Document AI for faster and more accurate financial decisions

Ocrolus helps lenders manage risk and avoid fraud by automating document analysis.

Quickly retrieve data from any file using our AI-driven document automation software, regardless of format or image quality

Increase accuracy

Make smarter decisions with trusted data

Accelerate processes

Eliminate manual review and "stare and compare" work

Scale on-demand

Flex up (or down) on-demand, 24x7x365

Bolster compliance

Protect your data with bank-level security and a robust audit trail

Ocrolus technology elevated our bank statement analysis capabilities to the next level.”

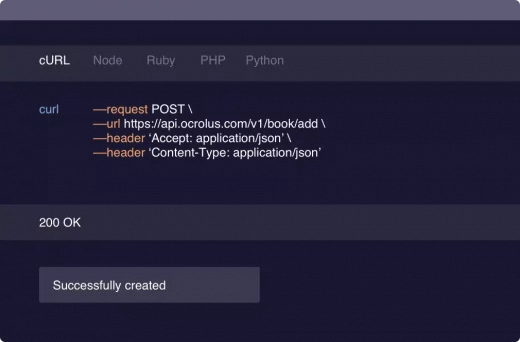

Explore our API

Build on Ocrolus to create innovative and streamlined customer experiences.

Ready to go?

See how our intelligent document processing software can optimize your ability to analyze documents and make financial decisions quickly with AI.