The State of Small Business Credit for 2023

It’s often said that small businesses are the lifeblood of the U.S. economy, and the past several years have reaffirmed this fact. The U.S. is home to 33.2 million small businesses employing 46.4% of the private workforce, accounting for 44% of US economic activity. The ability to obtain access to capital is critically important to the stability, vibrancy, and growth of our economy and the society at large. Since the beginning of 2020, small business owners have had to weather volatile conditions, as have the institutions that provide them with financial services. Despite the volatility and uncertainty of the pandemic era, low interest rates and government assistance programs preserved the availability of credit, and default rates remained low. Now, as we begin 2023, interest rates have increased, delinquency rates have started to climb, and signs point to a more complex and difficult road ahead for small business credit.

At Ocrolus, we’re constantly in conversation with our lender clients and partners about the market dynamics that affect them and how we can help them succeed. There are some recurring themes to these conversations. In particular:

- New business formation is on the rise, and younger businesses comprise a greater share of new credit applications

- Delinquencies have increased year-over-year

- Lenders have tightened underwriting standards, particularly banks

- Cost of capital has increased, which is squeezing lenders’ margins

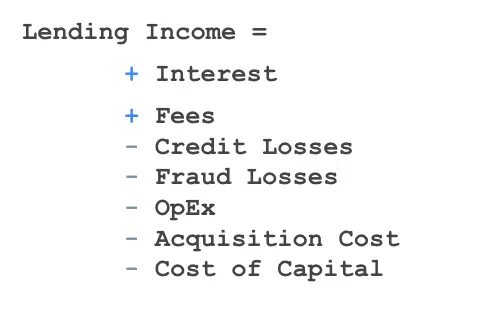

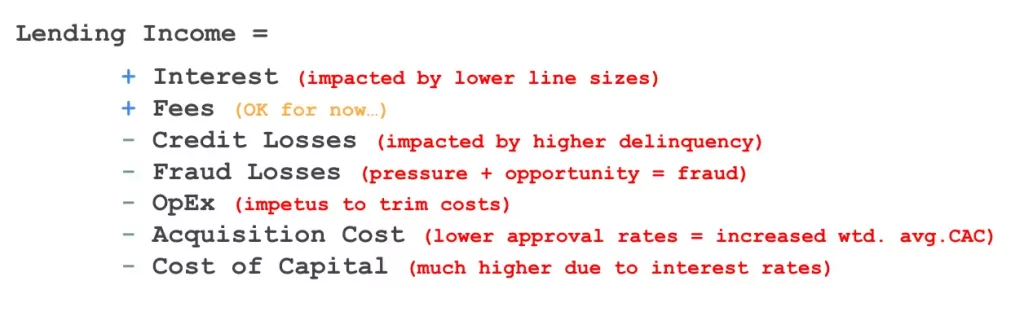

Before diving into more details about the state of small business credit, let’s briefly cover how a lender makes money. Later, we’ll use this structure to explore the impact of these market dynamics through the lens of a lender’s P&L. The equation below will certainly differ by type of lending business and by product, but in general, the structure is common to all lenders. Lenders earn money on interest and fees, lose money on credit and fraud losses, and spend money on operations, marketing, and cost of capital.

