Consumers, Cars & Credit: The Costs of Constrained Supply on Auto Lending

In 2020, I wrote about the state of the automotive lending markets in the United States. The post covered auto sales figures, loan originations, credit standards, and delinquency rates. It ended up being one of the most popular items on the Ocrolus blog. The situation in mid-late 2020 could be summed up as follows: amid higher delinquency rates, uncertainty around post-pandemic consumer financial health, and the growing insufficiency of traditional underwriting methods, auto lenders had tightened their criteria for new borrowers, and origination decreased.

We now find ourselves in different circumstances. While we still have pandemic-related uncertainty, the auto market is currently dominated by the issues of supply-chain disruption, inflation, and high consumer demand. We can now explore data on the auto market and related loan performance and consider what it implies for the current and future health of the American consumer.

Expanding Consumer Credit

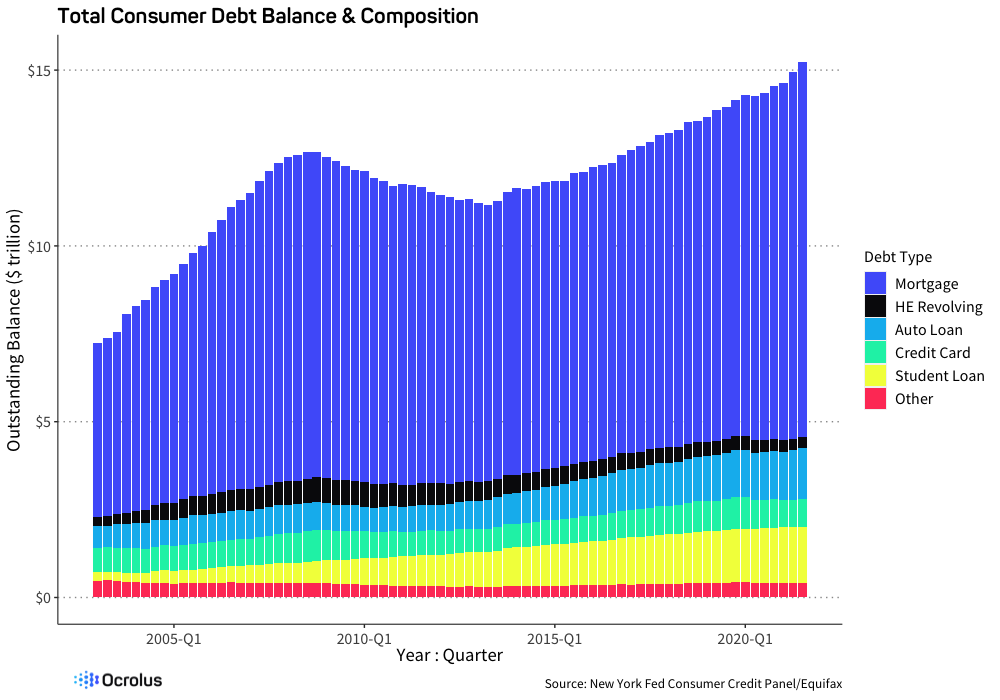

It is important to view automotive lending in the context of U.S. consumer debt in general. As we can see in the graph below, Americans now have $1.44 trillion in outstanding auto loan debt, out of a record $15.24 trillion outstanding across all debt types. After a temporary tightening of standards in Q2 2020, the floodgates quickly reopened. In an environment of economic stimulus, inflation, and extremely low-cost capital, consumer lending as a whole has continued to expand at a rapid pace.

Supply-Demand Imbalance

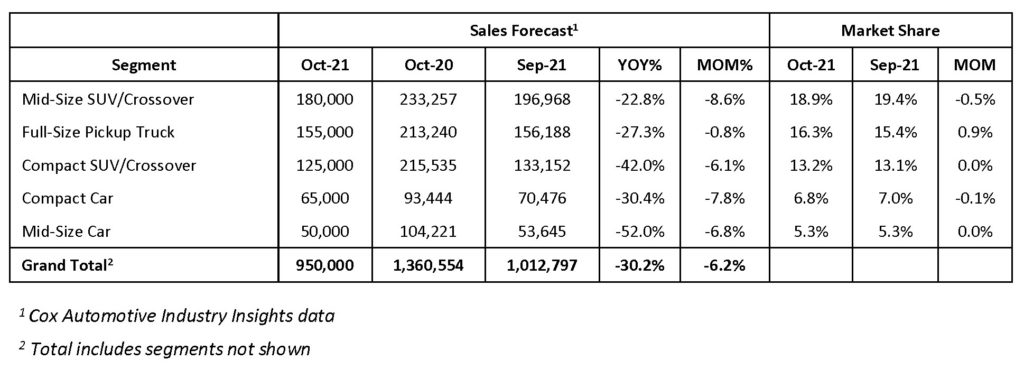

If you’ve attempted to purchase a new vehicle the past few years, you’ve likely experienced the automotive supply chain crisis firsthand. Most directly (but not exclusively) caused by the global chip shortage, manufacturers have dramatically slashed production, and dealers have struggled to maintain any inventory on their lots. Many buyers have needed to wait months upon months for their vehicles of choice to arrive, often paying thousands of dollars above MSRP when they do. While some chip manufacturers say they are back to full production, industry experts are still saying the chip shortage will last well into 2023. The table below reflects this reality, with October 2021 sales down 30.2% from the previous year.

