This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

SBHI Quarterly Updates

- Americans returned to the road, skies and stadiums this quarter as the U.S. economy exceeded its pre-pandemic size. But lately, the great reopening has lost some momentum

- Widespread business reopenings, rising vaccination rates and a big infusion of government pandemic aid this spring helped propel rapid gains in small business recovery – the economy’s main driver. But that burst of economic growth is starting to slow, particularly for services-based industries and tourist destinations, amid continued supply constraints, a shortage of available workers and the spread of the new Delta variant

- The stability in consumer spending and small business revenue is the clearest signal that firms anticipate the Delta drag on economic growth to be transient.

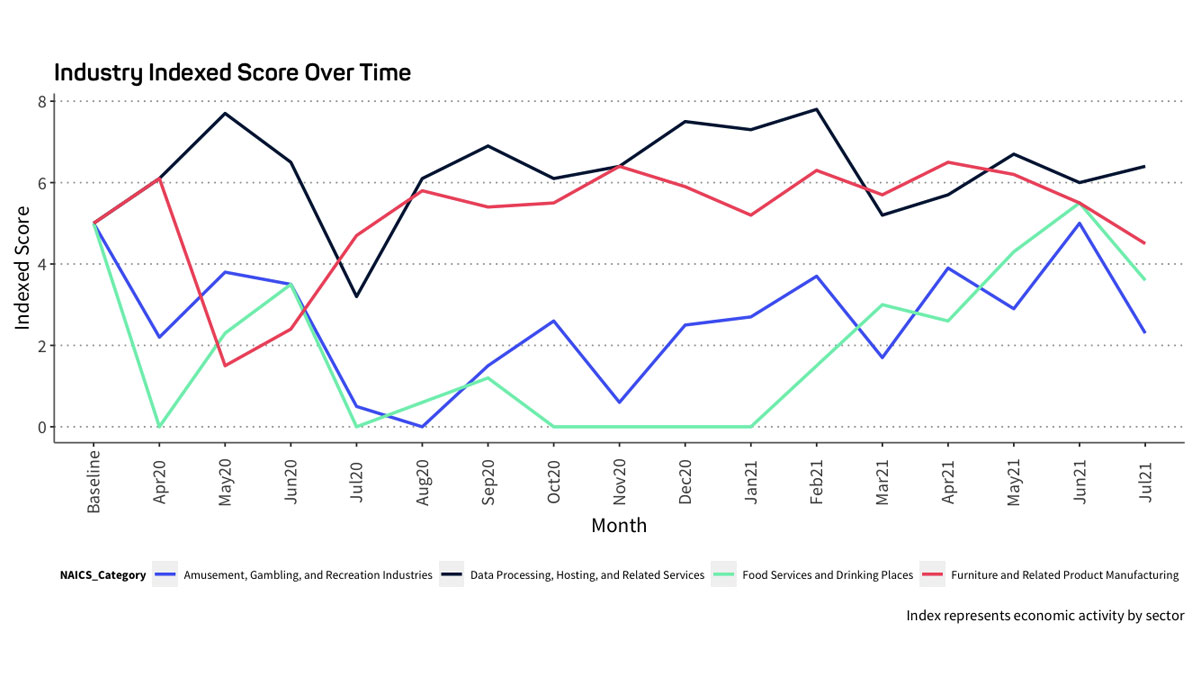

SBHI Scores Over Time

Vaccination Rates Over Time

SBHI Overall Summary

The National Bureau of Economic Research reported last month that the pandemic recession officially ended in April 2020 after only two months – the shortest on record. Despite this milestone underscoring the speed of the recovery that began in May 2020, the outlook has turned cloudier due to the fast-spreading Delta coronavirus variant. Virus cases are rising again, particularly in parts of the country where vaccination rates remain low.

For months, people around the U.S. opened their wallets and spent on everything from cars to travel. Investors grew more optimistic about the economy, as Americans got vaccinated, businesses reopened and many people found themselves flush with cash, fueled by trillions of dollars in fiscal stimulus. One survey by Gallup showed that the percentage of Americans who considered themselves to be “thriving” in life reached 59.2% in June, the highest in more than 13 years. Recently, signs have emerged that this optimism is starting to fade. Fresh data last week showed that consumers stepped up spending in June, yet new figures show that consumer sentiment in the U.S. declined in July. Meanwhile, the unemployment rate has stagnated, and many purchasing managers are concerned about a labor shortage hampering the economy. One of the biggest factors weighing on sentiment is inflation – the consumer price index rose 5.4% in July from a year ago, the same pace as in June, the fastest 12-month rate since August 2008.

There are two ways the spread of the Delta variant could derail the robust recovery: First, some state and local governments could reimpose restrictions on businesses. Second, consumers could curtail spending on travel, dining out and moviegoing out of heightened cautiousness.