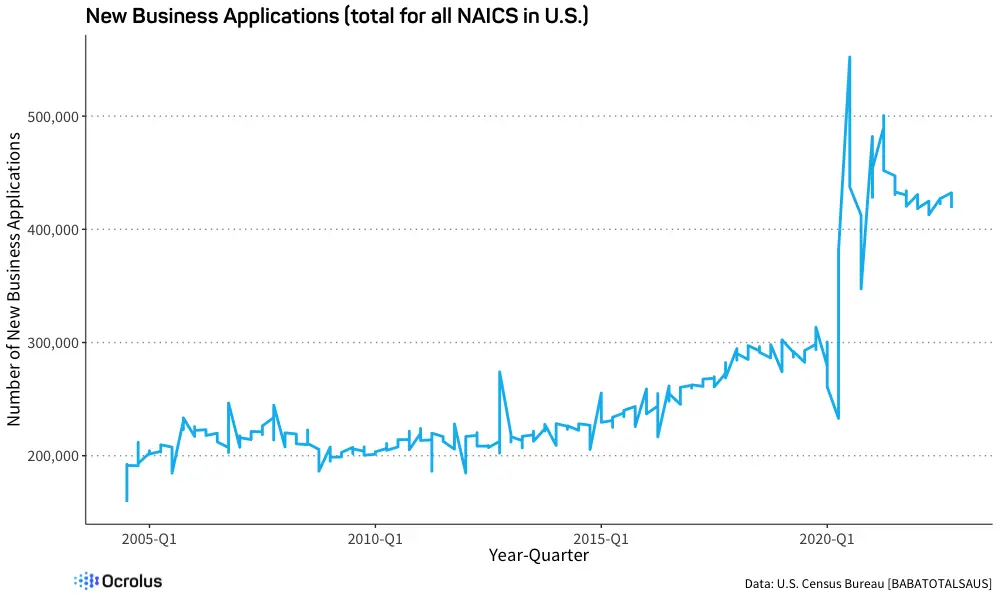

New Business on the Rise

New business incorporation spiked during the pandemic, with the level of registration remaining historically high to this day. An increasing share of the workforce is now self-employed, representing a historic realignment in the nature of work. With fewer barriers to new business creation and self employment, lenders have the challenge of underwriting credit for entities with limited borrowing history.

Share of U.S. Labor Force that is self employed (2000-2022)

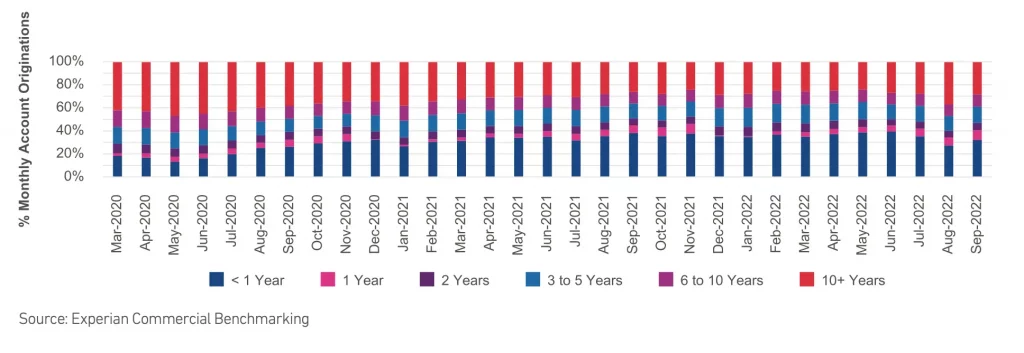

New Applicant Time in Business Skewing Lower

As one might expect given the rate of new business creation, the mix of commercial credit applicants is also shifting. This has an impact on approval rates, as many lenders have a strict cutoff for “time in business” – typically 1 or 2 years. It also affects lenders’ ability to fully assess risk and mitigate losses. First, newer businesses are less likely to have commercial credit history that can be obtained from credit bureaus. Second, business owners often utilize their personal credit to finance their business, particularly in the early days, often resulting in damage to their FICO or Vantage scores. These dynamics cause credit bureau data to be insufficient for a complete understanding of the financial dynamics of a business, and many lenders will need to increase their reliance on cash flow and firmographic data to fully evaluate risk.

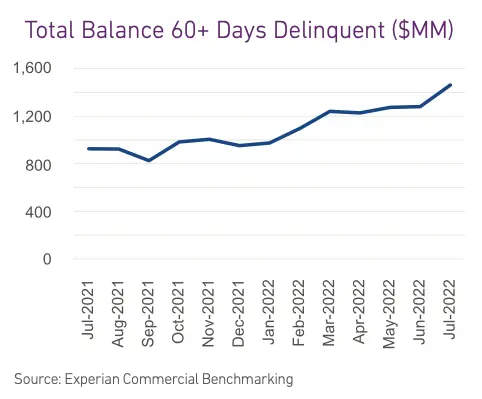

Delinquencies on the Rise

According to Experian, delinquent balances on commercial loans are up 50% year over year, while total commercial loan balances have only increased by 7.6%. Simply put, more businesses are having trouble servicing their debt, and, unsurprisingly, smaller businesses appear to be having the greatest difficulty.

