This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Use Business Process Automation for Fast and Accurate Financial Decisions

Business process automation (BPA) is transforming mortgage, banking, and small business lending by replacing legacy manual processes with AI-driven document processing.

Understanding Business Process Automation

What is Business Process Automation (BPA)?

Business process automation involves the use of software for data manipulation, document management, record-keeping tasks, and analysis. The use of BPA is aimed at improving workflow efficiency in business processes.

The Evolution of Business Process Automation

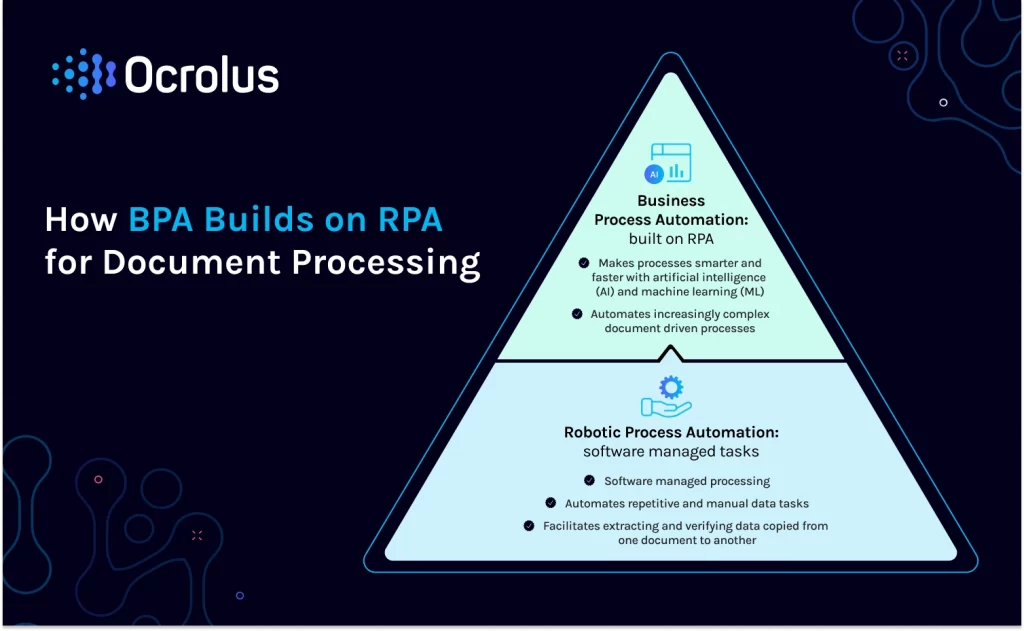

BPA has evolved from robotic process automation (RPA) for document processing to data-driven analytical tools powered by artificial intelligence (AI) and machine learning (ML). State-of-the-art document processing automation is built on a foundation of RPA, in which software manages tasks that don’t require human insight. RPA is well-suited for routine information, such as data collected in form fields. It also facilitates extracting and verifying data that is being copied from one document to another.

RPA is increasingly being integrated with human decision-making in order to optimize document management. This hybrid technology combines machine processing power and speed with human analysis and insight. The result is unparalleled document processing efficiency that automates classification, capture, and analysis.

Intelligent document processing combines document-driven workflows and data-driven workflows into a system that enables enterprises to digitize documents and extract the data into a structured format for analysis. This unlocks the value of data stored in customer documents and business archives. Automation facilitates database updates while, at the same time, providing analytics tools to help users structure and analyze their data for business insights.

Enterprises can use the data generated from automated document processing for predictive modeling. Automated document capture also fuels data-driven workflows that enable the use of machine learning artificial intelligence for analysis.

Automation streamlines the loan process by simplifying everything from online form completion to review and due diligence. Automated review facilitates a faster and more accurate loan approval process. Increased efficiency is motivating lenders to use automation to help reduce costs, eliminate paper forms, and improve underwriting accuracy.

Document- and Data-Driven Workflows

Document- and data-driven technology enables organizations to customize business workflow automation solutions. For example, lending automation replaces often-complex manual loan processes in which applicants are required to complete multiple repetitive documents and submit them in person or via email as separate files. Business workflow automation reduces much of the friction in manual processes, reduces operational costs, and streamlines approvals.

