This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Small Business Lending Data: 3 New Analytics Principles for Lending Evaluation

As cities, states, and the nation reopen, small business’ access to capital will be a critical ingredient in recovery. The colossal pandemic of COVID-19 has had a wide-ranging impact on public health, civil society, and the economy. In the world of financial services and financial technology, small business lending companies lending to small businesses were among the hardest-hit. Let’s take a dive into the pandemic’s impact on our world and small business lending specifically, analyze the data, and consider three key analytics principles to use during the small business underwriting and evaluation process.

The COVID-19 pandemic’s dramatic impact and uneven recovery

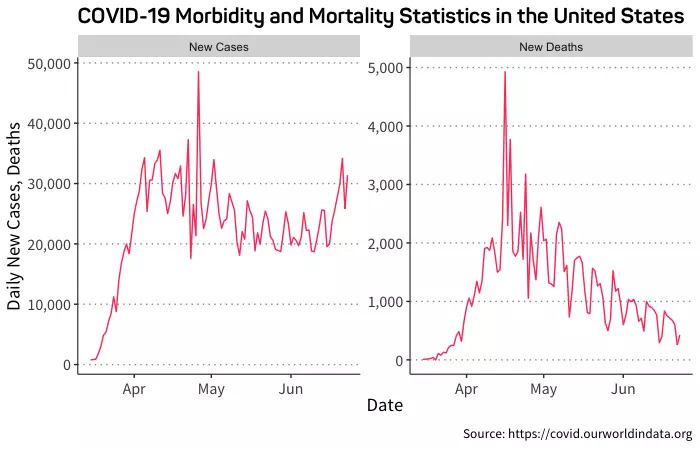

It’s impossible to overstate the depth or breadth of the pandemic’s impact on our world. To date, in the United States, 24MM jobs have been lost, and over one-hundred-sixteen thousand people have died, more than the number of Americans who perished in World War I. It is still too early to tell the longer-term impact on society, government, and the nature of work.

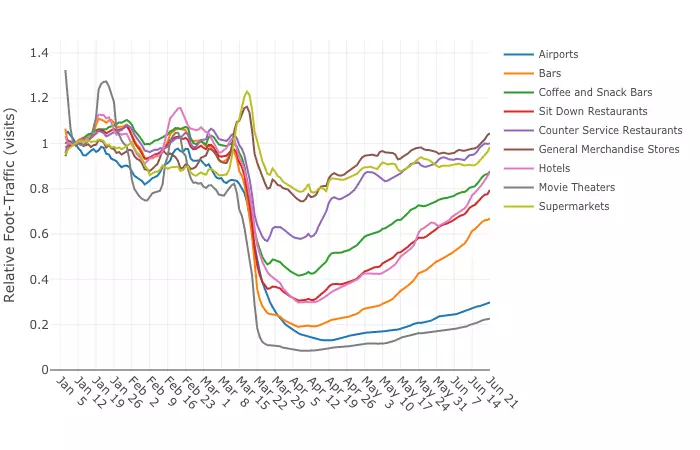

The economic impact of COVID-19 has been sharper and more severe than that of a typical recession. To avoid the devastating health effects of a global pandemic, people have been staying home more, events have been cancelled, and businesses were shuttered. Many small businesses were legally not allowed to operate at one point, and those that had the capital to survive slowly began to reopen.

How was small business lending affected by the pandemic?

As mentioned earlier, small business lending companies were among the hardest hit. Most small business lenders severely curtailed their operations, with many pausing non-government-backed lending completely. This historic pandemic has revealed countless truths, among them the insufficiency of credit data and the need for small business lenders to adopt a deeper, more data-driven, and more personalized approach to risk management. This unique disruption has caused many small business lending companies to reexamine the way they operate. As lenders continue to ramp up, automation, efficiency, and trusted small business analytics and data have taken on even higher importance.

It is critical for small business lenders to develop a nuanced understanding of customers’ business dynamics and future prospects. At Ocrolus, we offer an extensive set of analytical metrics for use in small business underwriting and are now augmenting and enhancing them with insights specifically geared towards small business recovery. Below, we summarize the three key small business analytics principles to use for evaluation.

Three key analytics principles for small business lending evaluation

- Data: Increase the breadth of data sources used to evaluate a small business;

- Duration: Widen the timeframe used for evaluation; and

- Detail: Incorporate greater detail about each prospect and use automation to scale a personalized approach.

Data – increase breadth of sources for small business lending

Small businesses are inherently complex, and each business is different. It is not sufficient to rely on traditional credit data. In a volatile world, the value of past experience as a predictor of future performance is diminished.

Bank data

Bank data is particularly important, as small business lenders will want to understand cash balances, revenue, and expenses. Several important questions can be answered with this information. How have cash balances trended over time, and has a business’ cash cushion become more robust or depleted? What is monthly and annual revenue, and is there seasonality to these figures? What are the main sources of revenue, and what fraction of them are recurring vs. episodic? Are revenue sources overly concentrated or diverse? What are monthly expenses and net cash flow; are these figures trending up or down; what costs are fixed vs. variable; what are the largest expense categories?