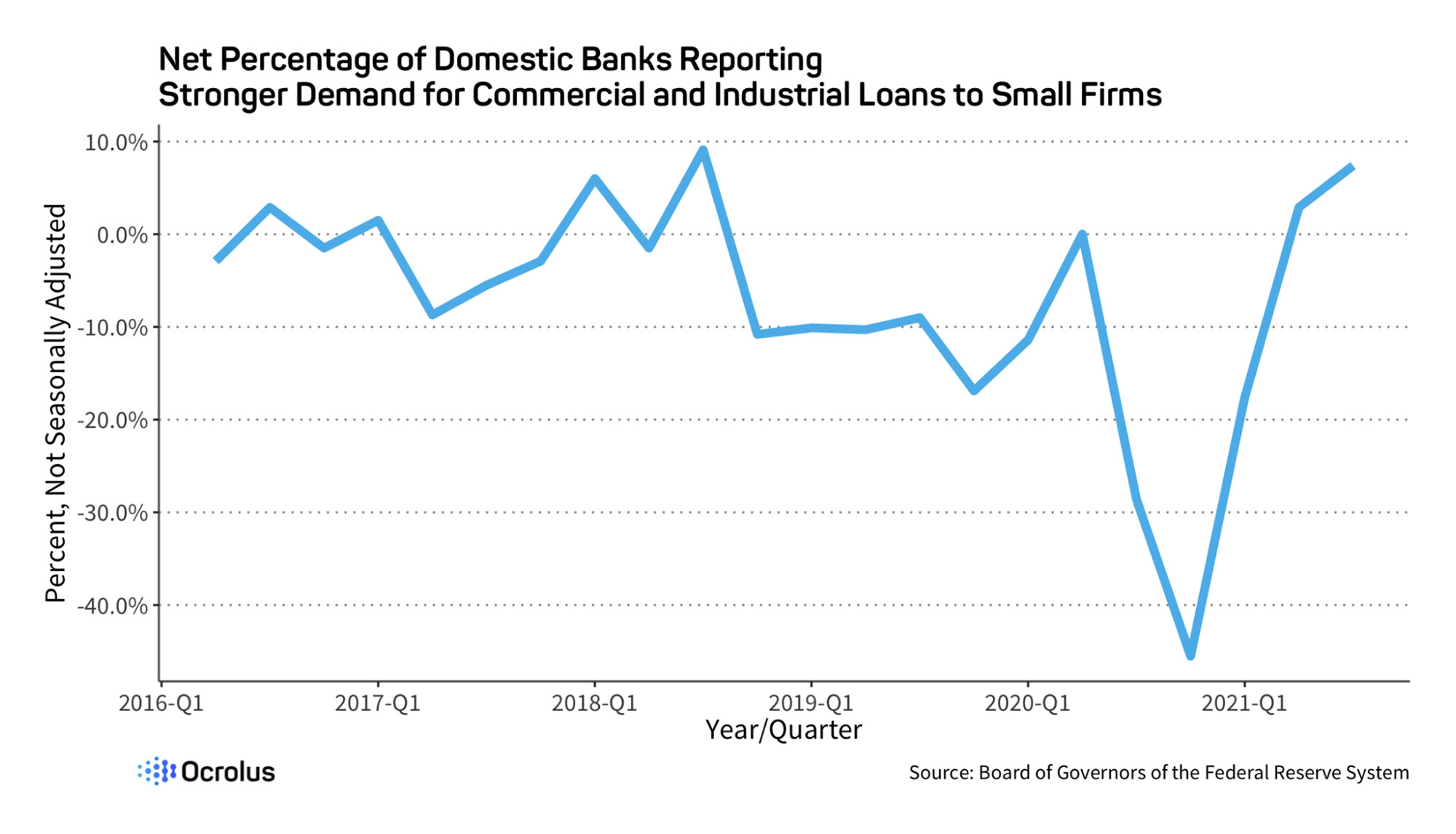

Macro Indicators of Recovery

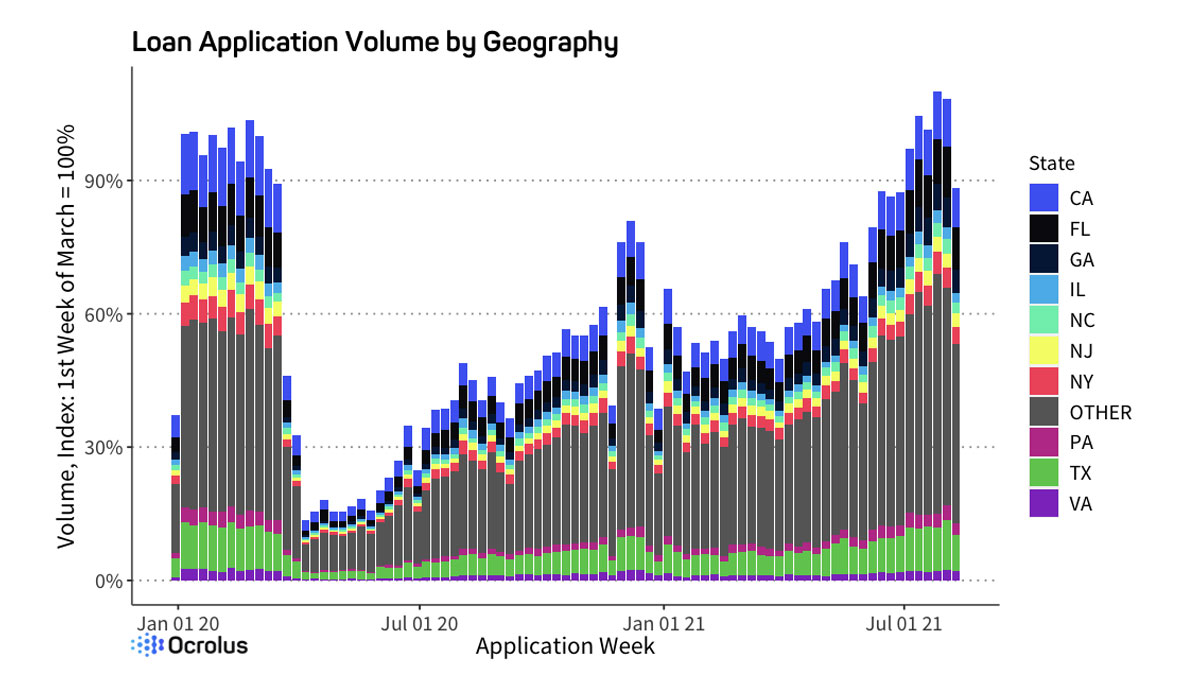

Economic and lending activity for small and medium sized businesses has undergone a fast reversal from the tightened bank underwriting standards and lack of strong loan demand, completing the V-shaped recovery since the two-month recession ended in April 2020.

The labor market recovery after the coronavirus pandemic and related shutdowns is playing out unevenly across the U.S., from states where there are five openings for every unemployed worker to several where historically high jobless rates persist. Continued strong demand pushed the median U.S. home price to a record high last month, though the national house-buying frenzy cooled slightly as supply ticked higher. The University of Michigan’s index of consumer sentiment plunged 13.5% from July, one of the sharpest declines since the index began in 1978.