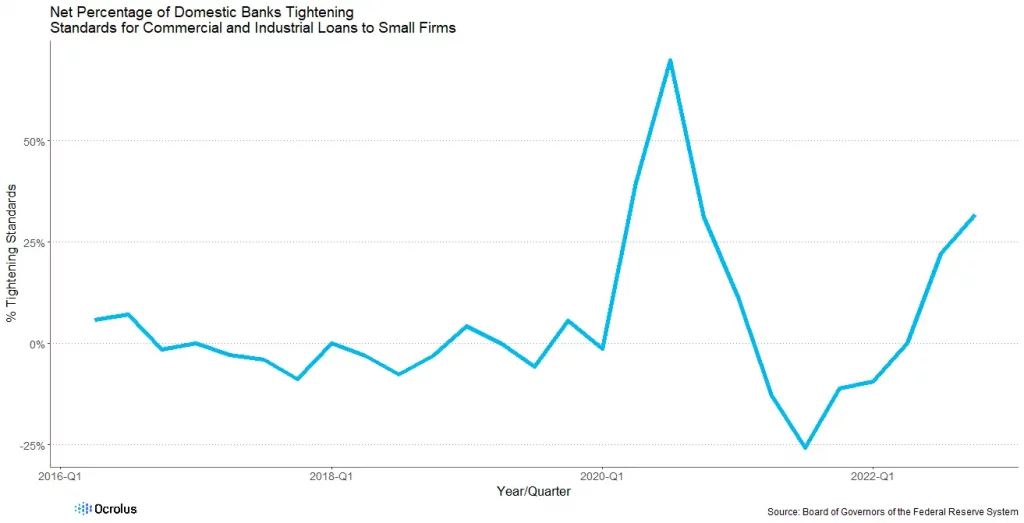

Tighter Underwriting

Given rising delinquency, the shorter business operating tenure of applicants, and the looming economic uncertainty, lenders are adjusting their underwriting criteria. As we can see in the graph below, banks have been tightening their standards for business underwriting for the past few quarters. This comes after a mass tightening at the beginning of the pandemic and then a substantial relaxing of standards during most of 2021.

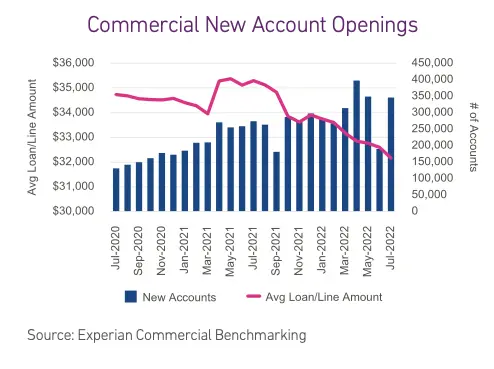

We’ve observed similar trends among non-bank lender clients, with many reporting greater application volume but lower approval rates. In addition, lenders are taking less exposure even on approved loans, as we can see in the graph below.

While it makes sense for lenders to adopt stricter criteria ahead of a potentially challenging economy, the above dynamics do present a challenge to lenders’ return on investment. If the costs to acquire a lead and process a new loan application are relatively fixed, approving fewer of these loans increases the average cost of acquisition. This, combined with loan/line sizes decreasing potential interest revenue, can stress a lender’s profit margin.

