This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Small Business Recovery Index (SBRI): March 2021 Update

What’s the latest update for small business recovery and the Ocrolus Small Business Recovery Index (SBRI)? Let’s find out!

U.S. economic recovery, including small business recovery, continues to pick up steam as consumers increased their spending last month, particularly on in-person services. A growing number of external data sources are pointing to pent-up demand and robust recovery from home prices that are rising at the fastest pace in 15 years to airport volumes that are hitting their highest levels in a year in March.

Importantly, these macro trends are being positively reflected at the small business and micro-level as applications for small business loans reveal sharp spikes over the past month. The application volume that we are seeing internally at Ocrolus indicates small business recovery and optimism, particularly in industries hard hit by the pandemic, as consumers grow more comfortable dining, shopping and traveling outside their homes.

Key takeaways from March 2021 for Small Business Recovery:

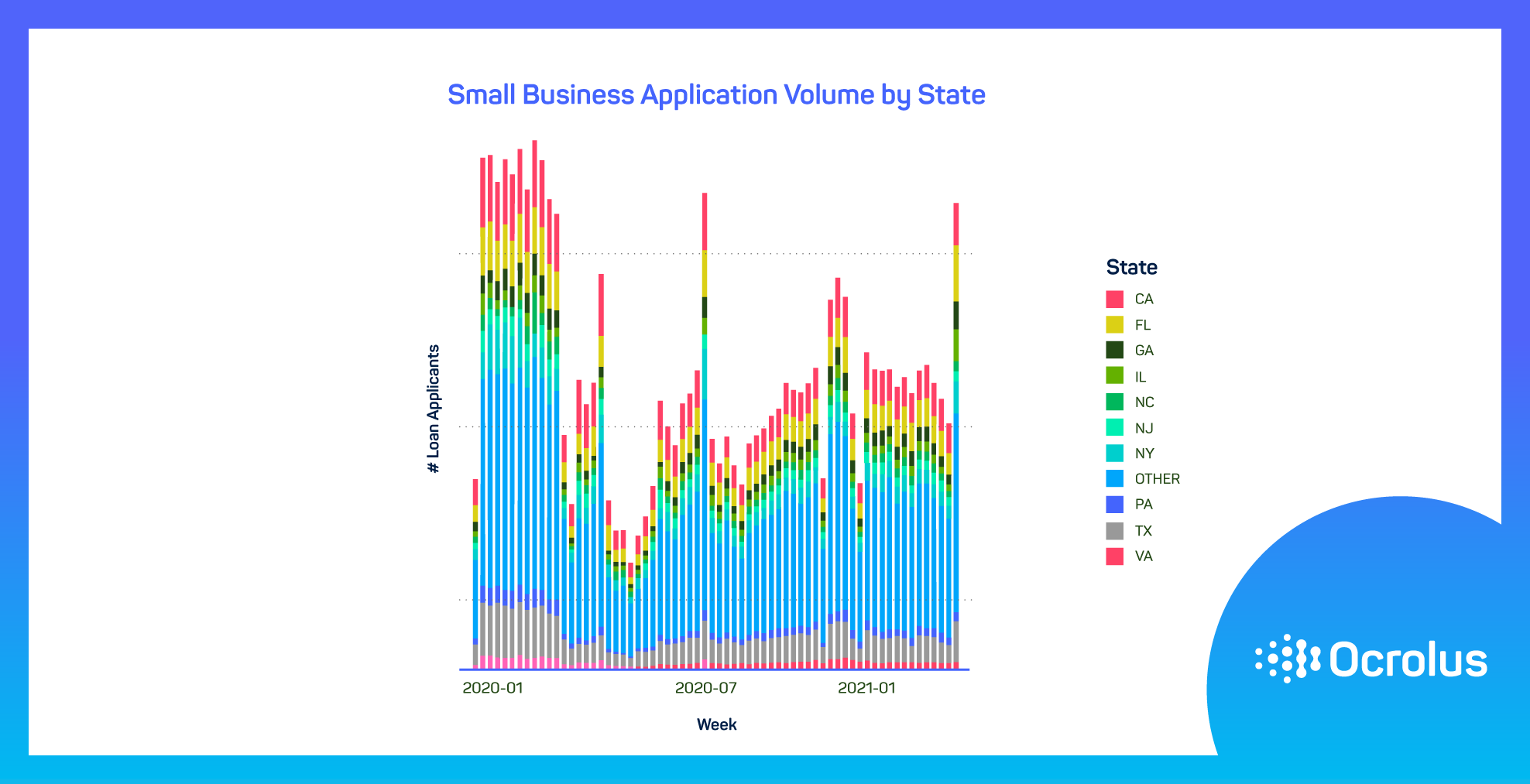

- Small business loan application volume soared across the board in March, however most acutely in Florida, Illinois, Texas and New York

