This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Ocrolus Update – 9/1/19

Welcome to your weekly Ocrolus Update – 9/1/19!

Here’s a curated list of industry news, recommended reads, fundraising announcements, and some laughs. Please drop us a line if you have any tips or content that you want to see in the future.

Industry News

Latin America Hangs On to Its Economic Gloom (Wall Street Journal): Brazil’s economy likely shrank slightly in the first half of 2019, and Mexico’s didn’t grow at all. Argentina is now tumbling toward another episodic financial crisis. Venezuela won’t have much of an economy left after it shrinks another 25% to 35% this year. In the past six years, about two-thirds of its annual economic output has vanished. South America appears to still has a hangover from the China-driven commodity boom during the 2000s. An aging workforce, corruption, weak institutions, and fiscal mismanagement certainly are contributing to the decline.

Turning a New Leaf: Banking Committee Chairman Says It’s High Time for New Cannabis Company Regulations (deBanked): In the past decade, partial or full marijuana legalization has swept across multiple states. However, many legitimate cannabis companies cannot open bank accounts due to tough federal restrictions. But momentum for a fix is on the rise. A new piece of legislation in Congress, The Safe Banking Act of 2019, aims to remove the red tape hindering cannabis companies from accessing the banking system. The bill has bipartisan support, but experts feel that the measure will ultimately fail. Still, the bill suggests that marijuana banking laws are gaining ground at the federal level.

Export Slump Pushes German Economy to the Brink of Recession (Bloomberg): A collapse in exports pushed Germany, Europe’s largest economy, to the brink of recession in Q2. In the midst of the US-China trade war, Germany’s shipments abroad declined 1.3%, the most in more than six years. That led to Germany’s second contraction in total economic output over the past year. Weaker global trade and upheaval in the auto industry seem to be dragging Germany’s economy deeper into trouble, with repercussions for the broader euro-area economy. Some are piling pressure on Chancellor Angela Merkel to provide fiscal stimulus.

Funding Circle Surpasses $10 Billion Lent to Small Businesses Globally (BusinessWire): Funding Circle, a leading small business loans platform in the UK, US, Germany, and the Netherlands, recently announced that investors have lent more than $10 billion to small businesses globally through its platform. Over the last nine years, Funding Circle has facilitated loans from more than 90,000 investors to 72,000 small businesses. Funding Circle has added $8.7 billion to the global economy and 115,000 new jobs, according to Oxford Economics.

Facebook’s Libra backers look to distance themselves from project (Financial Times): Intensifying regulatory scrutiny of Libra, Facebook’s digital currency, has spooked some of the project’s early backers. The 28 members of the Libra Association, including Visa, Mastercard, Uber, Spotify, and the Facebook subsidiary Calibra, made a non-binding pledge to invest at least $10 million in the project. But two of the project’s founding backers have now said they’re concerned about the regulatory spotlight and are considering cutting ties.

