to-income (DTI) ratio calculator that allows you to calculate not only front-end and back-end DTI but also the most complex income scenarios.

- Access to accurate borrower data, which speeds the application process for loan officers and enables faster processing and underwriting in addition to improving efficiency, increasing customer satisfaction, and reducing costs.

Download the complete checklist

*No email required