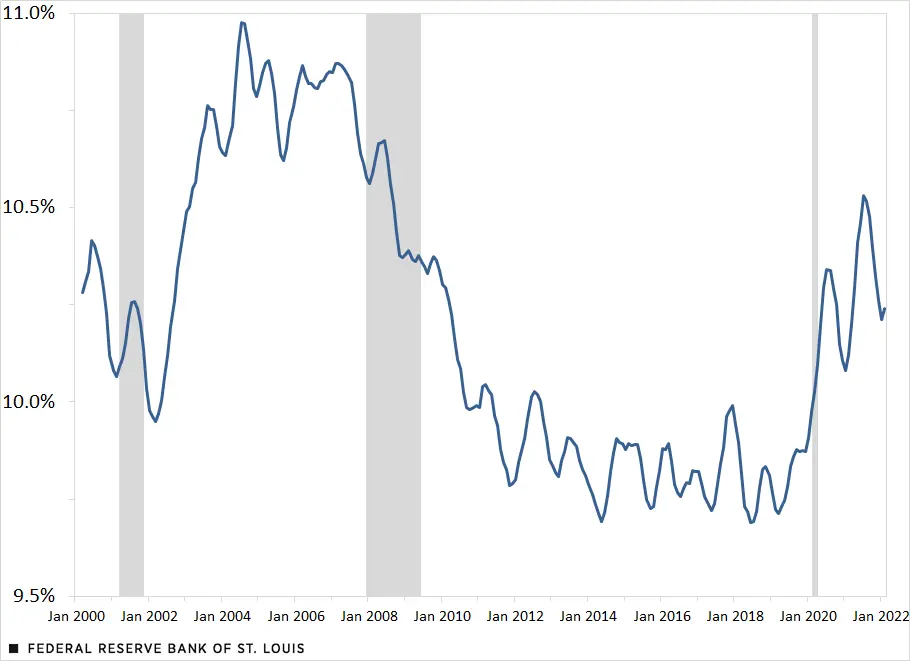

Cost of Capital

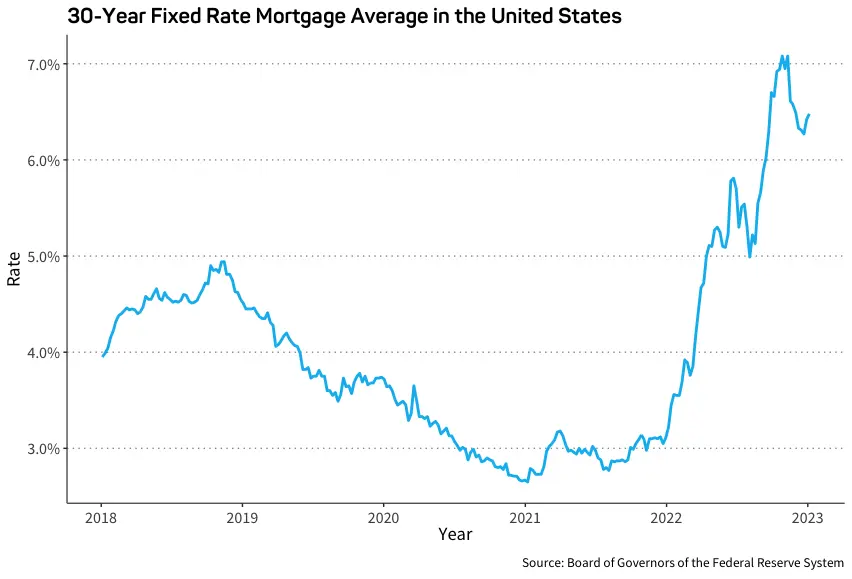

As interest rates have sharply increased from historic – and lengthy – lows, nearly every corner of finance is affected. People often speak of the impact of interest rates on demand for credit. For example, if rates are higher, fewer people apply for a new mortgage, and far fewer people apply to refinance their mortgages.

