This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Mortgage Document Processing: Increase Efficiency and Profitability with Automation

To allow mortgage lenders to meet the high expectations of potential borrowers, mortgage automation solutions that employ intelligent document processing have become a staple. With intelligent document processing, tasks like reviewing bank statements to verify income have become more efficient and more easily scalable.

More efficiency brings notable advantages to mortgage lenders and originators, specifically, reduced operational costs and faster loan processing times.

Furthermore, mortgage document processing automation can be used for non-traditional applicants submitting bank statement mortgages, or any other potential borrower with a diverse income portfolio.

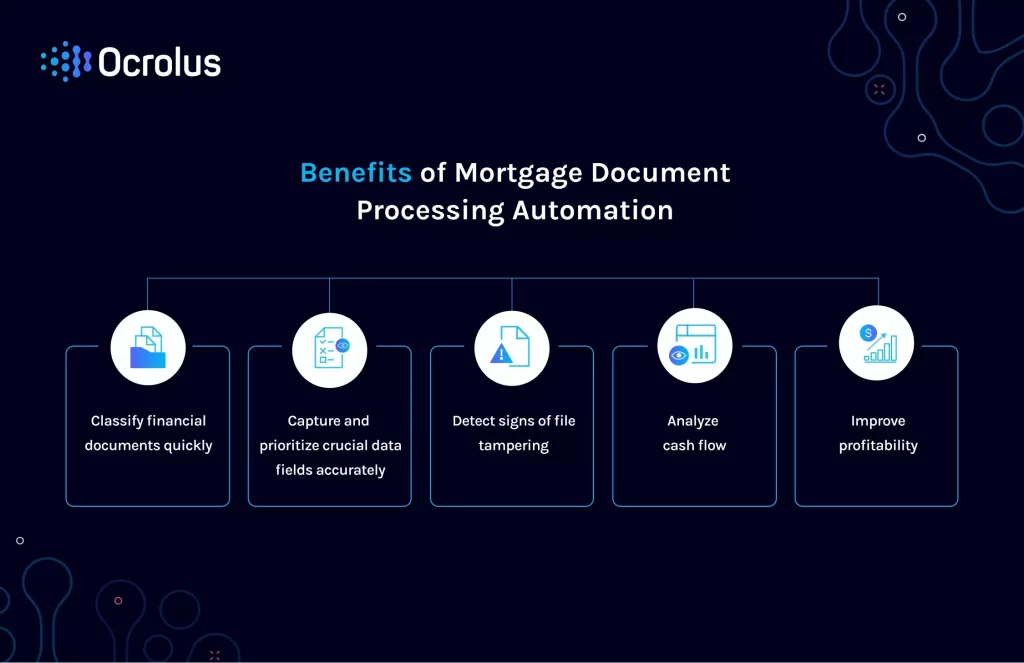

Advantages of mortgage document processing

The traditional manual review and underwriting process no longer meets potential borrowers’ expectations.

Therefore, many leaders in the industry have embraced automation because it’s allowed them to:

- Classify financial documents quickly

- Capture and prioritize crucial data fields accurately

- Detect signs of file tampering

- Analyze cash flow

- Improve profitability

Additionally, lenders will see the value of automation technology, reducing the likelihood of potential borrowers seeking lending services elsewhere.

Automation for bank statement processing

Before automated bank statement processing, lenders and underwriters would spend hours manually reviewing bank statements to verify income. On top of the high likelihood of human error with this method, the resources and hours required can strain profitability.

Once reliable, intelligent technology got introduced, the ability for faster, more precise, and cost-effective mortgage loan processing became the standard. Lenders relying on manual processing are quickly being left behind in terms of processing capabilities and user experience.

Automation technology also allows loan experts to avoid administrative tasks that can take them away from higher-level focus areas. A byproduct of borrowers manually sending bank statements is that it forces the lender to retrieve, review, and process them. Mortgage automation can easily take over this task and verify up to two years’ worth of bank statements faster and more accurately than even the most efficient underwriter could manually.

Mortgage lenders can speed up the process even more by using an income calculator like the one Ocrolus has recently launched. This calculator provides accurate and verified income data in one place, organizable by deposit amounts, and with the freedom to adjust any transaction.

Mortgage automation for non-traditional borrowers

Mortgage document processing automation also helps non-traditional borrowers such as self-employed applicants and real estate investors. A non-traditional borrower is likely to have a diverse income portfolio, and so have difficulty qualifying through traditional methods like W2s. Document automation allows lenders to process a variety of documents and qualify applicants on a broader range of metrics including any combination of W2s, 1099s, paystubs, Social Security award letters, and more.

Executing Non-QM loans has traditionally added a layer of complexity to an already robust, manual process. This complexity can include managing potential borrowers with less-than-ideal credit or a bankruptcy on their profile. With mortgage document automation, non-traditional mortgage applicants can expect a quicker and more accurate loan assessment.

Mortgage document processing automation will only increase demand as more non-traditional borrowers enter the market. Many young professionals in particular are pursuing self-employment and work flexibility and thus will not meet traditional mortgage qualifications. As a result, the lending industry should expect more applicants with diverse income portfolios.

Fortunately, mortgage document automation reduces the risk of human error in these income applicants and uses advanced analytics to streamline mortgage origination, closing, and servicing.

Why Use Automation for Mortgage Loan Processing?

Through automated mortgage loan processing, lenders can expect to see:

- An increase in efficiency and profitability

- The ability to accurately review and verify bank statements at scale

- The skill to navigate complex non-traditional borrower applications

Most importantly, mortgage document processing automation presents a win/win for both borrowers and lenders. Documents are processed faster and more accurately, leading to faster turnover for the lender and a quicker result for a prospective borrower.