Net Percentage of Domestic Banks Reporting

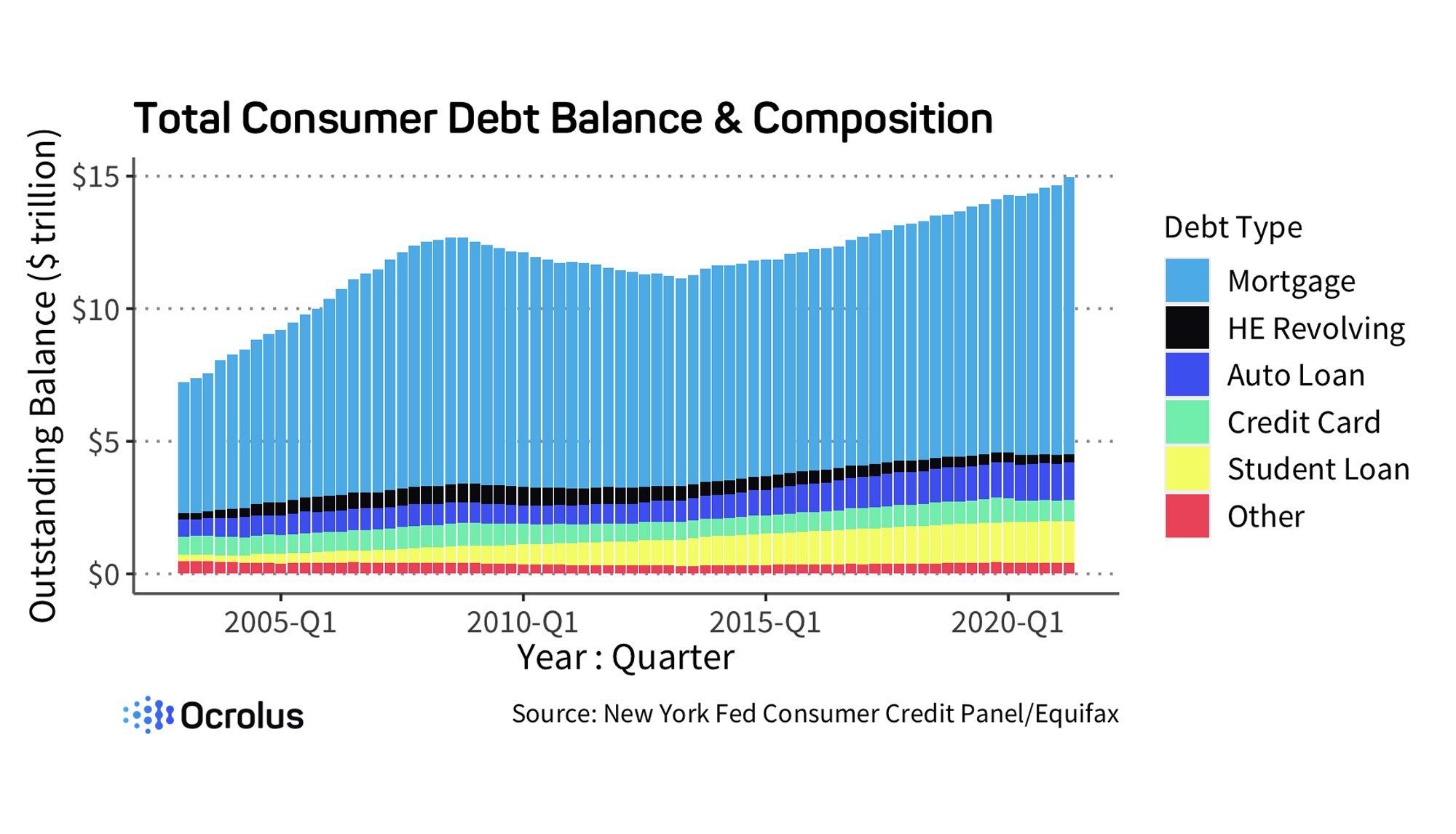

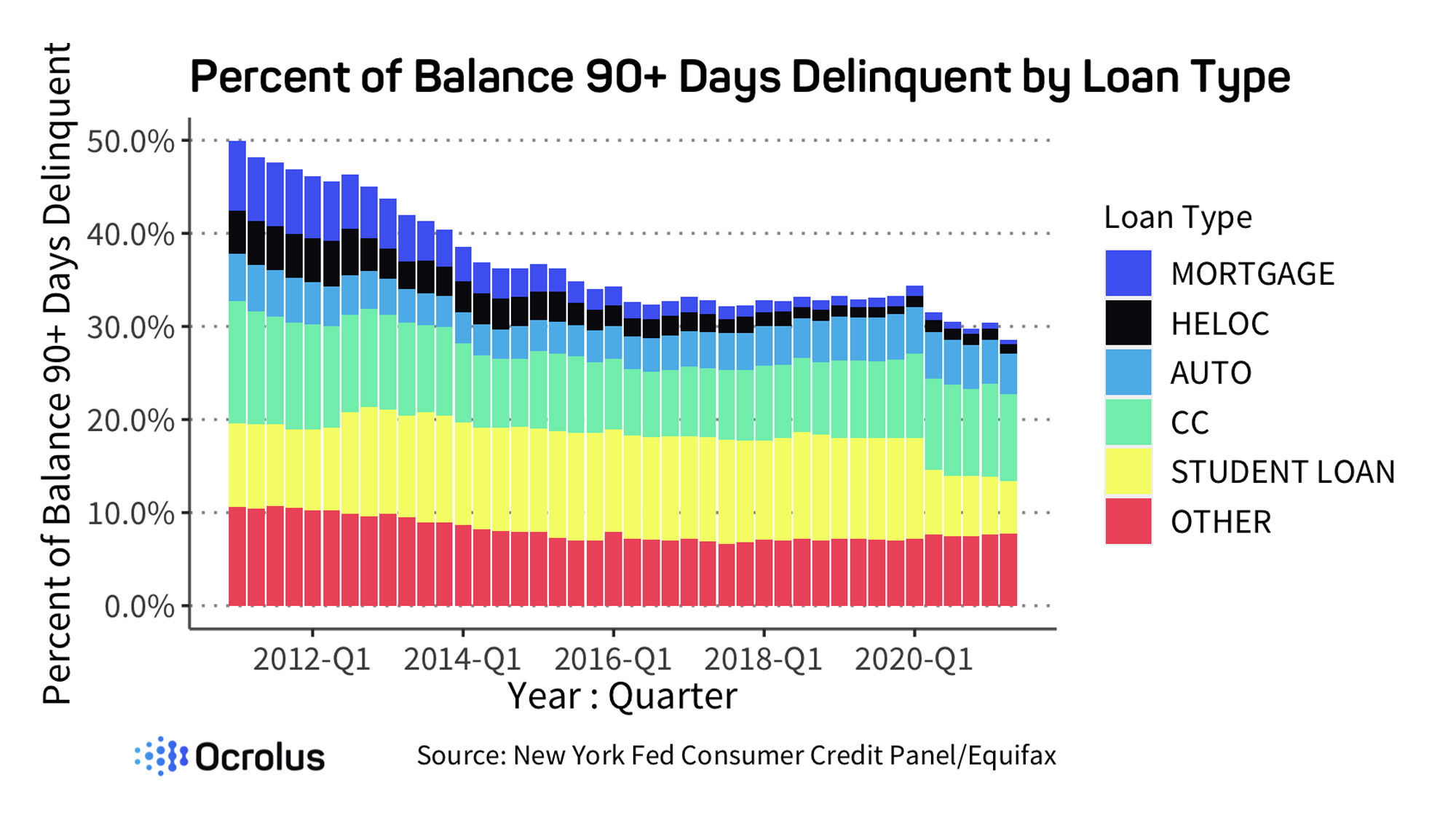

Despite these easing macroeconomic data points, there are still many signals in the overall economy that are flashing green for small business credit and health. Credit continues to flow as evidenced by the New York Fed Consumer Credit panel, while the percentage of loans past 90-days delinquent continues to decline.