Technology also enables organizations to process and extract data from any image or document with a high level of accuracy. Among the many types of documents that can be handled by business workflow automation systems are:

Ready to learn more? Book your demo.

Key Benefits of Business Process Automation in Document- and Data-Driven Workflows

Expedite Workflows and Improve Efficiency

Automaton is the key to implementing workflow management solutions that enable businesses to manage and process different document types with multiple form fields. The ability to index and organize without pre-sorting expedites the workflow process and eliminates much of the burden associated with manual data entry and validation.

Modern document automation solutions have evolved way beyond simple records management. Solutions range from document scanning and review to processing and analysis. What’s more, capture-to-process integration with records management gives compliance departments access to document and usage data, streamlining verification and audit inquiries.

AI-driven automation enables documents to be processed using natural language recognition and semantic analysis techniques. This facilitates real-time analysis of transactional documents. It also provides a way for fintechs and other businesses to use insights from proprietary data to streamline existing services and to create new products and services. For example, analyzing data from bank statements — and mapping that information against the performance of its loans — can help lenders optimize pricing and risk models and make better lending decisions.

Scale More Easily

BPA gives businesses the ability to scale more easily and meet demand. Automation can handle increased or decreased volume, reducing workforce volatility. The combination of machine learning automation and human decision-making also enhances the ability of lenders to classify documents. Data can be extracted more efficiently and validated through both AI and human review. That data can then be used to improve cash flow calculations and income metrics, helping lenders build better risk models.

Reduce Fraud

Business process automation is also a powerful tool for reducing fraud. Automation improves a lender’s ability to identify suspicious activity. Rather than identifying suspicious activities using a manual process, lenders can use technology — in tandem with human analysis — for automated review of borrower documents and data.

Moreover, automation is well-suited for helping to review income and asset documents, which are often the source of fraud risk. AI can be used to detect inconsistencies and to identify information that borrowers may have been altered. This can range from undisclosed properties and hidden debts to bankruptcies and forged documents.

Algorithmic fraud detection can, for example, identify file tampering and inconsistencies in borrower documents. Lenders also are benefiting from automation that expedites credit reviews while reducing risk. This includes support for know your customer (KYC) and anti-money laundering (AML) compliance.

Automated document review helps lenders verify borrower data as well as potential mischief by internal personnel. Technology also can help standardize a fintech’s fraud reporting process. Ultimately, streamlining the fraud review process reduces the number of bad loans, while enabling faster lending decisions.