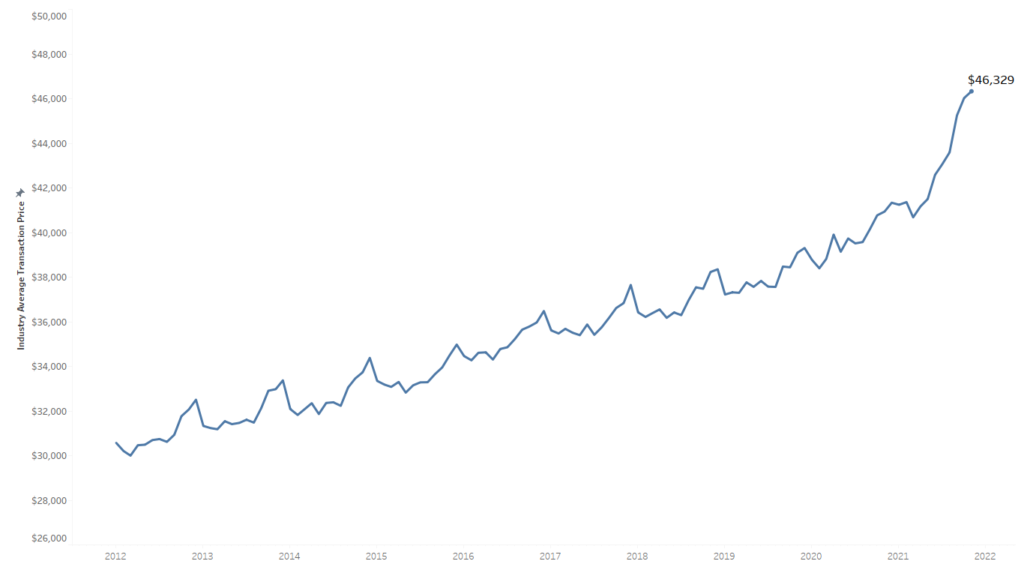

In addition, new and used car prices are at astoundingly high levels, with autos being one of the categories of goods with the highest rates of inflation over the past year.

While in last summer’s auto lending analysis, we pointed to tightening credit standards as a main contributor to decreased auto sales, the overwhelmingly dominant factor today appears to be the inability of supply to keep up with demand.

New Loan Origination

While unit automotive sales may be uncharacteristically low, the dollar volume of new auto loans in Q2 and Q3 2021 was very high, 32% higher than the same period in 2020.

This increase is likely the result of Three factors.