Micro Indicators of Recovery

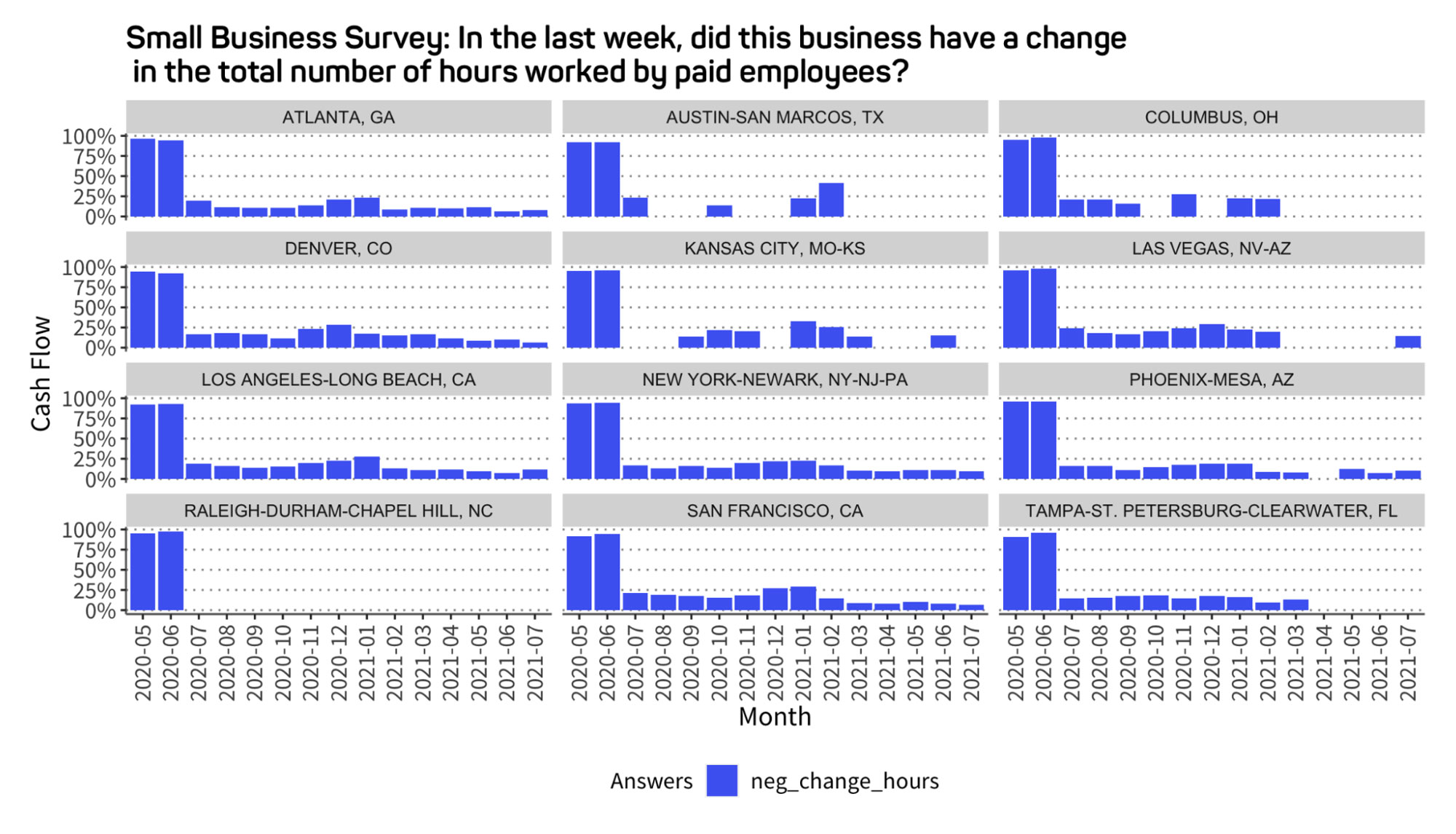

Bank-level transaction data at the individual borrower level match other indicators showing momentum in the labor market and broader economy despite signs that the recent rise in coronavirus infections is starting to crimp some business activity.

The SBHI data indicate that the U.S. expansion is entering a new, more measured phase. The reopening of large parts of the economy is supporting a vigorous bounceback in the services sector. But the Delta variant of the coronavirus could dampen this recovery in services, especially in tourism and hospitality.