Industries Benefiting From Workflow Automation

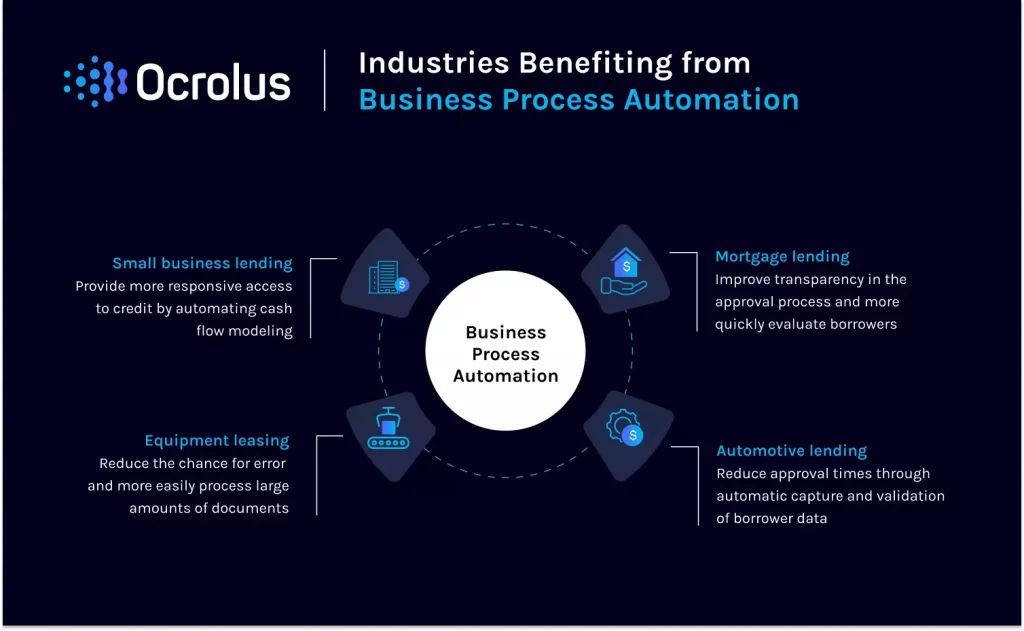

Small Business

Small business lending automation helps companies deliver financial services to their customers. One of the ways in which companies benefit from automation is by using small business lending software that integrates document and data processing with cash flow analysis and fraud detection.

Integrating automated document and data processing with fraud detection and detailed cash flow analytics empowers small businesses to onboard customers more efficiently, manage risk, and offer credit terms with confidence. Among the many benefits of automation for small business lenders are lower customer acquisition costs and the ability to use machine learning to develop cash flow-based models that improve underwriting and reduce exposure to risky customers.

ForwardLine Financial, for example, is using BPA to capture historical borrower data and more effectively analyze credit risk. Automation also has expedited the ability of ForwardLine borrowers to submit supporting documentation for loans, and has reduced loan approval time from three hours to under 45 minutes.

Mortgage Lenders

Fintechs are improving efficiency with mortgage automation that uses automated loan processing to help make decisions faster and more accurately.

Mortgage process automation improves mortgage workflow transparency and user control for lenders, which translates into better decision-making. The key to success is implementing user-friendly technology that complements human-centric analysis, instead of replacing it.

Mortgage processing software should reduce friction by integrating proven technology with a relatively low learning curve and a clear synergy with existing workflows. In particular, automation needs to deliver value-added benefits, such as document sorting, document validation, and income calculations.

Mortgage loan origination automation is particularly beneficial for the key internal stakeholders involved in the workflow process, including originators, processors, underwriters, and closers. Successful implementation of automated solutions for mortgage processing requires accurate mortgage origination data to ensure the quality of submissions for underwriting. Building trust requires workflow transparency and dependable, error-free document processing. Lenders need to be able to easily track, verify, update, and record during every step in the workflow process.

Exclerate Capital is an example of a mortgage lender that has benefited from automation. Implementing a mortgage automation solution decreased underwriter document review time from two hours to under 30 minutes. It also facilitated the automated review of more than a million pages of loan documentation each year.

Moreover, Blend is using human-in-the-loop automation for digital mortgage workflows. Automation improves document classification and data capture, and streamlines the lending process for loan officers and consumers.

Automotive Lenders

Automating auto lending can significantly reduce approval cycle times, while reducing costs and risks for the lender. One of the primary benefits of automotive lending solutions is the ability to digitize and validate cumbersome paper documents, such as pay stubs, bank statements, and personal IDs.

Automation also expedites the ability of lenders and underwriters to review and analyze loan applications. Using AI to extract relevant information from paper documents enables automotive lenders to automate their workflows. AI is particularly useful when it comes to validating borrower data, such as employment information, income, and assets.

An automation solution that combines AI with human analysis ultimately improves data capture, validation, classification, and fraud detection. Automation enables loan officers and underwriters to concentrate on validation and customer service.

Equipment Leasing

Equipment leasing automation enables lenders to improve both efficiency and compliance. Replacing manual processes with automated solutions reduces human error and eliminates much of the redundancy required for compliance. Moreover, automation expedites the documentation process, reducing overhead for equipment lessors.

Automation is also essential for the capture and review of borrower documents, which can help to expedite approval for long-term leases. The ability of leasing companies to automate the analysis of loan documents facilitates faster lending decisions based on complete and accurate data.

Why You Should Invest in Business Process Automation

Essentially, business process automation enables lenders to use intelligent automation to support faster and more accurate financial decisions. When an organization has especially document-heavy workflows, BPA that incorporates document automation creates a strong foundation for the digital lending ecosystem, facilitating accurate credit decisions across the fintech, mortgage, banking, small business, and equipment leasing ecosystems. Better access to trusted data and higher efficiency translate into lower risk, higher margins, and more satisfied customers.