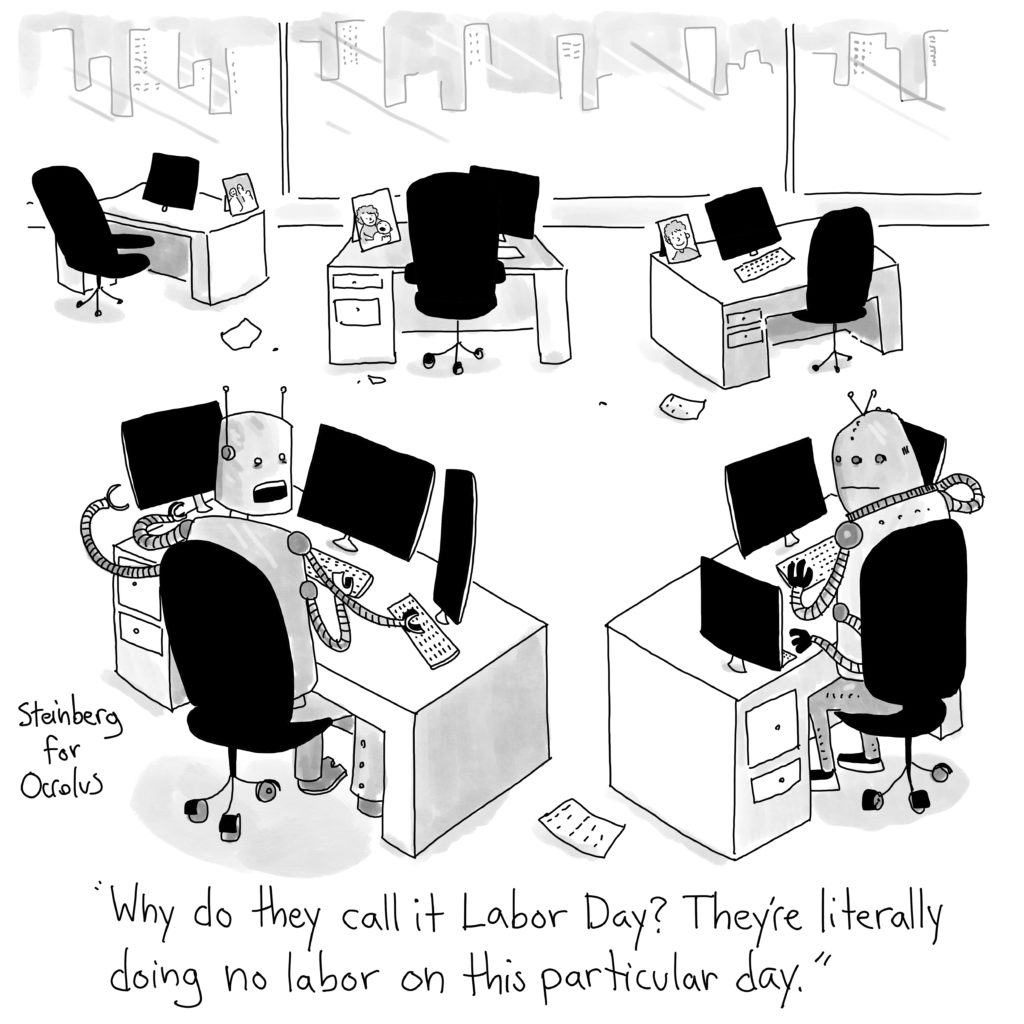

Cartoon of the Week

Fundraising Announcement of the Week: Tala

Congrats to Tala (TechCrunch) for gaining $110 million in Series D funding! Tala creates a specialized credit profile, using financial transactions and user behavior, to provide uncollateralized loans to millions of people in emerging markets. The company said it will use its new funds to build new solutions and expand its footprint in existing markets, including East Africa, Mexico and the Philippines.

Recommended Reads

The spy in your wallet: Credit cards have a privacy problem (Washington Post): You might think a card swipe at Target is just between you and your bank. But often, card purchases end up with marketers, Target, Amazon, Google, and hedge funds, among other third parties. Understanding who has access to your card data is extremely difficult. But one reporter tried to shine a light on this murky netherworld of personal data, with quite a few interesting results.

Astro robot dog learns new tricks using AI (The Robot Report): What would you get if you combined Apple’s Siri and Amazon’s Alexa with Boston Dynamic’s quadruped robots? You’d get “Astro,” the four-legged seeing and hearing intelligent robot dog. Using deep learning and artificial intelligence, scientists from Florida Atlantic University’s Machine Perception and Cognitive Robotics Laboratory are bringing to life one of about a handful of these quadruped robots in the world. Astro is unique because he is the only one of these robots with a head, 3D printed to resemble a Doberman pinscher, that contains a computerized brain.

How Uber Got Lost (New York Times): Uber went from the darling of the VC world to a cash hemorrhaging behemoth seemingly overnight. So went wrong? After a lackluster IPO, many have been asking tough questions of the ride sharing giant. Mismanagement, an attack at all costs culture, and an extreme version of the “losses mean growth” mentality are all to blame. The company isn’t going anywhere, but its recent earnings report has spooked certain investors.

Ocrolus News

New Ocrolus Product Demo: Check out our rebranded product demo! Dive into each layer of the platform – Capture, Detect, Analyze – and get an inside look at the Ocrolus web app. Learn how to harness the Ocrolus platform, from start to finish, to make smarter, faster financing decisions.

Upcoming Events (See You There!)

HSA Capture 2019 – 9/4 – 9/5

Boston Fintech Week – 9/11

Lend360 – 9/25 – 9/27

Thanks for reading, and see you next time!