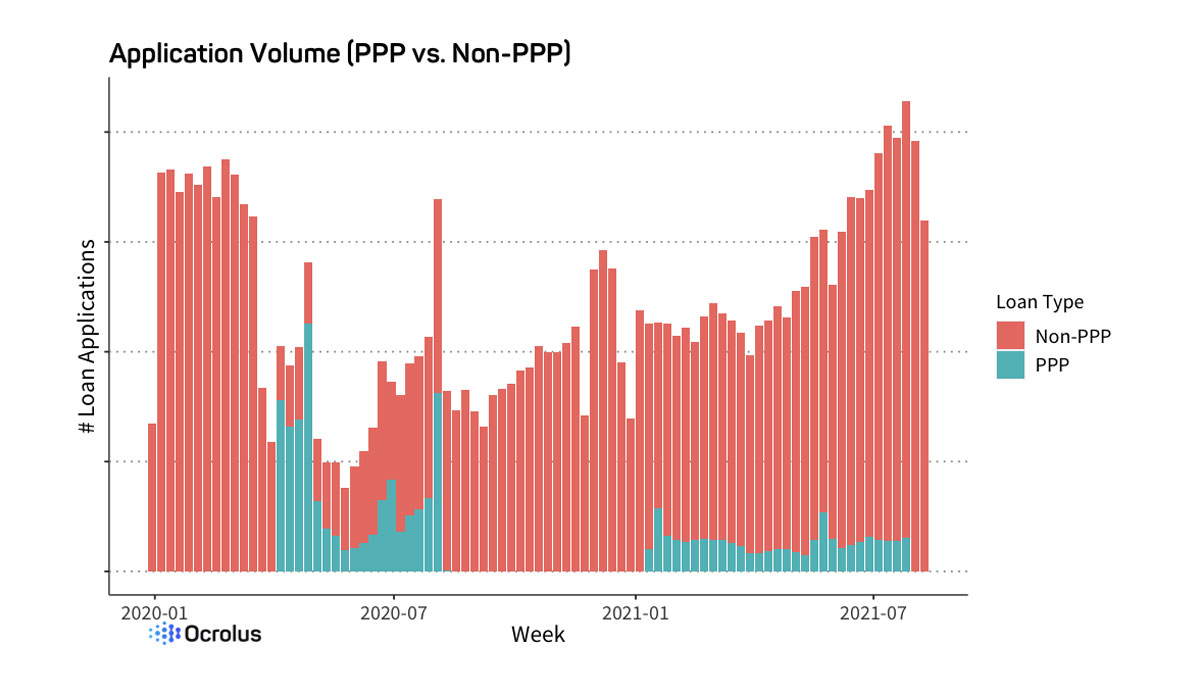

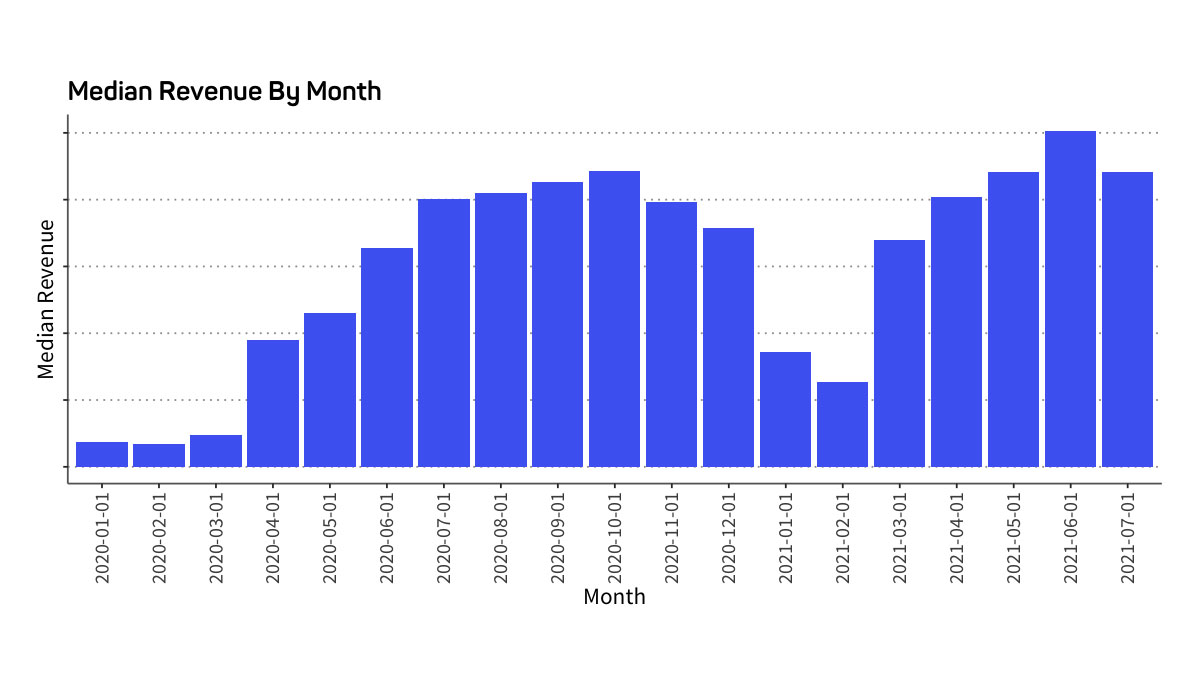

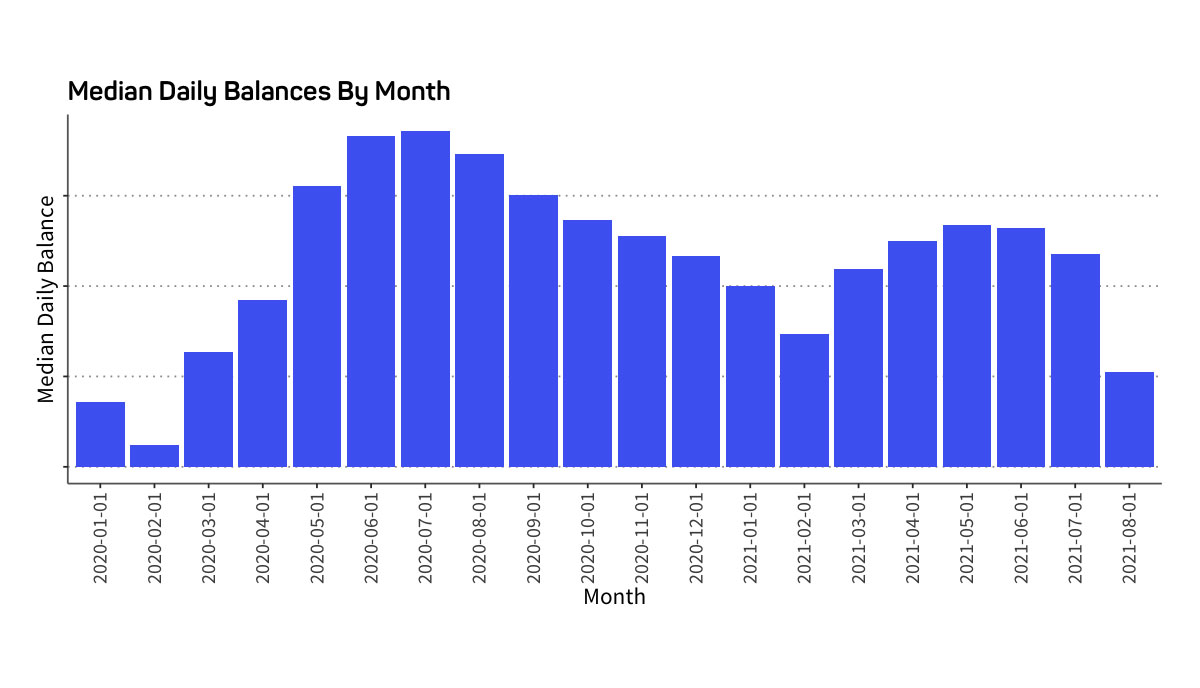

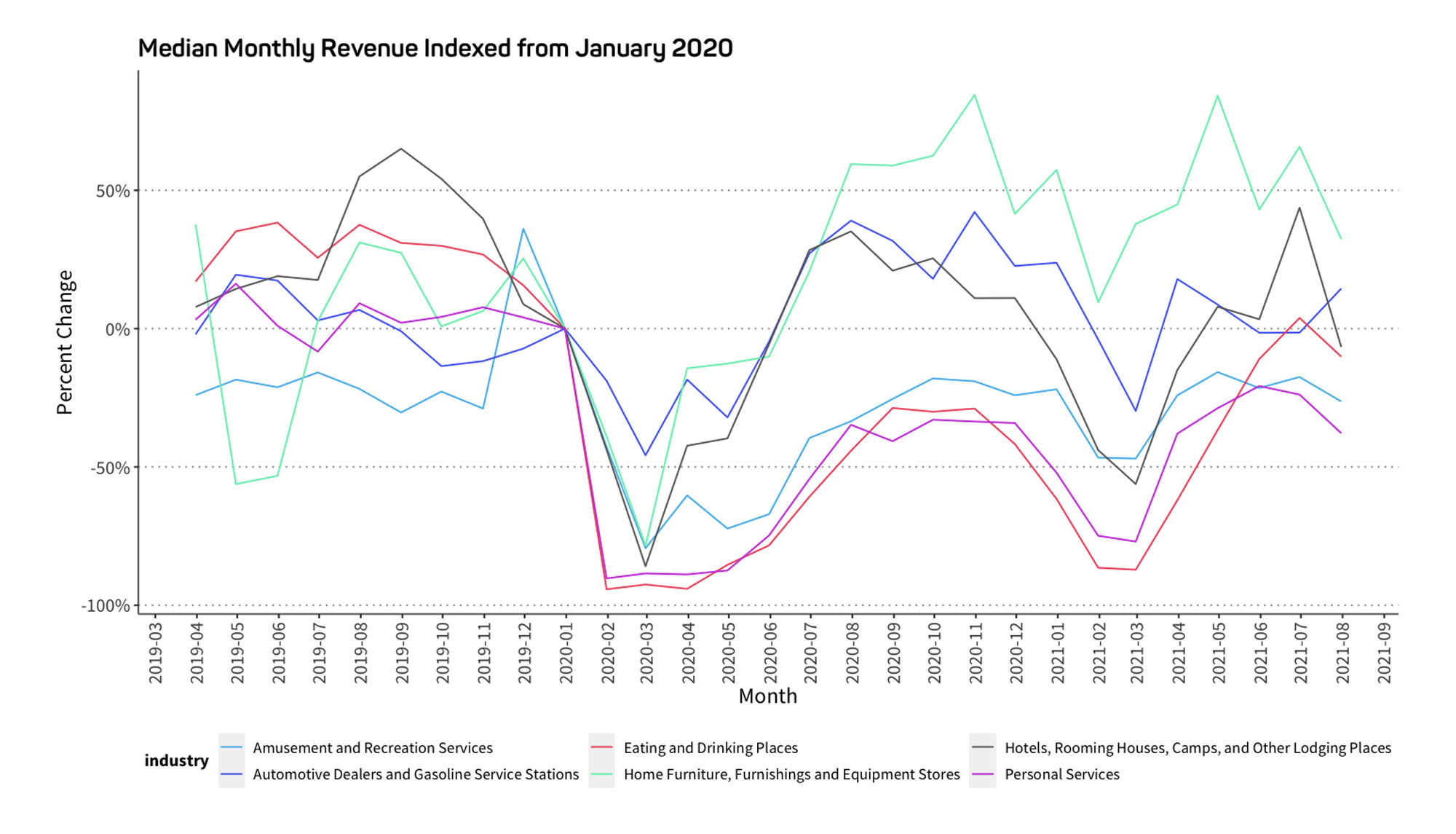

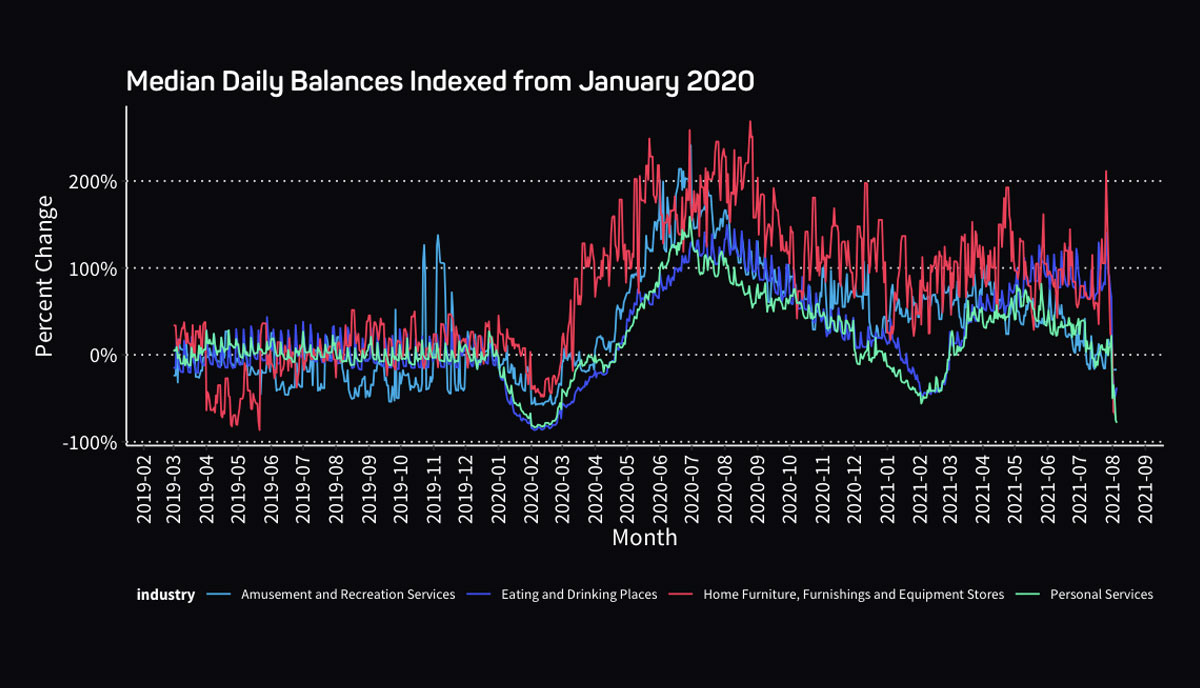

