Evaluate risk through multi-source employment verification.

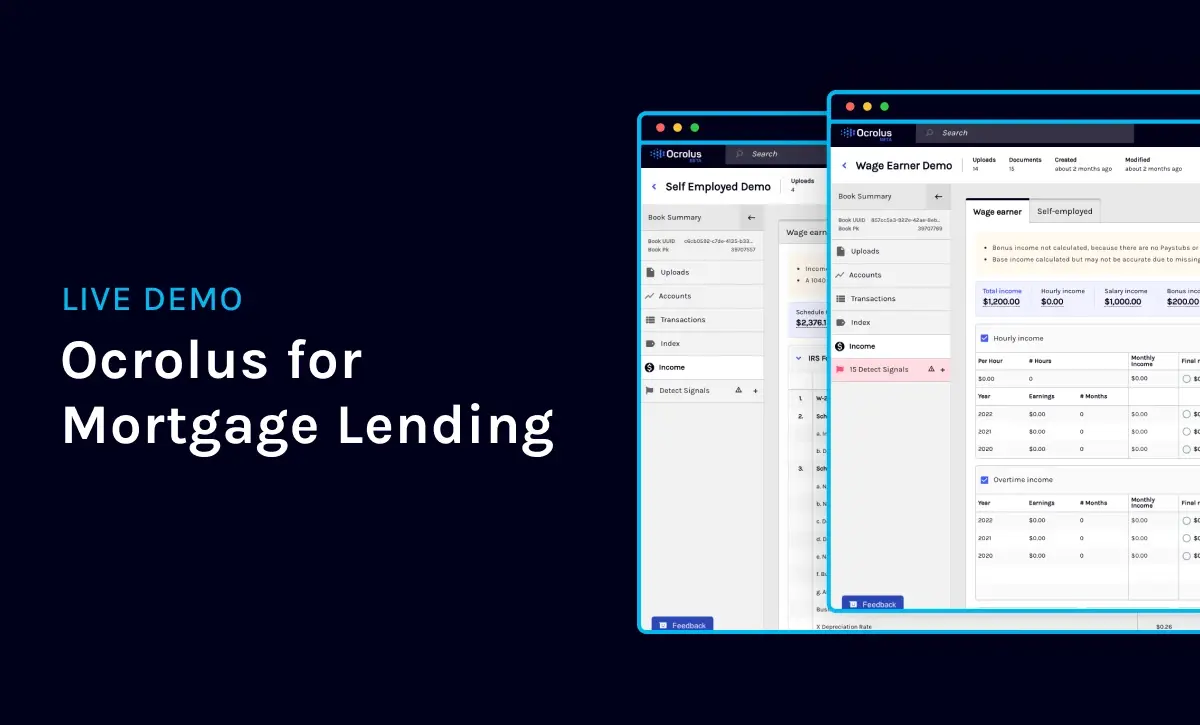

Our mortgage employment verification technology transforms employment documentation into structured data. It works with everything from pay stubs and The Work Number forms to W-2s and verification letters, regardless of document quality. Our AI and Human-in-the-Loop document process automation accelerates processing and contributes to faster decisions.

Verify employment quickly and reduce turnaround time

Save your underwriters and loan processors time and effort by verifying employment data and income across bank statements, pay stubs, W-2s, and tax returns quickly and efficiently.

Improve customer satisfaction through convenient employment data submission

Surprise and delight your customers by completing KYC (Know Your Customer) checks within minutes. Enable applicants to submit employment data and documentation in ways that work for them – even smartphone images. Loan decisions accelerate, customer satisfaction rises, and your brand gets a boost.

Compare employment documents with ease

Cross-source validation automatically compares fields across multiple employment documents and data sources. Eliminate time-consuming and error-prone “stare and compare” work and reduce time to decision.

Ocrolus technology elevated our bank statement analysis capabilities to the next level.”

Frequently asked questions

Employment data verification is the process of confirming a borrower’s work history with documents such as W2s, paystubs, and Work Number forms.

Yes, Ocrolus can provide employment verification for a mortgage loan. Our mortgage employment verification technology transforms employment documentation into structured data, helping lenders to evaluate risk through multi-source employment verification.

Regardless of document quality, Ocrolus can verify employment using many types of employment verification documents such as bank statements, pay stubs, W-2s, tax returns, The Work Number forms, and more.

Banks typically verify pay stubs or bank statements by requesting a copy of the document from the applicant and then reviewing it to ensure that it is accurate and legitimate. This process can be done manually but is more efficient and accurate when using human-in-the-loop automation. The goal of this process is to confirm that the information on the pay stub or bank statement matches the applicant’s employment and financial history, and that it has not been altered or falsified in any way.