This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Small Business Health Index – Q3 2021 Research Report

Small Business Health Highlights

- US economic growth is losing momentum after it’s initial post COVID spike

- Supply constraints, worker shortages and the spread of the Delta variant are the biggest threats to continued small business recovery

- Stability in consumer spending and small business revenue is the clearest signal that firms anticipate the Delta drag on economic growth to be transient.

- For more insights, download the full research report

Q3 Summary and The Effects on Small Business Recovery

Let’s take a look at trends and data from Q3 and the effects those might have on small business health and recovery. For months following the initial economic downturn from the COVID-19 outbreak, people around the U.S. opened their wallets and spent on everything from cars to travel. One survey by Gallup showed that the percentage of Americans who considered themselves to be “thriving” in life reached 59.2% in June, the highest in more than 13 years.

Recently, signs have emerged that this optimism is starting to fade and new figures show that consumer sentiment in the U.S. declined in July. Meanwhile, the unemployment rate has stagnated, and many purchasing managers are concerned about a labor shortage hampering the economy. One of the biggest factors weighing on sentiment is inflation – the consumer price index rose 5.4% in July from a year ago, the same pace as in June, the fastest 12-month rate since August 2008.

There are two ways the spread of the Delta variant could derail the robust small business recovery we’ve seen: First, some state and local governments could reimpose restrictions on businesses. Second, consumers could curtail spending on travel, dining out and moviegoing out of heightened cautiousness.

Sector and Small Business Health Summary

Leisure and hospitality jobs, including restaurants, rose by 380,000 in July, reflecting Americans’ renewed interest in dining out and traveling this summer. However, the hospitality industry still has 1.7 million fewer jobs than in February 2020, a large share of the 5.7 million jobs employers have yet to recover from the pandemic downturn.

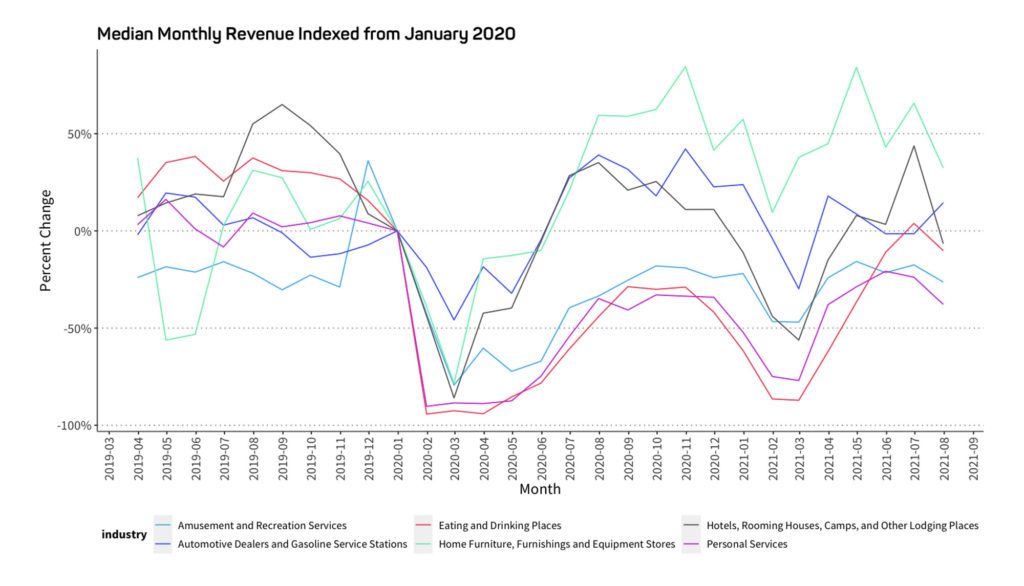

Services businesses were hit hard earlier in the pandemic and would be among the first to face setbacks if the Delta variant triggers restrictions that limit their operations. The Small Business Health Index showed activity in the services industry slowed for a second straight month in July, as evidenced by falling median revenues.

Small business sales were robust in the beginning of the summer at restaurants and bars and clothing and accessories stores as more consumer-facing businesses fully reopened. Meanwhile, sales fell in categories that benefited from strong demand earlier in the pandemic as Americans stayed at home. Small Business Health Index scores at furniture, sporting goods and building materials stores all dropped.

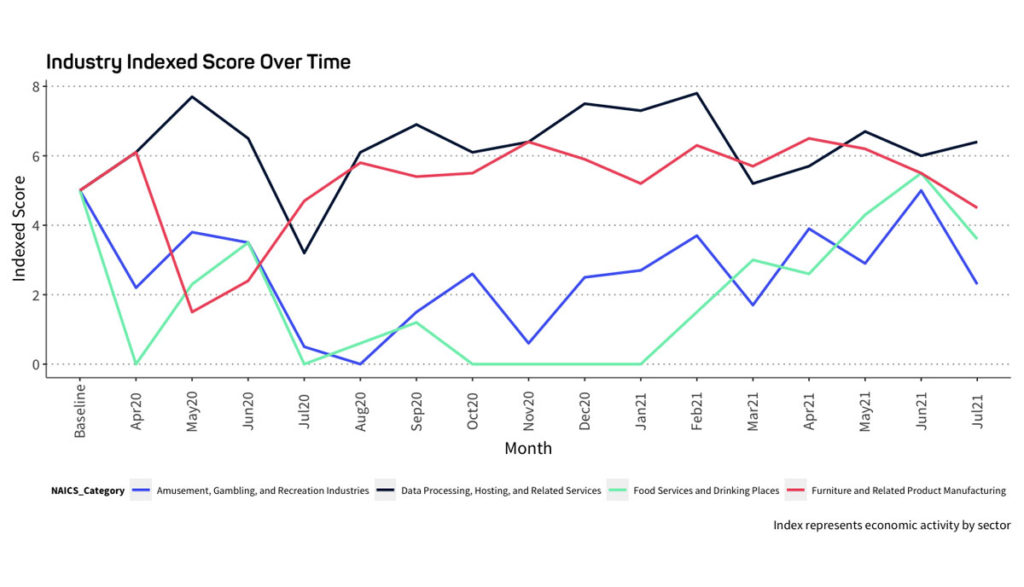

| Industry Index | ||

| Industry Type | SBR Score | Change |

| Food Services and Drinking Places | 3.6 | -1.9 pts |

| Amusement, Gambling, and Recreation Industries | 2.3 | -2.7 pts |

| Data Processing, Hosting, and Related Services | 6.4 | +0.4 pts |

| Furniture and Related Product Manufacturing | 5.5 | -1.0 pts |

What is the Small Business Health Index by Ocrolus?

Ocrolus is committed to supporting the lending community in its understanding of underlying credit risk with real-time income and cash flow analytics derived from bank account data and other sources. The amalgamation of highly relevant external data at the regional level, combined with proprietary Ocrolus insights at the borrower level, provides a window into the resilience and prospects for recovery for millions of businesses in the U.S. This is what the Small Business Health Index seeks to capture — a real-time snapshot of the health of small businesses by industry and geography.

Download the full Small Business Health Index research report below.

Download Now

Fill out the form below to download the full report.