Does Automation Minimize Bias In Lending? New NYU, Ocrolus Study Indicates Yes

A recent New York Times article entitled, “Racial Bias Skewed Small-Business Relief Lending, Study Says,” offers an excellent overview on a new study conducted by NYU Stern School of Business, in conjunction with several industry partners, including Ocrolus, on the accessibility of credit to diverse groups of small business owners across the United States, such as Black small business owners. There is an untold story that sits within this data related to the hotly debated topic of whether technology, namely automation, minimizes bias in lending. Our data finds that, very likely, business automation does minimize bias and increase accessibility for Black small business owners.

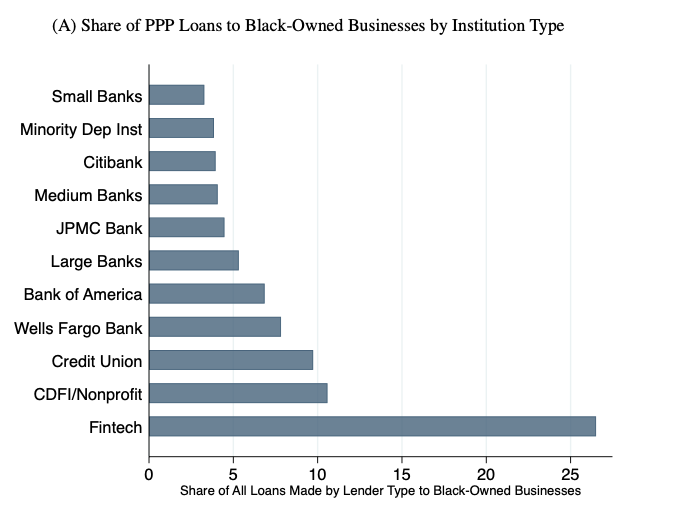

The study, which looked at data regarding the $806B Payment Protection Program (PPP), illustrates how fintech lenders, followed by large banks utilizing automation, fared much better in issuing PPP loans to Black small-business owners in the United States compared with smaller banks that largely relied on human-centric workflows for loan processing. Using publicly available data from the SBA for a sample of 5.7 million PPP loans made between April 3, 2020 and February 24, 2021 (when the program’s rules changed to prioritize small firms and minority-owned businesses), the study found only 3.3% of loans from small banks and 7.8% of loans originated by Wells Fargo were to Black-owned businesses. However, 26.5% of PPP loans originated by fintech lenders were to Black-owned businesses. Overall, fintech lenders were responsible for 53.6% of PPP loans to Black-owned businesses, while only accounting for 17.4% of all PPP loans in the sample.

While PPP loans were fully guaranteed by the government, removing the need for lenders to focus on typical measures of creditworthiness, lenders still needed to determine how to handle the significant documentation requirements and how to prioritize massive application queues, all while migrating to a remote work environment during a global pandemic.

In recent years, there has been some criticism of automation and AI-driven underwriting methods, centered on the potential for unintended consequences of biased algorithms. Some of these concerns have merit, as an algorithm trained on a biased dataset will likely persist and accentuate those biases, meaning that practitioners must take care in developing ML-based automated systems. However, the researchers for this study take into account numerous factors including geographic racial distribution in populations, demographic statistics on loan sizes and existing customer relationships between borrowers and the lending organization. They found that traditional banks, which were more likely to manually process loan requests, served fewer Black small-business owners by comparison, with Black-owned businesses 12.1 percentage points more likely to obtain their PPP loan from a fintech lender. The researchers also found higher disparity in areas of the country with greater measures of racial animus.

How Automation Minimizes Bias in Lending and Improves Access for More Diverse Communities

In addition to reducing potential for human bias when leveraging automation in lending processes, automation also accelerates the process for lenders and borrowers, allowing borrowers to get faster decision feedback when seeking a loan, and helping banks serve broader communities. One anecdote included in the study from a regional bank mentioned that the organization was able to process loan requests in two days after adopting automation compared with 10 days when manually processing loans. For PPP loans, this could mean banks were able to expand beyond prioritizing customers with existing relationships and therefore serve a more diverse set of borrowers.

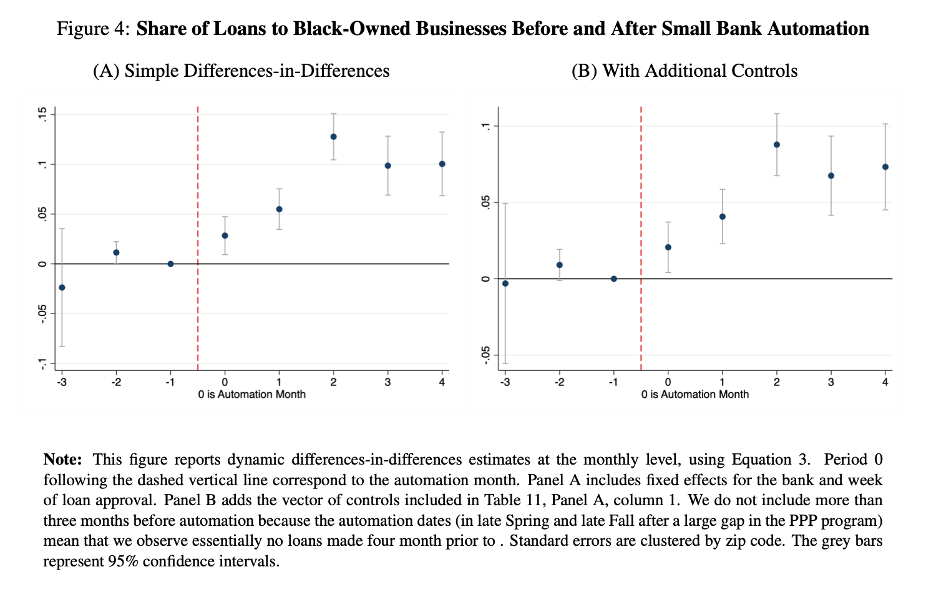

Particularly interesting is that small banks that utilized automation showed a higher rate of loans approved to Black small-business owners. Figure A from page 37 of the study, below, illustrates the substantial increase in share of loans to Black-owned businesses from small banks after they implemented automation, with the red line marking the start of automation. The effect persists even when controlling for bank, time, zip code, industry, and other factors

In the wake of the pandemic, fintech lenders and infrastructure firms like Ocrolus stepped up to accelerate access to PPP capital for small businesses in need. They demonstrated the strength of technology to not only automate the origination process but to do it better, faster, and with greater accuracy. For example, Cross River Bank, which is a regional bank but uses highly-modern technology and serves as a partner to many fintech lenders, originated loans to over 375,000 small businesses, placing it among the top lenders nationally, surpassing several mega-banks with thousands of branches. In total, Ocrolus-enabled lenders processed over 20% of total PPP volume. Combined with the above data, it is clear that automation can enable banks and financial services providers of all sizes to accelerate and broaden access to credit.