This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Ocrolus Update – 8/25/19

Welcome to your weekly Ocrolus Update – 8/25/19!

Here’s a curated list of industry news, recommended reads, fundraising announcements, and some laughs. Please drop us a line if you have any tips or content that you want to see in the future.

Industry News

Gold Rush: Merchant Cash Advances Are Still Hot (deBanked): What is the current state of the MCA industry? Over the past five years, the MCA industry’s financings grew by 20% annually. MCA lenders are expected to contribute $19.2 billion in small business funding by the end of 2019, more than double the amount in 2014. Bankrolled by a broad assortment of hedge funds, private equity firms, family offices, and assorted investors, MCA lenders are currently offering profit rates of anywhere between 20% – 80%. Whether government scrutiny, on Capitol Hill and in states like New York, will change the rapidly growing industry is an open question.

Used vehicles provide big opportunities for lenders, TransUnion says (Automotive News): Shifting consumer demand, changes in vehicle supply, and growing issues of affordability in the new-vehicle market are prompting key players in auto retail to pivot toward used vehicles. TransUnion’s Brian Landau is suggesting that lenders can take advantage of this shift to grow their auto portfolios with used-vehicle loan and lease originations. Lenders can thrive as this market shits by partnering with digital startups, engaging with traditional retailers, and recognizing opportunity with higher credit tier customers.

Negative Mortgages Set Another Milestone in No-Rate World (Bloomberg): The world’s sprint to zero or negative interest rates just passed another milestone: Homebuyers in Denmark are effectively being paid to take out 10-year mortgages. Jyske Bank A/S, Denmark’s third-largest lender, announced a mortgage rate of -0.5% in early August, before fees. Nordea Bank Abp, meanwhile, is offering 30-year mortgages at annual interest of 0.5%, and 20-year loans at zero. All across the world, it’s become clear that years of easing by central banks have distorted the traditional economics of lending and borrowing.

How credit startup Deserve aims to reach the ‘unscoreables’ (Bank Innovation): When Kalpesh Kapadia moved to the U.S. from India as a student more than 20 years ago, access to credit was a major challenge for him. Kapadia founded Deserve in 2013 to offer credit cards for international students and other thin-credit file customers using transaction flow data and other non-traditional factors. The Menlo Park-based company has since expanded its card portfolio, and is working with credit bureaus on their efforts to develop new scoring models. This is just the latest company that has built on the revolution in cash flow analysis to offer unbanked and underbanked borrowers a chance at credit.

Move Over, Shareholders: Top CEOs Say Companies Have Obligations to Society (Wall Street Journal): The leaders of some of America’s biggest companies are chipping away at the long-held notion that corporate decision-making should revolve around what is best for shareholders. The Business Roundtable recently said that it is changing its statement of “the purpose of a corporation.” No longer should decisions be based solely on whether they will yield higher profits for shareholders, the group said. Rather, corporate leaders should take into account “all stakeholders” – that is, employees, customers, and society writ large.

