This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

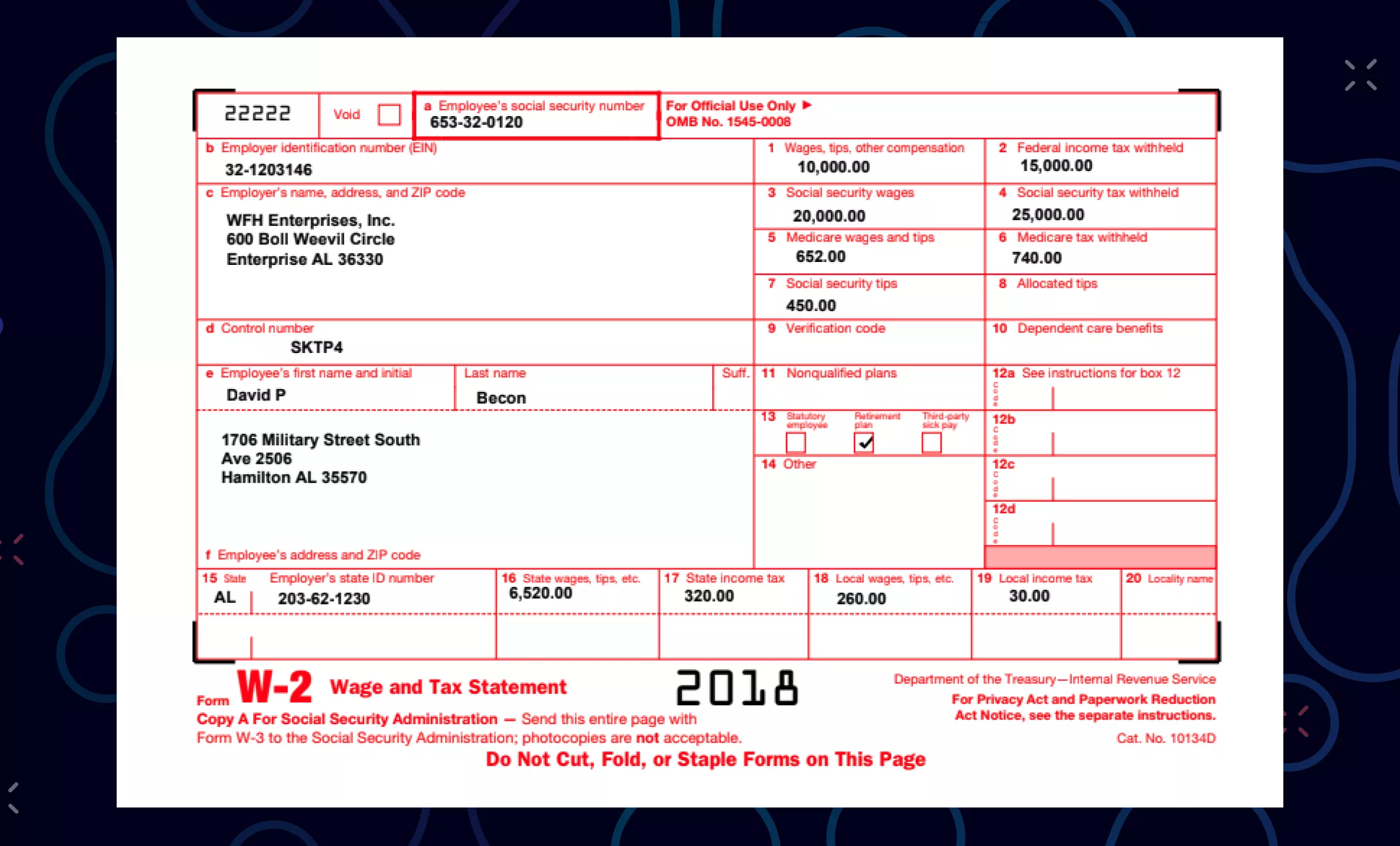

Leverage intelligent automation for W2 data capture and document automation

Ocrolus supports document classification and data extraction of W2 forms for faster, more accurate lending decisions. Our Human-in-the-Loop automation solution processes and analyzes W2s with over 99% accuracy.

Why should lenders use Ocrolus for W2 data capture and form processing?

Loan underwriters process W2s to verify borrower income. Without a reliable intelligent document processing solution, lending professionals spend hours manually processing W2 data to verify a borrower’s income, often resulting in human error and inaccuracies.

Ocrolus automated W2 processing solution provides a better borrower experience by speeding up the entire underwriting process and empowering underwriters to make smarter decisions with trusted, accurate data.

Advantages of Ocrolus’ automated W2 processing

Retrieve data from W2 regardless of format or image quality

- Verify borrower income in minutes

- Develop robust, data driven income assessments

- Increase originations with an expedited underwriting process

- Identify suspicious activity and potential fraud with tampering detection

Ocrolus' document processing stats

financial pages analyzed

documents flagged for suspicious activity

business loan applications analyzed