Payroll and tax information and other critical documents

In addition to bank data, small business lending companies may also seek to examine payroll information, tax documents, financial statements, and personal/corporate identity verification documents. For certain business types, specific information on rent and inventory may be relevant. While there are many potential sources of valuable information, this data is often complex, disparate, and fragmented. It is difficult to access, resource-intensive to manage, and full of noise. Each lender needs to focus on the datasets that contain pertinent information for their particular customer segment and determine how to extract valuable signals in an automated and reliable way.

Duration – extend the timeframe

Ask any analyst or risk manager how much small business lending data they want, and you will receive a predictable answer: “as much as possible!” Of course, there has always been a balance between completeness of customer information and the technical friction required to obtain it. While many business lenders have historically relied on three months of financial data, they are wise to now consider six months or more as the minimum, particularly as automation reduces the marginal friction of additional history.

Observing performance over a longer time period helps reveal seasonal patterns in business cash flow. It can also make it easier to detect anomalous events or longer-term trends in a business’ upward or downward trajectory. For example, it would be relevant to compare revenue and expenses pre-COVID and post-COVID and understand the extent to which a business was affected, what – if any – stimulus relief it received, and how quickly it has been able to recover momentum. 3 months simply won’t provide enough information.

In addition to obtaining data at the point of underwriting, forward-looking small business lenders will look to maintain insight across the customer lifecycle. This is particularly important for more persistently-accessible financial products, such as a line of credit that allows a customer to draw and repay multiple times, a credit/charge card, or various insurance products. For longer-term customers, it is useful to understand revenue growth, profitability, and cash balances. In addition, lenders will want to know how quickly and effectively their capital has been utilized, as well as if the customer has obtained other sources of credit. Failing to monitor a customer’s cash flow analytics and use of credit post-approval may lead to a miscalculation of debt capacity and lack of ability to detect emerging risks in a portfolio.

Gathering more data over a longer period of time requires an investment on the part of the lender and borrower alike. Lenders and data service providers will need to work together to offer low-friction solutions to provide this data in a cost-effective way. At Ocrolus, we accomplish this using machine-learning-powered automation, with human-in-the loop intervention where necessary. Our algorithms learn over time, reducing turnaround time and friction as they gain more experience. Through Ocrolus+, we are also able to combine data collected from documents with persistent financial account connections in a single API.

Detail- Deeply Understand Business Dynamics

Each small business is unique, and lending to this segment of the market requires a nuanced appreciation of the financial and operational dynamics of particular businesses. It’s not enough to concentrate on a limited set of data points, and it doesn’t make sense to evaluate all applicants in the same manner.

Consider, for instance, a retail store and a local law firm, each with $1MM in annual revenue. Would you evaluate their small business creditworthiness in the same way? Of course not! The retail business likely has a high cost of goods sold, as well as major fixed expenses such as rent and payroll. The law firm likely has a much higher gross margin, as its major cost is the time of the partners and other staff.

By examining both businesses at a transaction level, it is possible to classify expenses as recurring vs. episodic, understand the seasonality of revenues, and determine the categories driving a company’s spending. Upon examining this type of data, a lender would likely make different decisions on loan/line size, pricing, and eligibility for businesses with different operating models.

A bank transaction at first glance contains a limited amount of information: a date, an amount, and a description that could scarcely be considered human-readable. However, models trained on billions of transactions allow us to discern a variety of useful information from each record.

Bank transaction record details

- Who is the merchant/payee?

- Is this transaction recurring?

- Should this transaction count as revenue?

- What category tag(s) can we assign?

- Is this a non-sufficient-funds or overdraft transaction? Is it a fee transaction pertaining to one?

- Does this transaction indicate a relationship with an alternative lender? How can we use this to understand a business’ use of capital and its capacity to service debt?

- Is this transaction a transfer from one of the business owner’s other accounts, or is it actual revenue from a customer?

- Is this revenue from a merchant processing transaction?

- Do the numbers from a set of transactions tie out perfectly, or is there a suspicious inconsistency?

As one might expect, detailed, transaction-level data as described above can also be stitched together to understand patterns across transactions, bank accounts, time periods, and entities. This information can be used to understand the intricate financial dynamics of a business. It can also form a profile that can be used to measure the likelihood of successful payback, predict delinquency, or identify fraudulent behavior. Small business lending is a business where money is made or lost at the margin, and in times of volatility, it is essential to make risk decisions with full visibility into the nuance of customer dynamics.

Conclusion

Small businesses account for over 60% of net new jobs in the United States. The economy depends on the health and vitality of business owners and their companies. As the crisis caused by COVID-19 hopefully abates, small businesses will require capital to form, to operate, and to grow. As lenders begin to scale up their activity, forward-thinking leaders will be wise to consider how they can evaluate borrowers in a more complete and nuanced way. This is essential for making capital available for business while also managing risk in an ever more volatile world.

Through analyzing an expanded set of data, over a longer period of time, in greater detail, small business lending companies can make high-quality decisions. If they can do this in an efficient and automated way while maintaining a pleasant customer experience, they can hone in on the keys to successful small business lending and create significant value for themselves, small businesses, and the overall economy.

Ready to learn how you can accelerate and automate your small business lending processes? Book a demo to connect with one of our document automation software experts today.