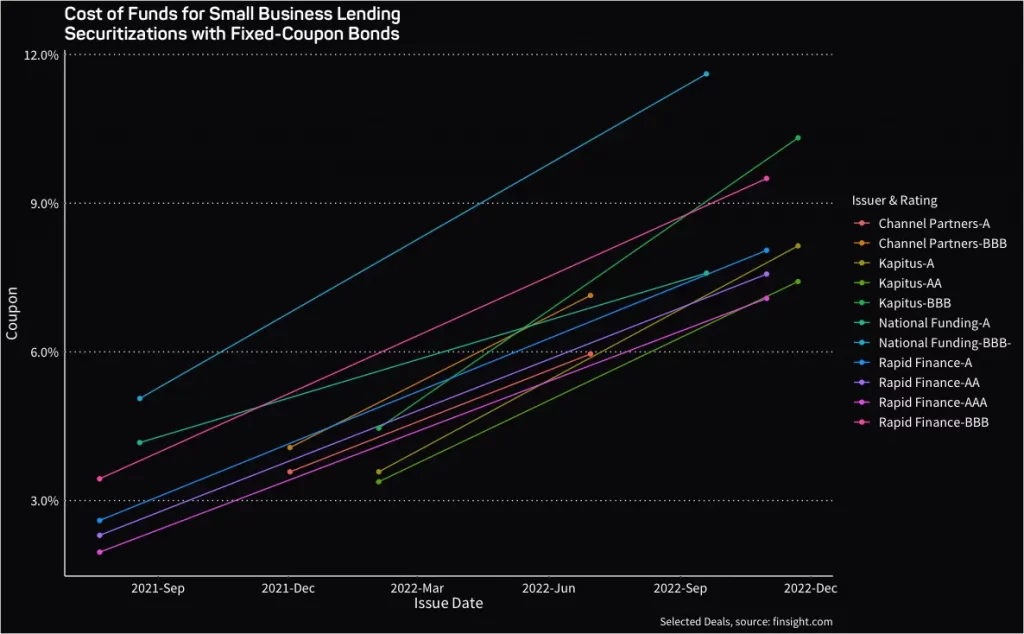

Less discussed is the impact of interest rates on the supply of credit. With higher rates, the cost of funds for lenders has increased substantially, often more than doubling year-over-year, all other things being equal. In the graph below, we can see the coupon rates for variously-rated bonds of major non-bank business lenders.

While these numbers do not exactly equal cost of capital (which depends on debt/equity funding mix, portfolio composition, and other factors), their steep rise poses a challenge. Lenders typically can and do pass on some of this cost to borrowers, but they often can’t pass on all of it, lest they overly suppress demand for their loans, particularly in a market where competitive lenders may keep rates low for longer than advisable in order to win market share.

Summary of Lender Impact

Let’s remember how lenders make money! We can review the impacts of the above dynamics on each aspect of the lender income equation.

The effects on a lending business are multiple:

- Lower line sizes and loan amounts mean less opportunity to earn interest revenue.

- Higher delinquencies point to increased credit losses as vintages season.

- Fraud losses will undoubtedly rise as well, brought on both by the pressure of a challenging economy as well as the many misrepresentation vectors that are possible in digital channels.

- Lenders will feel pressure to contain operational expenses and will likely aim to reduce acquisition costs when faced with an environment with fewer desirable borrowers.

- Finally, an increased cost of capital compresses lender margins and constrains the space of ROI-positive investments.

What’s a lender to do in 2023?

While an environment of low interest rates and high GDP growth makes it easy for lending businesses to post good results, challenging economic conditions give the best-equipped lenders the opportunity to differentiate from their less-prepared peers.

In the realm of operations, lenders benefit from adopting highly automated and scalable workflows that free them from the high fixed cost base of manual documentation review and judgmental underwriting. Automation allows lenders to scale resources up and down with volume and allows them to allocate their human capital towards the most challenging and differentiated activities, such as working with distressed borrowers to pay down debt.

In uncertain times, lenders need to strengthen their fraud defenses any way they can. Potential pitfalls come in the form of professional fraudsters preying on stretched-thin risk teams as well as desperate ‘friendly fraudster’ applicants who may falsify information to obtain credit for which they would not otherwise qualify. At Ocrolus, we see this in our Detect product, where we identify document tampering invisible to the naked eye and provide lenders with detailed, contextual signals to identify potential fraud. Prepared lenders will evaluate and utilize any technology, tool, or dataset available to identify potentially suspicious behavior in its tracks and take action before funds go out the door.

On credit, lenders need to be able to evaluate borrowers in the context of a changing environment, where the correlation between past behavior and future repayment performance is likely to decrease. Thoughtful lenders will gather and evaluate a broad set of data on their borrowers, including bank account cash flow data that provides a lens into the detailed financial dynamics of a business. Providing these cash-flow-based credit attributes is one of our key products at Ocrolus. Whereas stressed borrowers may have previously been able to refinance into other credit products, thus stopping (or at least delaying) losses, those options may be less available in 2023, leaving existing lenders with larger than expected risk. Rather than try to predict the future, I prefer the technique of simulating many potential scenarios, analyzing the likelihood of each, the financial impact, the KPIs to monitor to know that it is happening, and the specific plans one would enact if that scenario were to take place. Smart lenders will take action early, monitor their portfolio KPIs every day, and invest in getting their technology, process, and teams prepared to take action rapidly.

Finally, lenders need to do all of this while still providing capital to eligible businesses with transparency and a high-quality customer experience. In the words of my former colleague during the Great Financial Crisis, you don’t want to, “catch a dolphin in the tuna net.”

If you’re a lender and would like to learn more about how Ocrolus can help with automation, cash flow underwriting, and fraud detection, please get in touch!