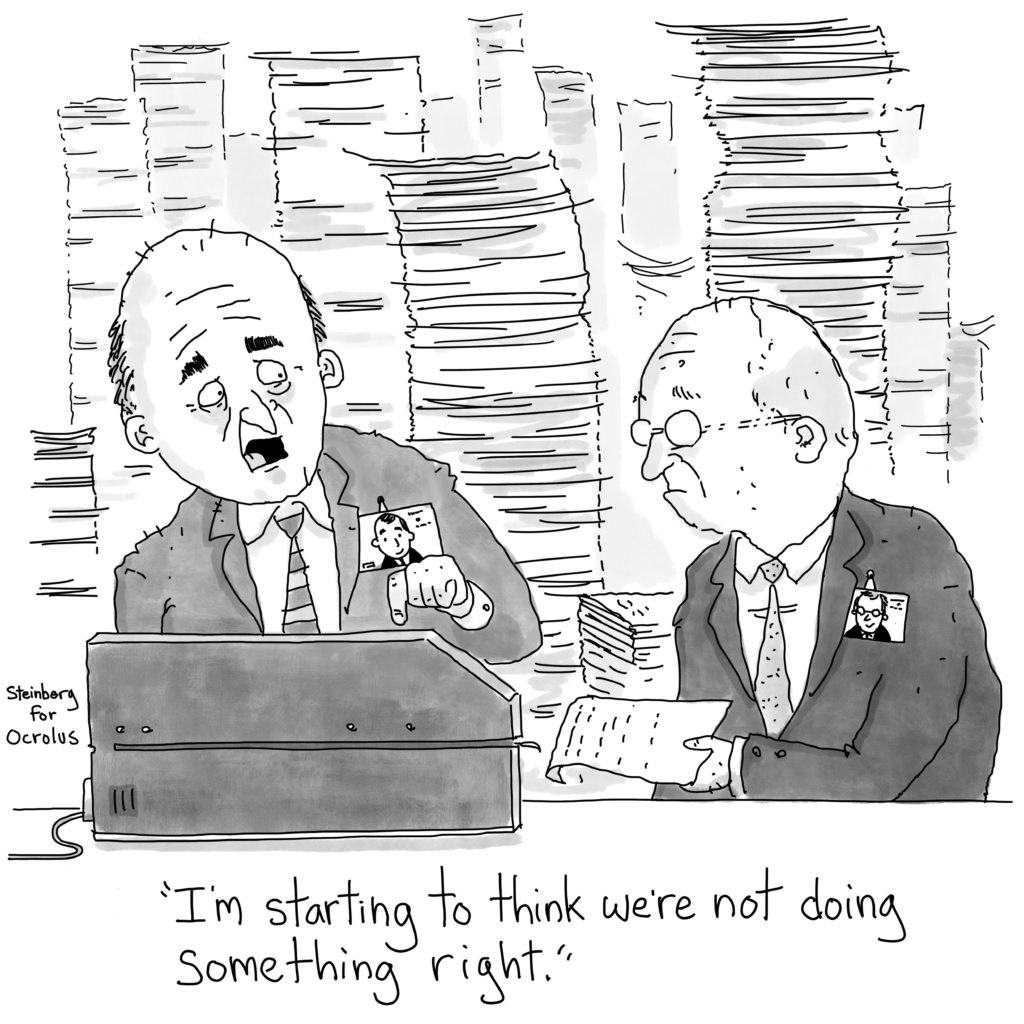

Cartoon of the Week

Fundraising Announcement of the Week: Better.com

Congrats to Better.com (Fortune) for raising $160 million in Series C funding! Better.com is part of a wave of fintech startups targeting the home-buying market via tech-oriented platforms that appeal to millennials, who now account for most new mortgages in the U.S. The capital will be used to further scale the mortgage lender’s operations and grow its product offerings.

Recommended Reads

To Power A.I., Start-Up Creates a Giant Computer Chip (New York Times): Cerebras, a Silicon Valley start-up, is challenging the notion that a computer chip should fit on a fingertip. This week, the company unveiled what it claims is the largest computer chip ever built. As big as a dinner plate – about 100 times the size of a typical chip – it barely fits in someone’s lap. The engineers behind the chip believe it can be used in giant data centers and help accelerate the progress of AI in everything from self-driving cars to talking digital assistants like Amazon’s Alexa.

Researchers just created a robotic lens that can be controlled by the eyes (Washington Post): A team of researchers at the University of California at San Diego think there may be a day – in the not so distant future – when our glasses and contact lenses can read and respond to eye movements, adjusting in real time to the electrical signals created by the muscles in the lens. The researchers recently created a soft robotic lens prototype that responds to the electric pulses, called electrooculographic signals, that are generated by the eyes when they move. Besides eyewear, the soft robotic structures could be used during surgeries, in search and rescue missions, as body armor, and more.

The Serious Money Is Warming to Bitcoin (Wired):There’s an arms race afoot over who can store cryptocurrency the safest. The aim behind all these sophisticated security arrangements revolves around wooing Wall Street. A key property of crypto is that it’s fairly easy for thieves to target. This fact is concerning, especially when it comes to institutional investors, such as pensions and hedge funds and university endowments. To close the gap, new companies focused on hyper-safe crypto storage have emerged. Perhaps you’d like your bitcoin buried in a vault under a mountain in the Swiss Alps? Yes, there’s now a company that does that.

Ocrolus News

Ocrolus Summer Rewards: Nominate your friends to take Ocrolus for a test drive! Analyze 500 bank statements for free with each nomination. And each nominated friend that becomes an Ocrolus customer will earn you a $50 Amazon gift card. The offer is good through the month of August 2019.

Thanks for reading, and see you next time!