This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Ocrolus Detect can help lenders minimize risk and prevent unnecessary losses

NEW YORK, Sept. 12, 2022 – Ocrolus, the document and data analysis platform empowering lenders to make faster, more accurate lending decisions, today announced the launch of Ocrolus Detect, a comprehensive fraud detection solution for lenders. Detect provides high-quality, decision-ready data that can help lenders minimize risk and prevent losses.

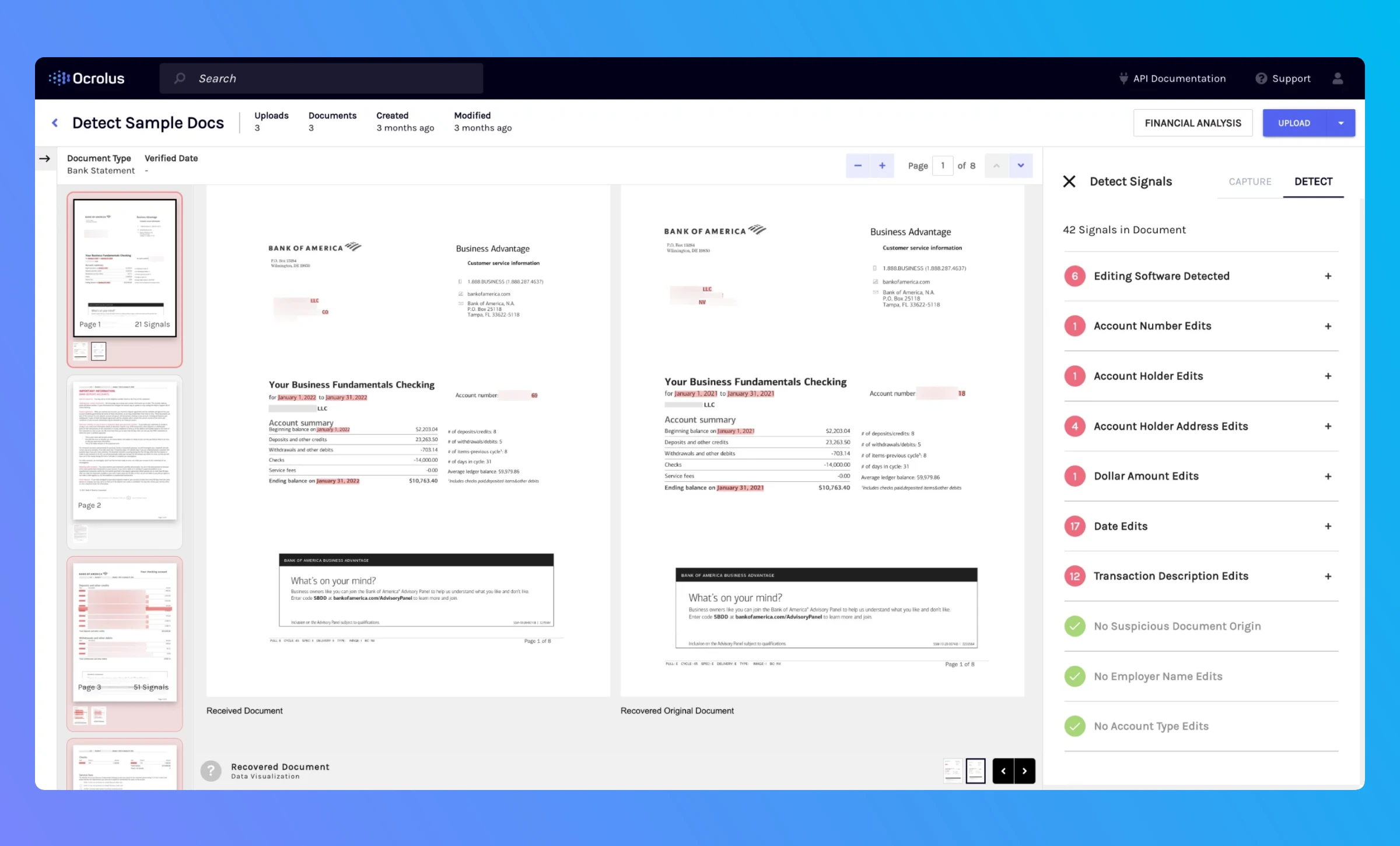

Lenders traditionally perform manual review of documents to inspect for file tampering, document manipulation, inconsistencies, and other suspicious activity. This time consuming, tedious, and error-prone process can result in significant losses. Ocrolus Detect automates fraud workflows, providing detailed signals and clear visualizations of fraudulent activity undetectable to the human eye.

“Detecting fraud is mission critical to our business, and Ocrolus is uniquely qualified to provide a comprehensive fraud solution with its focus on lending,” said Zack Whitaker, Risk Operations at AtoB, a fintech company modernizing payments infrastructure for trucking and logistics. “Fraudulent behavior needs to be caught in our underwriting process and Detect has proven to be a highly effective insight tool for our team.”

Detect indicates where file tampering has occurred on a document, what fields were modified, and how they were changed to provide the necessary level of context for more informed lending decisions. Detect also visualizes file tampering on documents received and often can recover the original document for fraud analysts to easily spot the modified fields.

Ocrolus processes millions of lending documents weekly, which enables the company to train its machine learning models with a unique and nuanced understanding of file structure and key data. During a customer beta program, Detect accurately uncovered four times more potential fraud than a leading competitor.

“As the lending industry shifts to digital loan application processes, fraud is rapidly increasing and becoming more difficult for humans to catch,” said John Forrester, SVP of Product at Ocrolus. “Detect enables lenders to quickly and confidently process more loans by proactively providing them with clear and reliable fraud signals.”

Detect is generally available today as part of Ocrolus’ premium package. To learn more about Detect or to schedule a demo, visit: https://www.ocrolus.com/product/detect/.

About Ocrolus

Ocrolus is a document automation platform that powers the digital lending ecosystem, optimizing credit decisions in small business, mortgage, and consumer lending. The company provides document analysis infrastructure to customers like PayPal, Brex, SoFi, Blend, and Plaid. Ocrolus enables financial services companies to make high quality decisions with trusted data. By empowering lenders to automate financial analysis, Ocrolus helps borrowers access credit faster and on better terms. The company has raised over $100 million from blue-chip fintech investors. Visit ocrolus.com to learn more.

Ocrolus Media Contact

Kali Myrick