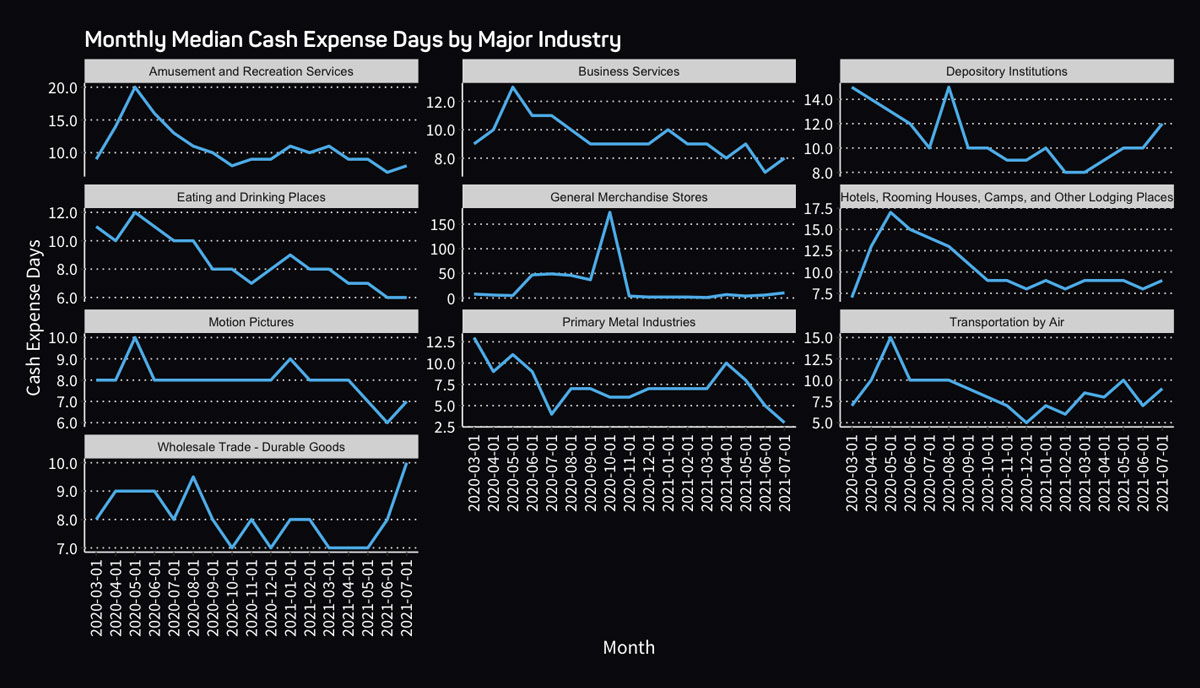

Below is a breakdown of median daily balances, median revenue by month, and overall (non-PPP) application volume from businesses applying for credit through Ocrolus-enabled lenders.

