This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Speed up the underwriting process with automated paystub data capture and form processing

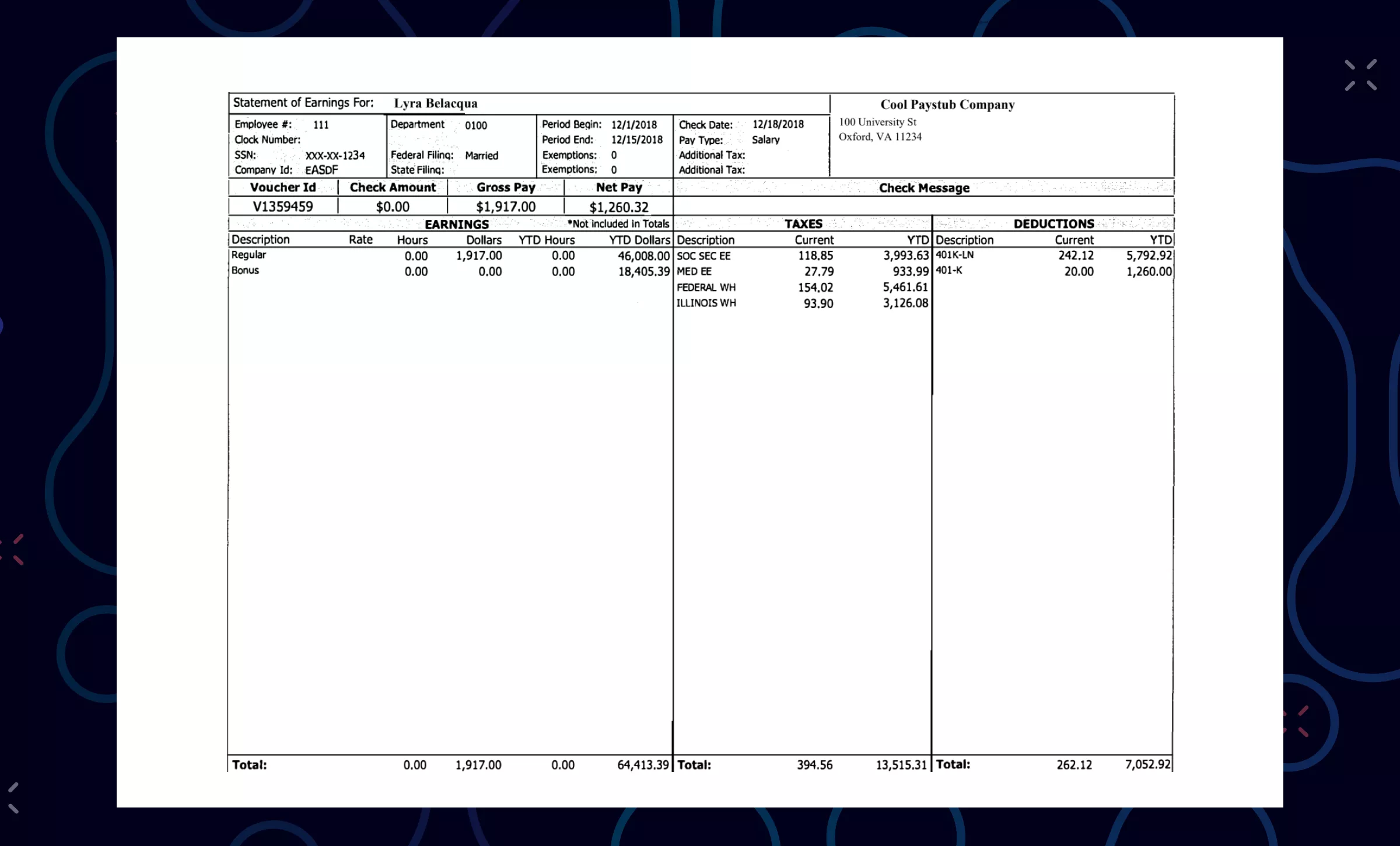

Ocrolus’ Human-in-the-Loop document processing automation solution captures and extracts data from paystubs to help you make smarter, faster lending decisions.

Why should lenders use Ocrolus for paystub data capture and form processing?

Loan underwriters process paystubs to verify borrower income. Without a reliable intelligent document processing solution, lending professionals spend hours manually processing paystub data to verify a borrower’s income, often resulting in human error and inaccuracies.

Ocrolus automated paystub processing solution provides a better borrower experience by speeding up the entire underwriting process and empowering underwriters to make smarter decisions with trusted, accurate data.

Advantages of Ocrolus’ automated paystub processing

Retrieve data from paystubs regardless of format or image quality

- Verify borrower income in minutes

- Develop robust, data-driven income assessments

- Increase originations with an expedited underwriting process

- Identify suspicious activity and potential fraud with tampering detection

Ocrolus' document processing stats

financial pages analyzed

documents flagged for suspicious activity

business loan applications analyzed