Small Business Application Volume by State

| Small Business Application Volume | |

| State | Month-over-Month Increase |

| Florida | +207% |

| Illinois | + 536% |

| Texas | +127% |

| New York | +249% |

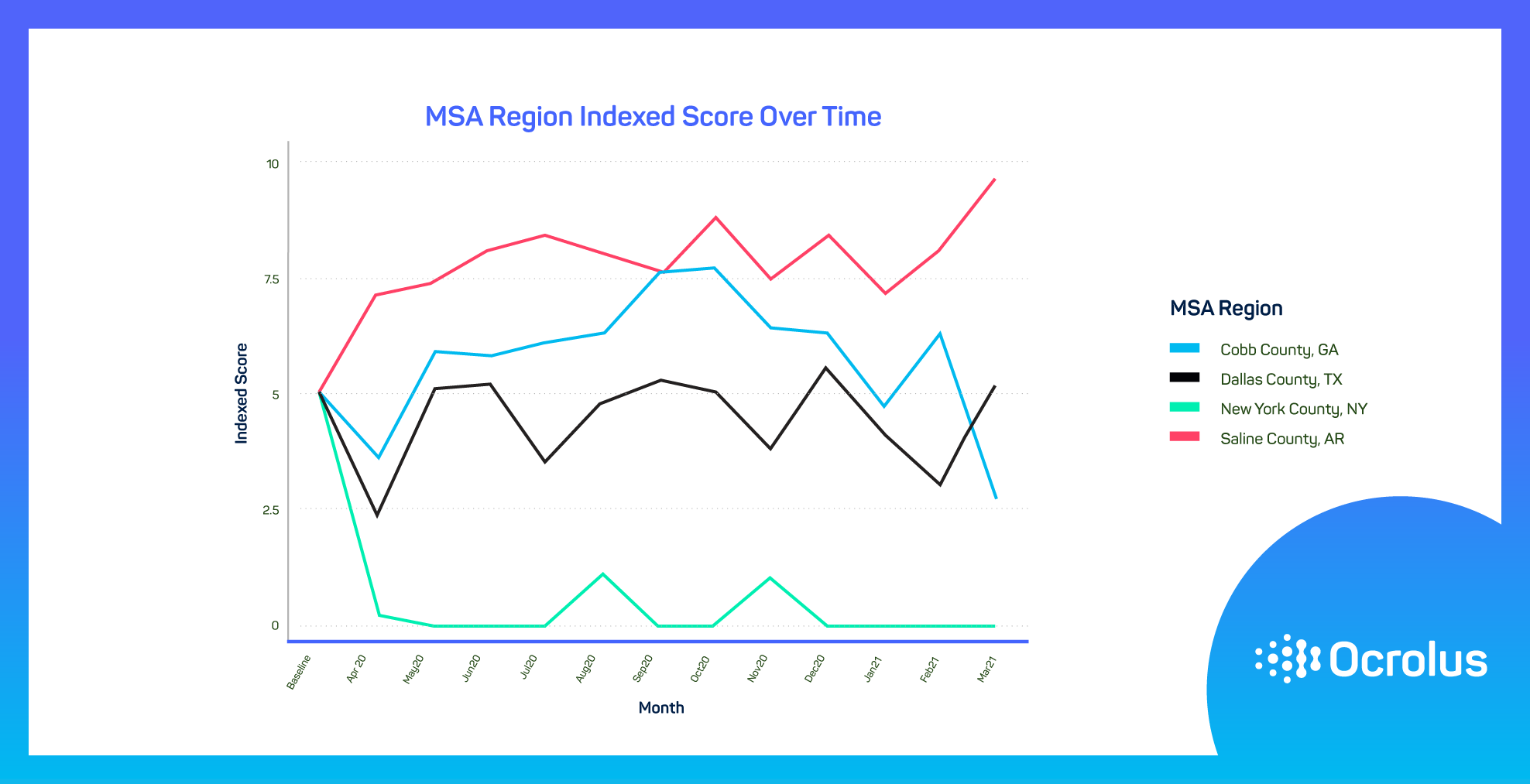

- The small business recovery scores, or SBR scores, by geography continue to highlight that the coastal regions most affected by the pandemic still face lengthy recoveries. Texas rebounded remarkably well from a drop largely attributable to cold weather and snowstorms. However, when analyzing small business recovery in areas of the country that depend largely on tourism, including Nevada and Hawaii, they still remain below pre-pandemic levels.