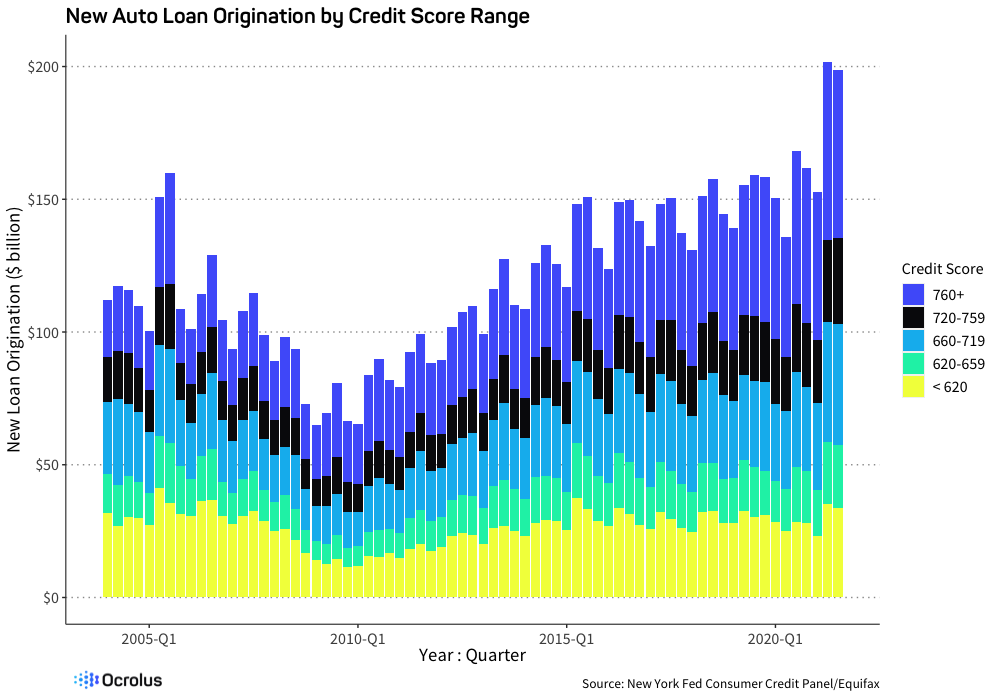

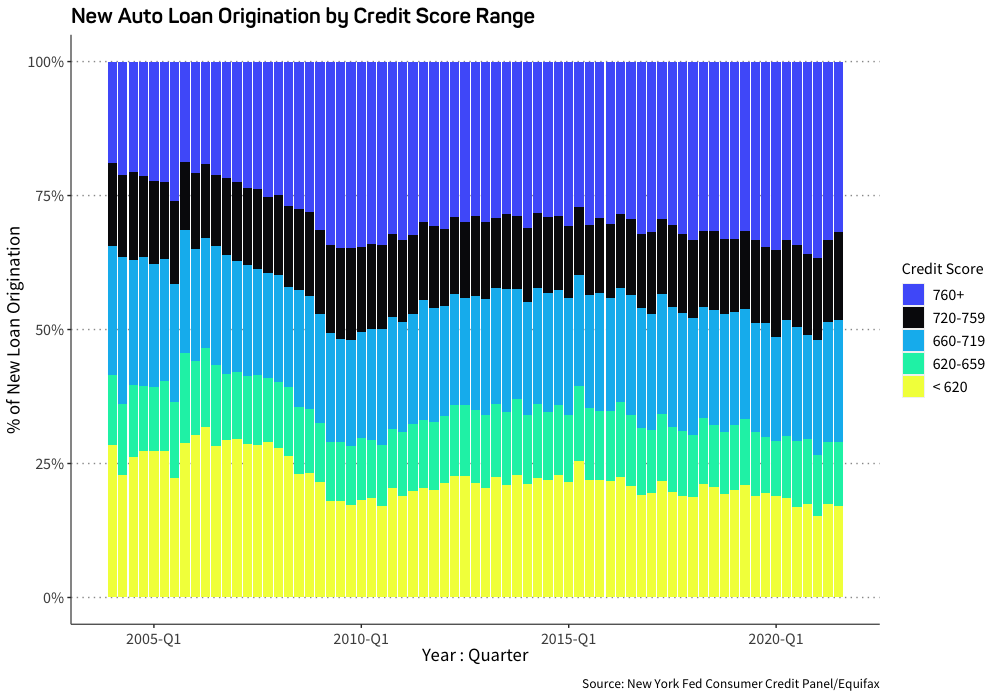

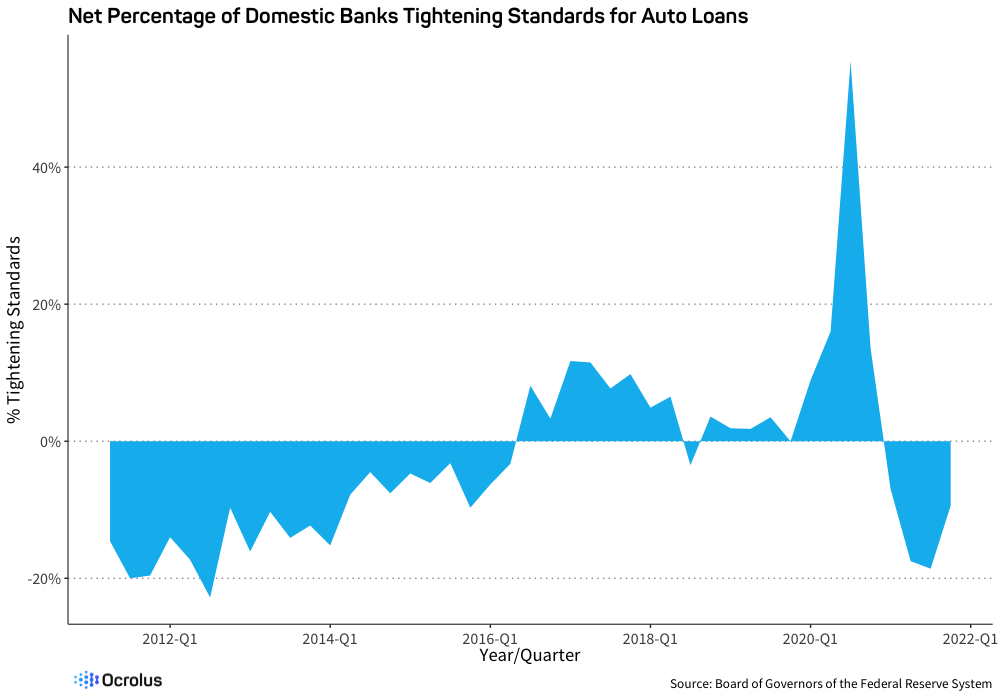

First, the massive increase in prices seems to have outweighed the decrease in unit volume. Next, automotive lenders have been relaxing their credit standards over the past couple of quarters. The graph below shows the distribution of new auto loans by credit score range, and the subsequent graph shows the number of banks tightening (or loosening) their standards for auto loans. While lenders sharply tightened credit in early-mid 2020, those changes have now reversed.

