This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Small Business Health Index – June 2021 Update

Highlights

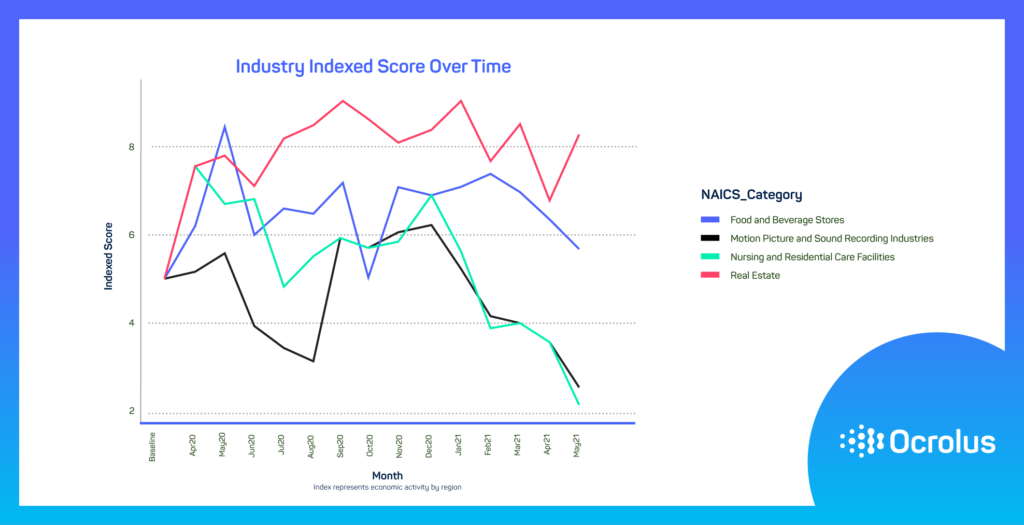

- Real Estate sector continues robust recovery

- Nursing and Residential Care Facilities continue downward trend

- Soaring job vacancies hampering food services sector

June Summary

(Note: As of June, Ocrolus renamed the Small Business Recovery Index the Small Business Health Index, reflecting the country’s move from pandemic recovery to business growth.)

Key parts of the economy stalled in its recovery from the pandemic — most notably, the ones that were most affected by Covid lockdowns. While macro data points to higher housing prices, higher levels of consumer spending, and elevated savings rates, our Small Business Health Index reveals some frictions are still in place that are restraining the recovery for the hospitality, leisure and tourism industries.

Sector Summary

Four million Americans quit their jobs last month, a 20-year record. At the same time, there were 9.3 million job vacancies at the end of April, another 20-year record. These vacancies rose the most in the accommodation and food services sectors, straining an already massive labor shortage in the retail sector. The combination of rising input costs, worker shortages, and unpredictable food supplies has squeezed small businesses in an industry that, before the pandemic, was responsible for ~17 million jobs and ~4% of U.S. GDP. As a result, restaurants, theme parks, and other similar businesses have had to curtail hours despite robust consumer demand with plenty of savings to spend.

| Industry Index | ||

| Industry Type | SBR Score | Change |

| Food and Beverage Stores | 5.9 | -0.5 pts |

| Motion Picture and Sound Recording Industries | 2.7 | -0.9 pts |

| Nursing and Residential Care Facilities | 2.3 | -1.3 pts |

| Real Estate | 8.6 | +1.3 pts |

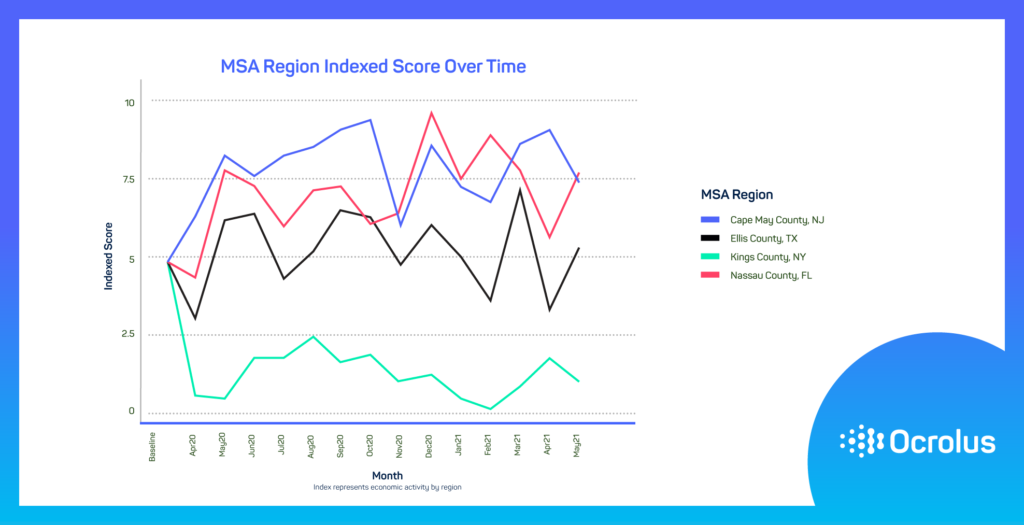

Geographic Summary

The challenges in hospitality threaten to hamper the rebound for regions reliant on summer tourism. For example, businesses in some seaside counties along the coasts rely on summer for 75% of annual tourist revenue. On the other hand, the current mass migration of former city dwellers in major job centers to the exurbs for the same or similar salaries is remaking the spending power of far-flung U.S. communities.

| MSA Index | ||

| County | SBR Score | Change |

| Cape May County, NJ | 7.4 | -1.5 pts |

| Ellis County, TX | 5.6 | +1.7 pts |

| Kings County, NY | 1.3 | -0.7 pts |

| Nassau County, FL | 7.9 | +1.8 pts |

About the Ocrolus Small Business Health Index

Ocrolus is committed to supporting the lending community in its understanding of underlying credit risk with real-time income and cash flow analytics derived from bank account data and other sources. The amalgamation of highly relevant external data at the regional level, combined with proprietary Ocrolus insights at the borrower level, provides a window into the resilience and prospects for recovery for millions of businesses in the U.S. This is what the Small Business Health Index seeks to capture — a real-time snapshot of the health of small businesses by industry and geography.

Sign up for our Ocrolus Insights Newsletter to receive the latest insights.