This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Achieve rapid, unparalleled efficiency with AI-based document processing

Ocrolus is on the cutting edge of AI and pioneered marrying machines and humans for data verification. Start making fast, accurate decisions with our document processing software today.

Quickly sort documents with precision using AI and machine learning

Attain best-in-class accuracy

Combine machine learning with human validation to get precise data every time.

Eliminate manual work

Save time by reducing the need for document pre-sorting.

Drive efficiencies

Retrieve structured, indexed output for all document types, enabling you to notify borrowers of incorrectly submitted or missing information quickly.

Instantly extract and structure data using computer vision and human validation

Increase accuracy

Generate over 99% accurate results on every file.

Accelerate processing speed

Analyze documents instantly or in minutes, 365x24x7.

Scale dynamically

Flex-up-or-down on demand.

Bolster compliance

Create a comprehensive audit trail of key data fields.

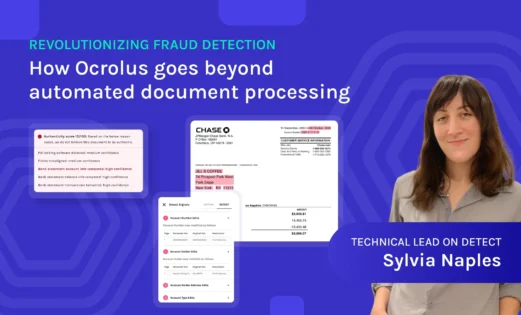

Rapidly identify suspicious activity and potential fraud with file tampering detection and algorithmic validation

Reduce fraud risk

Highly contextualized output ensures that you have all of the information you need to make more informed, confident decisions

Minimize fraud losses

Flag suspicious activity with Detect’s Authenticity Score, file tampering signals and visualizations to keep your business safe

Future-proof your business

Stay ahead of fraudsters with continuously learning algorithms and an expansive network of data from Ocrolus’ client base

Provide quicker decisions

Automate and streamline review processes and keep your customers happy and get decisions to them faster than ever before

Instantly gain deep insights into cash flow and income with clean, normalized data

Approve more borrowers

Combine document data in all formats with digital sources to accommodate the widest possible range of borrowers.

Simplify cash flow and income calculations

Develop a precise picture of your customers’ cash flow dynamics without the headache or hassle

More informed decision making

Measure a borrower’s ability to pay with higher precision than traditional data sources alone

Build flexible, automated workflows

Integrate Ocrolus output directly into your CRM or LOS

Ready to go?

See how our intelligent document processing software can optimize your ability to analyze documents and make financial decisions quickly with AI.

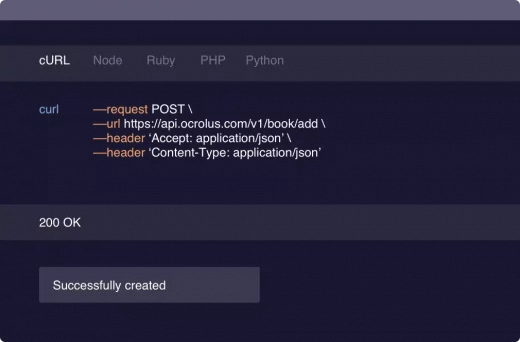

Explore our API

Our API documentation includes guides, references, and tutorials on document processing and AI-driven automation that show you what it’s like to work with Ocrolus.

Revolutionizing fraud detection: How Ocrolus goes beyond…

Frequently Asked Questions

Document processing involves converting physical documents into a digital format. With Ocrolus, our intelligent document processing solution utilizes AI and machine learning to automate the extraction and structuring of data from various types of documents.

Document processing is crucial for businesses as it helps to digitize and automate the handling of various types of documents. It improves efficiency, reduces manual work, enables faster processing, and enhances data accuracy, ultimately leading to better decision-making and improved customer experience.

Intelligent document processing combines technologies like machine learning, natural language processing, and workflow automation. It mimics human abilities to identify, contextualize, and process documents, converting unstructured data into digital formats that can be integrated into daily business processes.

Ocrolus’ document processing automation enhances efficiency and accuracy. It enables lenders to quickly and accurately analyze borrower information, calculate income and cash flow metrics, detect potential fraud, and make informed lending decisions.

Yes, Ocrolus can integrate with CRM (Customer Relationship Management) or LOS (Loan Origination System) platforms. The output from Ocrolus can be seamlessly integrated into your existing systems, allowing for efficient workflow and decision-making processes.

Ocrolus can process a wide range of documents, including bank statements, tax forms, pay stubs, invoices, loan applications, and more. It has the capability to handle both structured and unstructured data found in these documents.

Ocrolus’ document processing solution can be used in lending, fintech, financial services and many more businesses. Learn more about how Ocrolus specifically helps small business lenders and mortgage lenders.