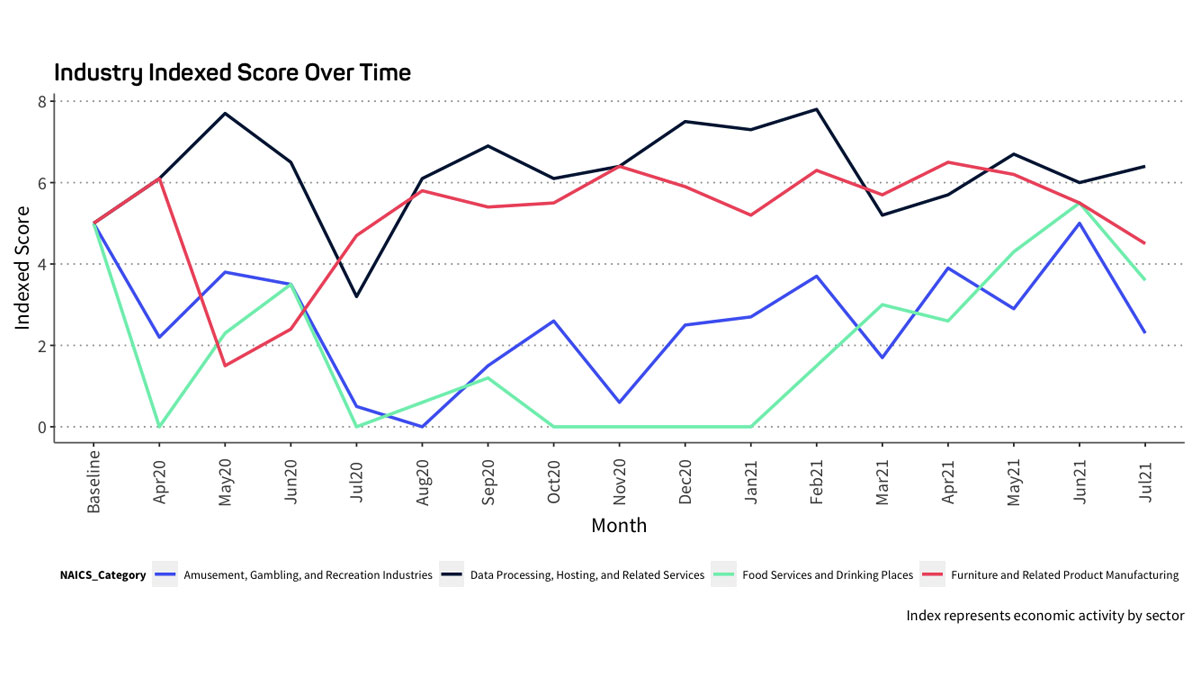

SBHI Sector Summary

Leisure and hospitality jobs, including restaurants, rose by 380,000 in July, reflecting Americans’ renewed interest in dining out and traveling this summer. However, the hospitality industry still has 1.7 million fewer jobs than in February 2020, a large share of the 5.7 million jobs employers have yet to recover from the pandemic downturn.

Services businesses were hit hard earlier in the pandemic and would be among the first to face setbacks if the Delta variant triggers restrictions that limit their operations. The SBHI index showed activity in the services industry slowed for a second straight month in July, as evidenced by falling median revenues, daily balances and cash expense days.

Small business sales were robust in the beginning of the summer at restaurants and bars and clothing and accessories stores as more consumer-facing businesses fully reopened. Meanwhile, sales fell in categories that benefited from strong demand earlier in the pandemic as Americans stayed at home. SBHI scores at furniture, sporting goods and building materials stores all dropped.