MSA Region Score Indexed Over Time

| MSA Index | ||

| County | SBR Score | Change |

| Saline County, AR | 9.4 | +1.5 pts |

| Dallas County, TX | 5.0 | +2.1 pts |

| Cobb County, GA | 2.5 | -3.7 pts |

| New York County, NY | 0.0 | flat |

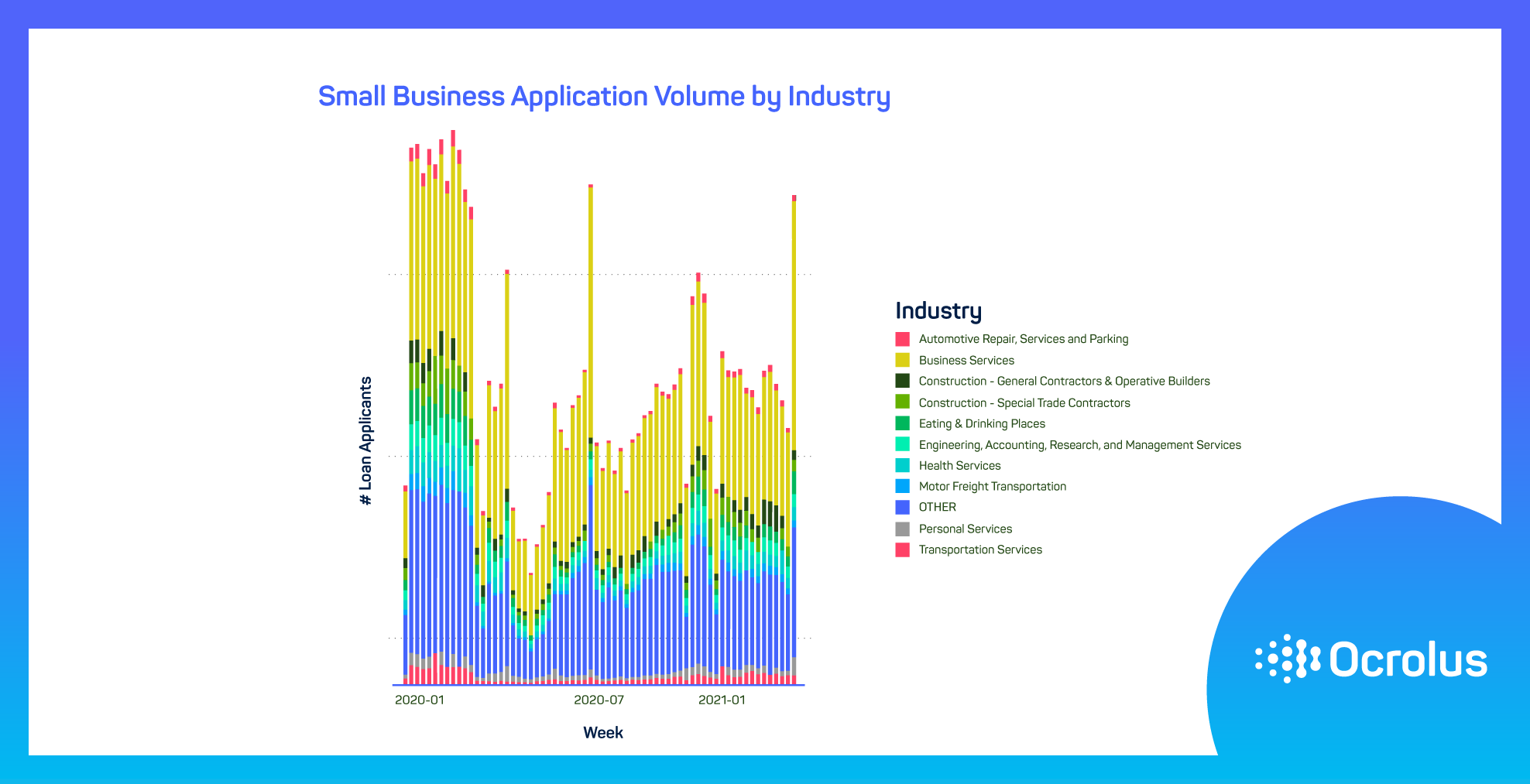

- SBR scores by industry rose sharply for selected in-person sectors, driven largely by increases in loan volume and job growth. Recent federal stimulus and easing business restrictions have propelled growth and hiring in the apparel stores and eating and drinking places industries.

