Adapting to the Rise of Non-Traditional Borrowers with Alternative Lending Options

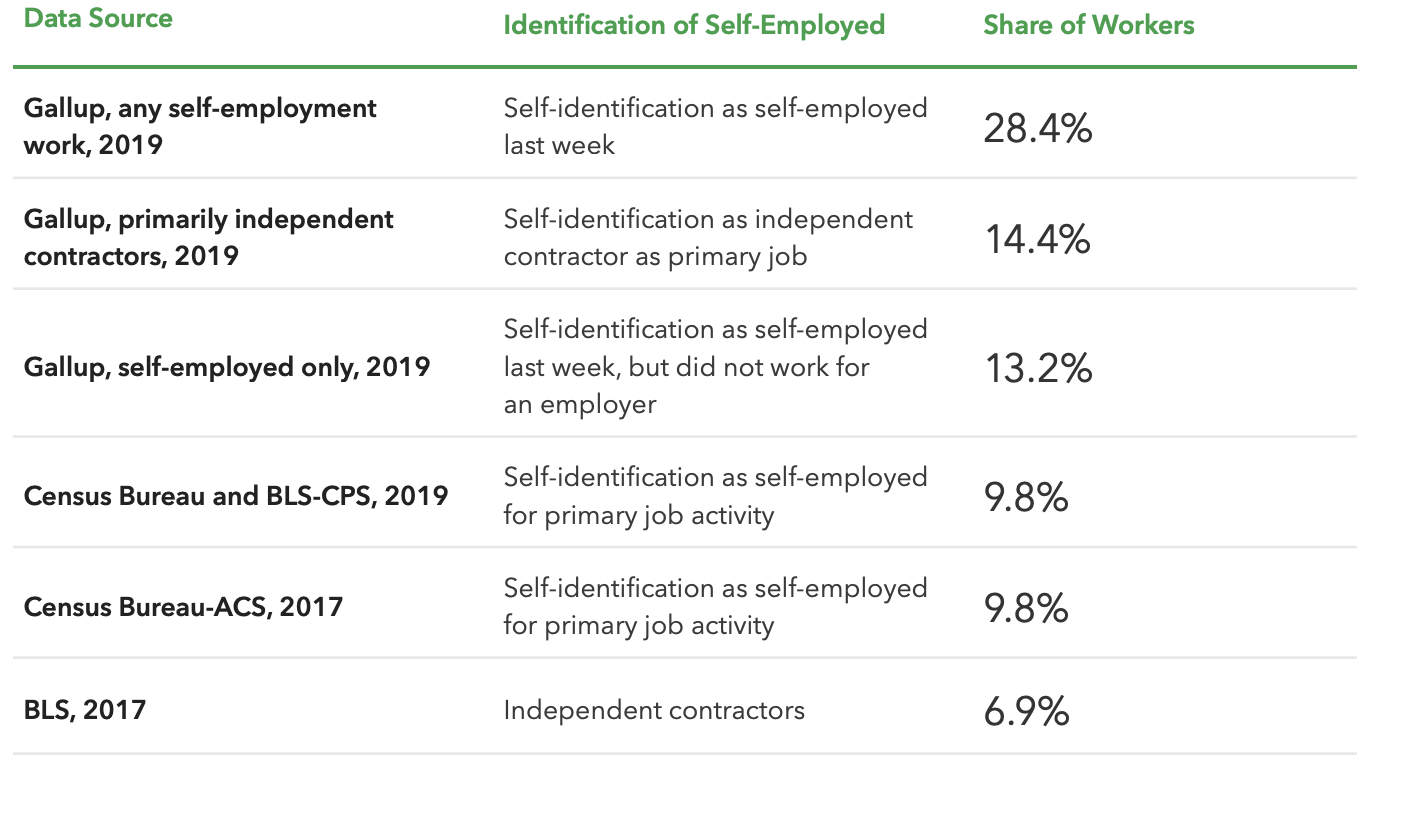

The gig (economy) is up! New research shows self-employment and gig economy working in the U.S. is on the rise. In a collaborative study, Intuit Quickbooks and Gallup found that self-employment is at an all-time high, with a record-breaking 44 million self-employed professionals in the U.S. That’s nearly 30% of Americans. The report also states that from 2000 to 2017, there was a +722% growth in sole proprietors, and this trend shows no sign of slowing.

With more and more Americans supporting themselves as non-traditionally employed workers (and with about 40% of gig workers reporting an excess of $50K), it’s time for mortgage lenders to look more closely at how they can serve this market of non-traditional borrowers.

Source: The State of the Self-Employed

Through my discussions with mortgage experts on this topic, it’s evident that many professionals are experiencing the same pain point around analyzing income analysis for self-employed borrowers. They are reluctant to lend to them because it’s more difficult to get to their goal; that is, turning data into one usable calculation to determine how much of the self-employed person’s income can be applied towards their monthly income.

Recently, I had a conversation with the Head of Operations at a major lender. When I asked what the company’s process was for handling non-traditional income analysis, he stated that, if he gives a group of underwriters the same self-employed income file, he’ll get three different calculations back. The need for a consistent and automated approach to self-employed income is there, and with mortgage rates at an all-time low, more of these non-traditional borrowers are applying for home loans.

In order to enact consistent underwriting treatment of self-employed income, lenders should develop a uniform consensus around the way to approach self-employed borrowers. Without technology, underwriters might push a non-traditional loan application with fifty pages of tax returns to the bottom of the pile. With the right technology partner, mortgage lenders can address this under-served market by automating document-driven processes for qualifying non-traditional borrowers.

Automation in Action: Self-employment income analysis

Ocrolus recently partnered with HousingWire to share our solution for self-employment income analysis & verification with their forward-thinking community of mortgage professionals. I had the pleasure of collaborating with our former Mortgage Product Manager, Christine Ponder-Stern, to show how lenders can make smarter, faster loan decisions on self-employed borrowers with the help of our automated solution.

Watch the demo below to learn more about how we help mortgage lenders analyze self-employed income.

View our Events page to catch us at an upcoming virtual mortgage event, including NEXTFALL22, Digital Mortgage, ACUMA, and the MBA Annual Expo.