| Industry Index | ||

| Industry Type | SBR Score | Change |

| Food Services and Drinking Places | 3.6 | -1.9 pts |

| Amusement, Gambling, and Recreation Industries | 2.3 | -2.7 pts |

| Data Processing, Hosting, and Related Services | 6.4 | +0.4 pts |

| Furniture and Related Product Manufacturing | 5.5 | -1.0 pts |

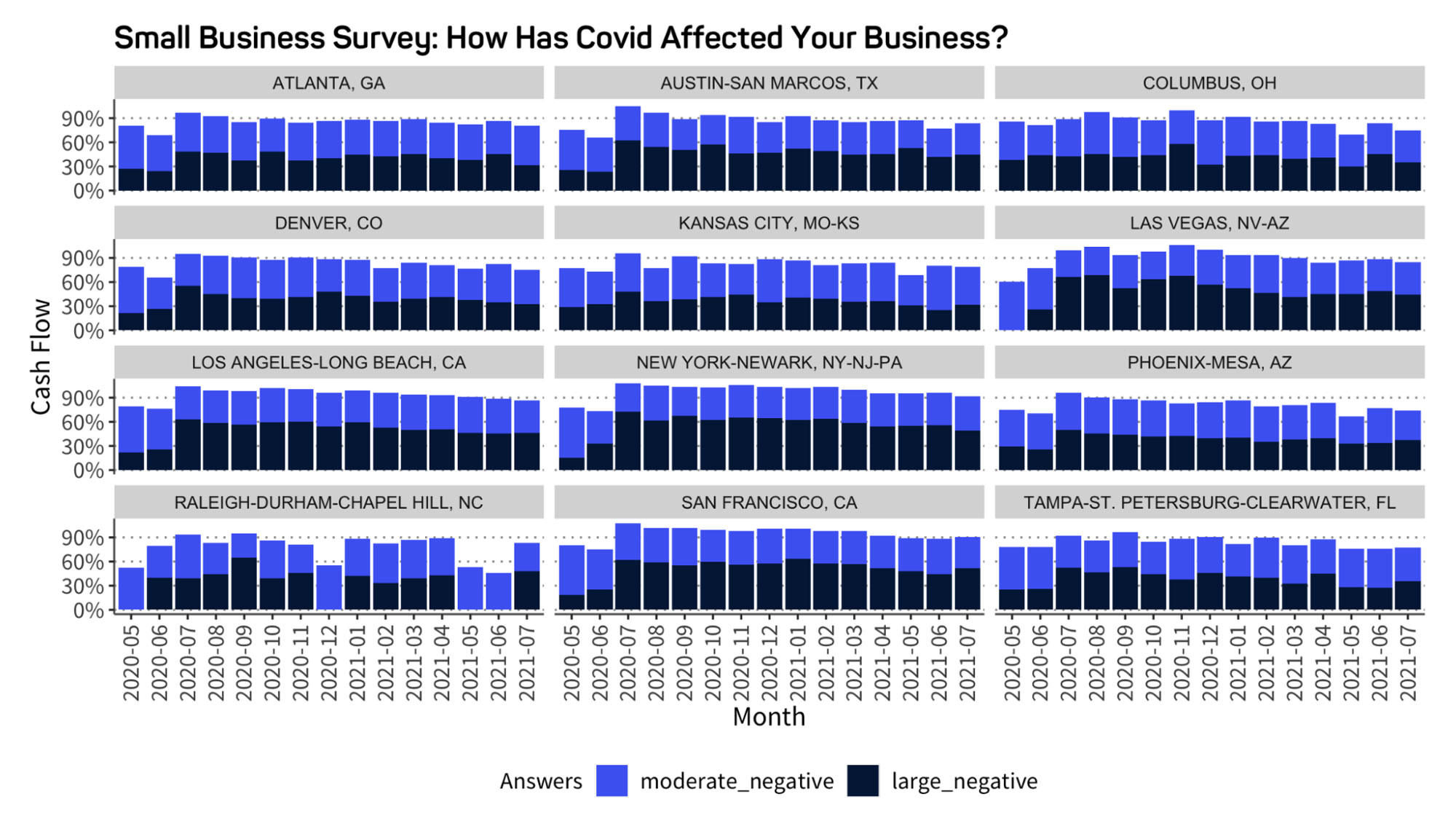

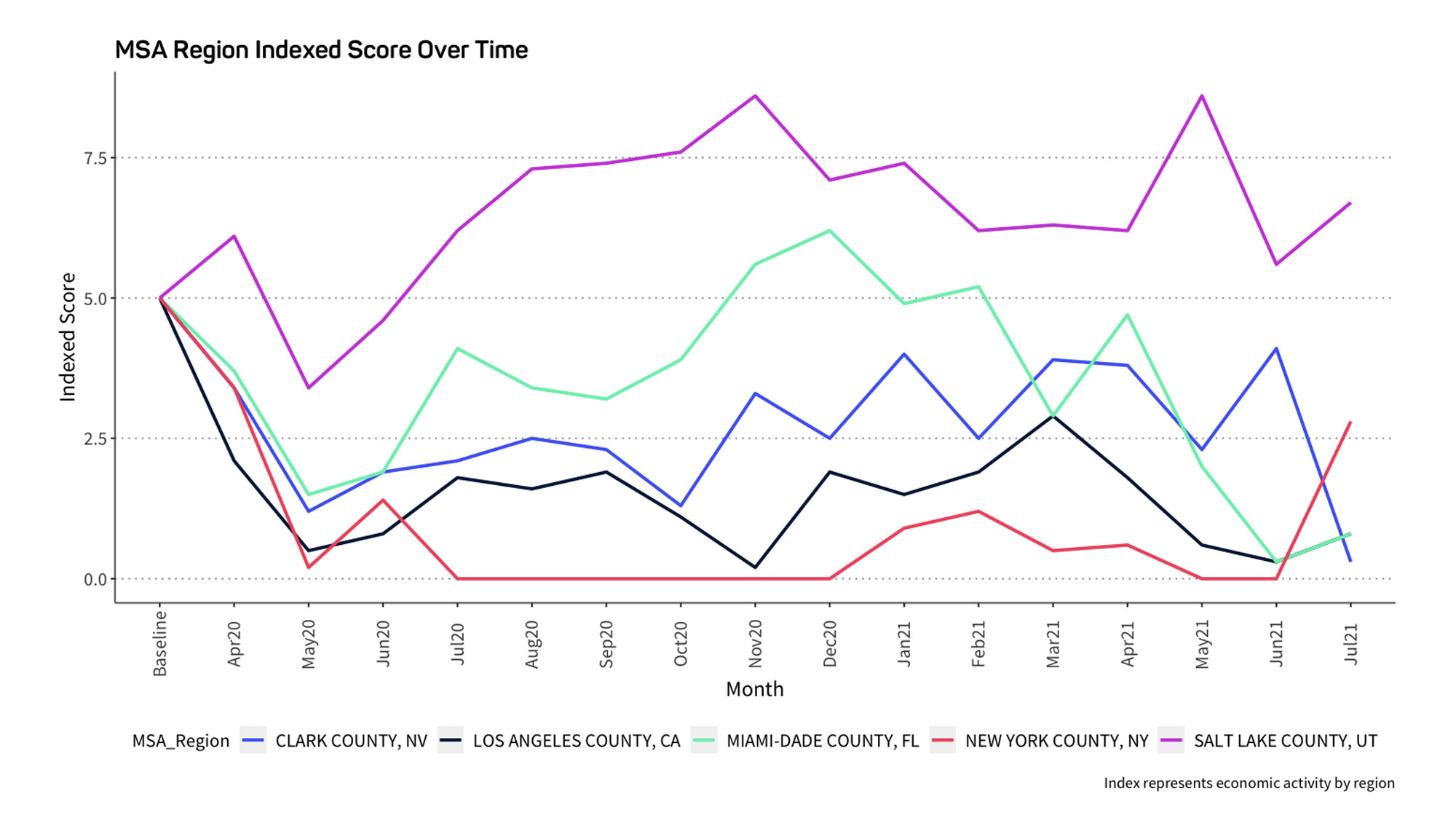

SBHI Geographic Summary

Small-business confidence dropped in August to its lowest level since early spring, as the rise in Covid-19 cases due to the highly transmissible Delta variant put a damper on expectations and turned entrepreneurs more cautious. Thirty-nine percent of small business owners expect economic conditions in the U.S. to improve in the next 12 months, down from 50% in July and 67% in March, according to a survey of more than 560 small businesses for WSJ by Vistage Worldwide.

Differences in small business confidence exist at the regional level, as demonstrated by the U.S. Census Bureau’s Small Business Pulse Survey.

These measures are part of the broader Small Business Health Index that tracks economic and bank data metrics such as small-business owners’ outlook for their companies and their availability of cash on hand. That overall figure remains positive, but fell to its lowest level since March, which firms attributed to labor and supply shortages.

So far, the new government-imposed restrictions on businesses have been limited in scope, but the list is growing. They include the reinstatement of indoor-mask rules in some localities such as Los Angeles County. Only about 50% of jobs have been recovered in California to pre-pandemic levels, whereas two-thirds of the national average have been recovered.

Parts of Mountain West, Plains and New England have three open positions for every unemployed person. In some regions, including less populated areas that imposed fewer Covid-19 restrictions – states such as Utah and the Dakotas – economic activity is booming, with many employers struggling to fill open jobs. Elsewhere, including in urban areas and tourist hubs that have been slower to ease restrictions – such as Nevada and Hawaii – economic activity is stalling and in some cases reversing from the gains made earlier in the summer.

| MSA Index | ||

| County | SBR Score | Change |

| Los Angeles County, CA | 0.8 | +0.5 pts |

| Miami-Dade County, FL | 0.8 | +0.5 pts |

| Clark County, NV | 0.3 | -3.8 pts |

| New York County, NY | 2.8 | +2.8 pts |

| Salt Lake County, UT | 6.7 | +1.1 pts |

Conclusion & Rankings

It appears we’re past the peak for growth from the pandemic recovery. But the economy can expect to continue growing solidly over the coming year, fueled by job gains, pent-up savings, and continued fiscal support.

Several forces are likely to ensure economic growth remains strong in the coming quarters. For one, millions of individuals who are unemployed or not looking for work will likely find jobs, giving them income to spend. Consumers also built up a large cash buffer during the pandemic. Americans were saving at an annualized rate of $2.3 trillion in May, nearly twice as much as they were saving in May 2019. September could be a pivotal month, as schools reopen widely across the nation and expanded unemployment benefits expire nationwide.

This new phase of the recovery comes with its own set of risks. Although many economists expect recent price pressures to be temporary, there is the possibility that costs for some goods and services push up inflation on a sustained basis. Another risk comes from the labor market, which has recovered more slowly than many economists anticipated earlier this year. The U.S. economy is still about 6 million jobs short of pre-pandemic levels, and some impediments to employment growth could be long-lasting.

About the Ocrolus Small Business Health Index

Ocrolus is committed to supporting the lending community in its understanding of underlying credit risk with real-time income and cash flow analytics derived from bank account data and other sources. The amalgamation of highly relevant external data at the regional level, combined with proprietary Ocrolus insights at the borrower level, provides a window into the resilience and prospects for recovery for millions of businesses in the U.S. This is what the Small Business Health Index seeks to capture — a real-time snapshot of the health of small businesses by industry and geography.