Small Business Applications – Volume by Industry

| Small Business Application Volume | |

| Industry | M-o-M Increase |

| Apparel and Accessory Stores | +272% |

| Business Services | + 209% |

| Depository Institutions | +341% |

| Personal Services | +367% |

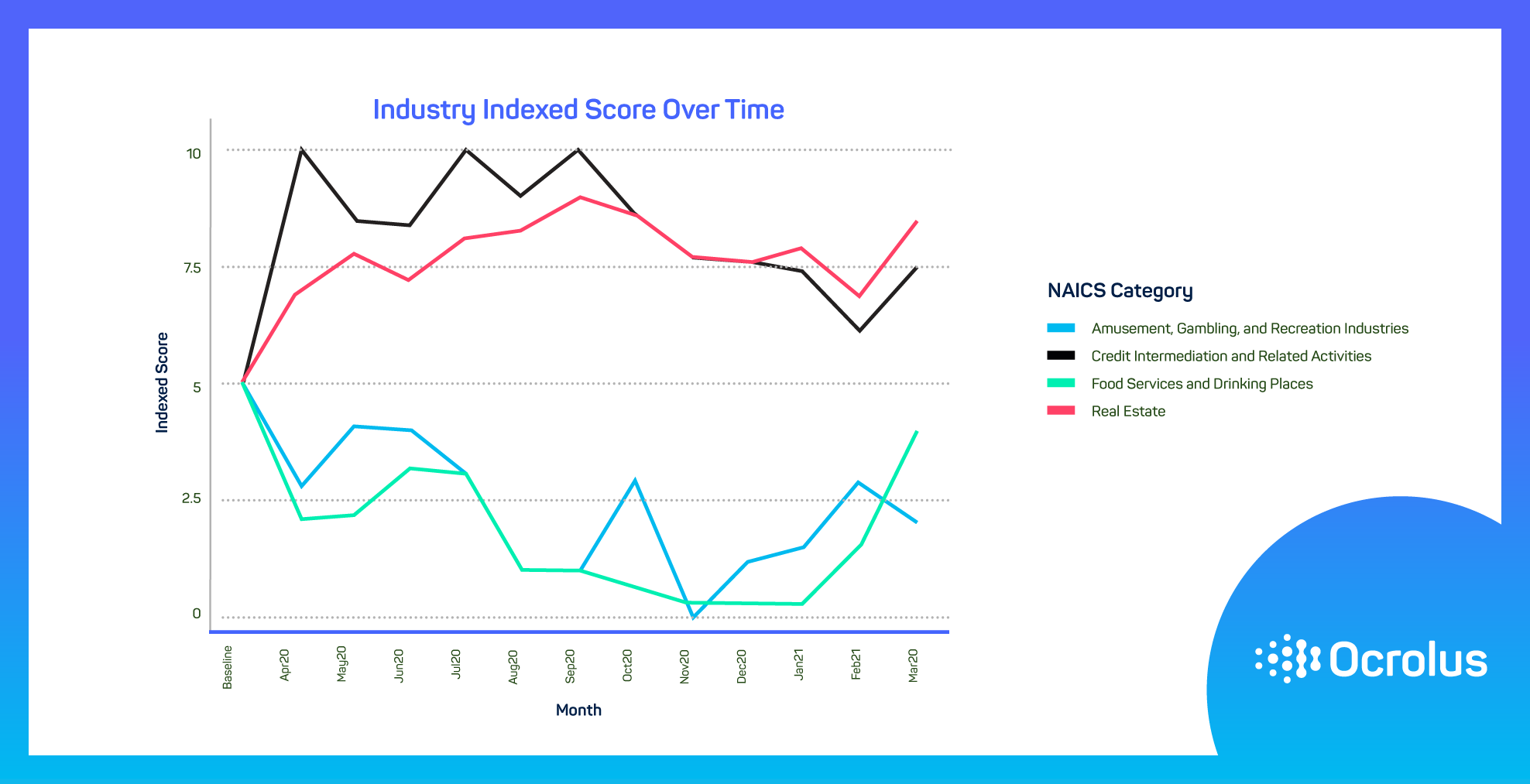

SBRI – Small Business Recovery Industry Score Indexed Over Time

| Industry Index | ||

| Industry Type | SBR Score | Change |

| Amusement, Gambling, and Recreation | 1.5 | -1.4 pts |

| Food Services and Drinking Places | 4.0 | +2.4 pts |

| Real Estate | 9.0 | +2.2 pts |

| Credit Intermediation and Related Activities | 8.0 | +1.9 pts |

About the Ocrolus Small Business Recovery Index

Ocrolus is committed to supporting the lending community in its understanding of underlying credit risk with real-time income and cash flow analytics derived from bank account data and other sources. The amalgamation of highly relevant external data at the regional level, combined with proprietary Ocrolus insights at the borrower level, provides a window into the resilience and prospects for recovery for millions of businesses in the U.S. This is what the Small Business Recovery Index seeks to capture — a real-time snapshot of the health of small businesses by industry and geography.

Interested in learning more about small business health? Check out our Q1 2022 research report on the Small Business Health Index.

Sign up for our Ocrolus Insights Newsletter and receive the latest insights from the Ocrolus blog.