This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Small Business Recovery Index (SBRI): April 2021 Update

After a little over a year into the pandemic-induced contraction of the U.S. economy, a first quarter burst of growth put U.S. GDP back to within 1% of its pre-pandemic peak, reached in late 2019. Furthermore, U.S. unemployment claims reached a new pandemic low, the latest sign of what is shaping up to be a rapid, consumer-driven recovery this year. Yet, the U.S. is still down ~8 million jobs from its pre-pandemic level in February 2020, as recovery has demonstrated clear disparities among industries and geographies.

As April’s Small Business Recovery numbers show, the same economy that is emerging from pandemic-related disruptions is also encountering restraints on job growth and imbalances in the supply and demand for goods and services.

Key takeaways from April 2021:

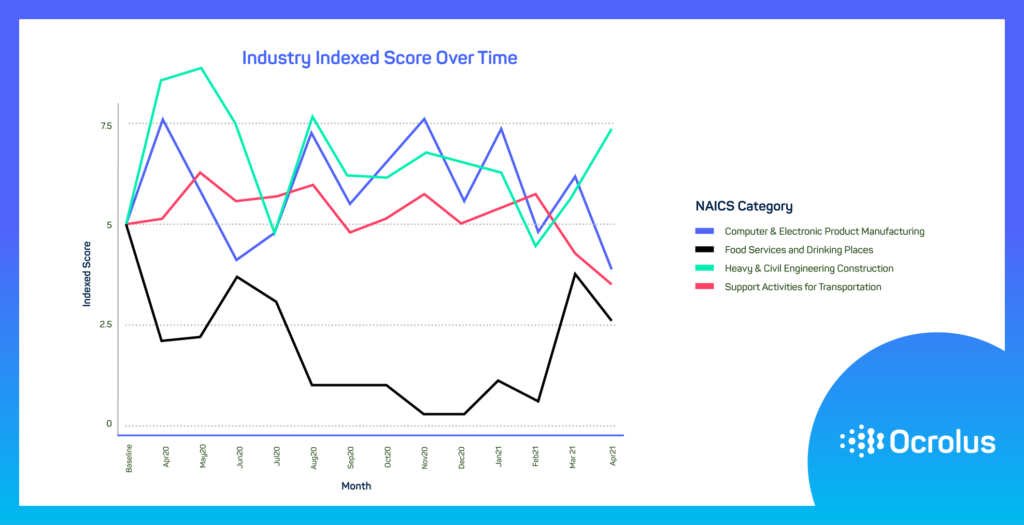

- SBR scores by industry showed signs of disruption in a rapidly heating economy coming out of lockdowns as businesses struggle to find workers in key segments of the economy from manufacturing to restaurants. Additionally, global supply chain issues, from the semiconductor shortage to global shipping and freight interruptions, idled factories and made it difficult for those industries to meet recovering demand. Meanwhile, heavy construction continues to boom as infrastructure spending becomes a priority for the government.

| Industry Index | ||

| Industry Type | SBR Score | Change |

| Computer and Electronic Product Manufacturing | 3.9 | -2.3 pts |

| Food Services and Drinking Places | 2.6 | -1.2 pts |

| Heavy and Civil Engineering Construction | 7.4 | +1.7 pts |

| Support Activities for Transportation | 3.5 | -0.8 pts |

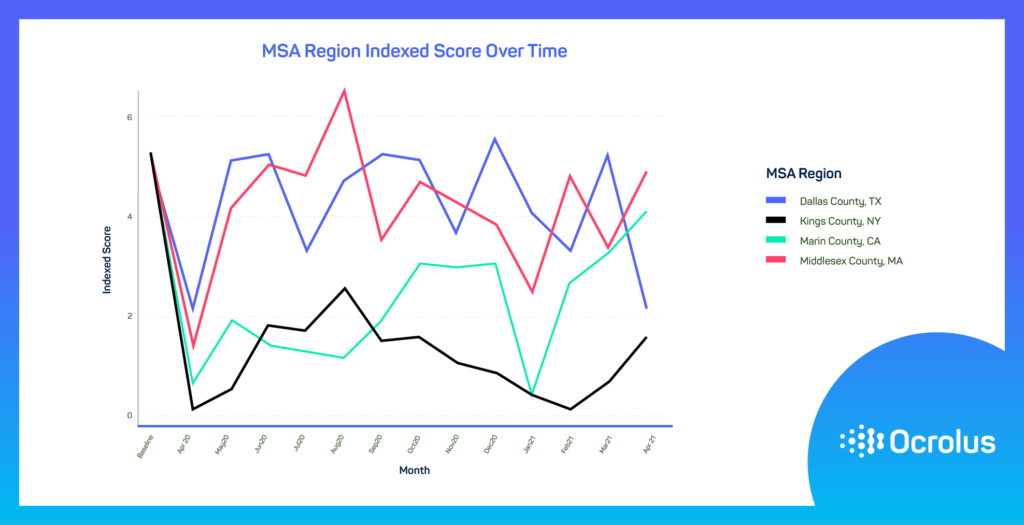

- The SBR scores by geography showed positive momentum for the coastal parts of the country most heavily impacted by the pandemic and its associated lockdowns. With the number of cases under control and vaccination rates ticking up, federal stimulus checks are fueling an economic revival that is poised to endure with an easing pandemic

| MSA Index | ||

| County | SBR Score | Change |

| Dallas County, TX | 2.4 | -2.9 pts |

| Kings County, NY | 1.9 | +0.9 pts |

| Marin County, CA | 4.3 | +0.8 pts |

| Middlesex County, MA | 5.0 | +1.5 pts |

About the Ocrolus Small Business Recovery Index

Ocrolus is committed to supporting the lending community in its understanding of underlying credit risk with real-time income and cash flow analytics derived from bank account data and other sources. The amalgamation of highly relevant external data at the regional level, combined with proprietary Ocrolus insights at the borrower level, provides a window into the resilience and prospects for recovery for millions of businesses in the U.S. This is what the Small Business Recovery Index seeks to capture — a real-time snapshot of the health of small businesses by industry and geography.

Sign up for our Ocrolus Insights Newsletter to receive the latest insights.