Finally, low interest rates and high prices likely led consumers to finance a greater portion of their new vehicle purchases in 2020 and 2021. In the previous inflationary environment with near-zero interest rates, it didn’t make sense to put much, if any, money down.

Loan Performance

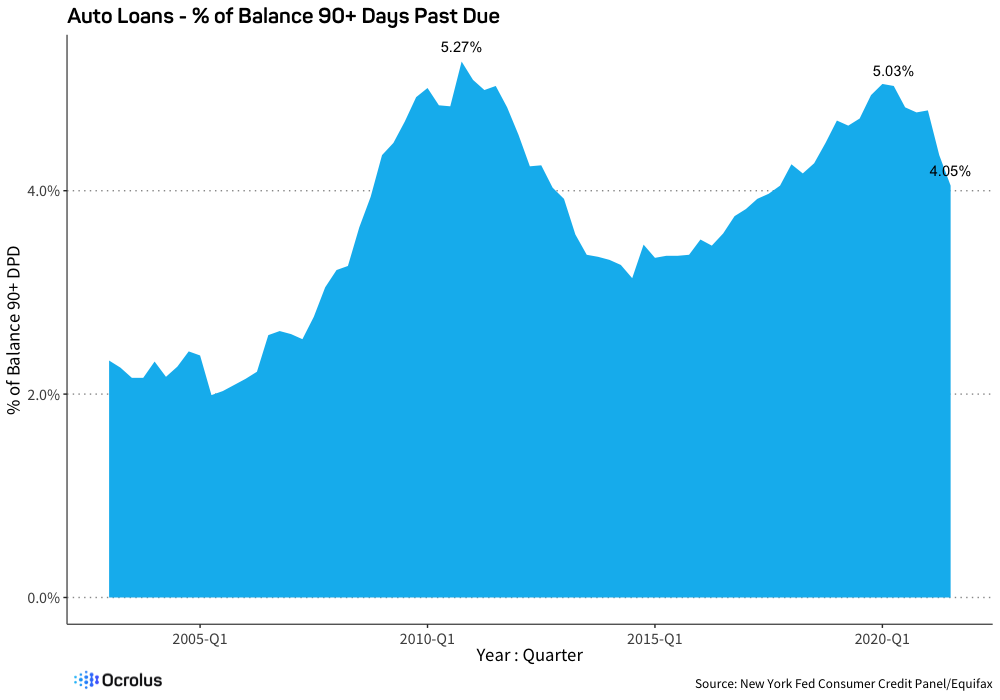

In our previous analysis, we noted that auto loan delinquencies were near great-recession levels, having been rising for many years amid an expansion in subprime origination. Over the past several quarters, this trend has reversed, with 4.05% of balances now 90+ days past due. While lower delinquency rates are good news, there is a chance these rates are artificially low, masking deeper issues.

Loan forbearance programs have temporarily decreased other monthly debt obligations for many households. For instance, federal student loan payments have been on hold for over 2 years. Government stimulus checks have also put more cash in consumers’ wallets. Additionally, the availability of inexpensive credit makes it possible for consumers to refinance existing debt into lower-rate, longer-term products. As in other asset classes, it is unclear to what extent these trends will reverse and delinquency rates will rise once the aforementioned factors are no longer present.

The Uncertain State of Consumer Financial Health

The same dynamics affecting the automotive lending market can be seen in most issues affecting the American consumer. Higher prices, supply-chain issues, multiple government programs with uncertain futures, and a generational change in the relationship between people, firms, and the nature of work itself. This is particularly true for lenders considering how to evaluate consumer creditworthiness and ability to repay.

In a time of great volatility, forward-thinking lenders (especially those who are Ocrolus clients) are utilizing more diverse sources of information, including bank transactions, payroll data, and more in order to construct a fuller and more real-time picture of a borrower’s ability to pay. As fewer Americans earn their incomes from traditional sources (i.e. the proverbial ‘9-5 job’) and shift to freelance work, the gig economy, and other types of labor, the automotive lending industry, as well as the lending industry at large, will need to ingest, synthesize, and analyze multiple sources of data to understand cash flow and a borrower’s capacity to service debt. This shift is unlikely to end anytime soon.