This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Document automation and lending analysis – Completing the lending technology stack

Over the past decade-plus, numerous advancements in lending technology have transformed the industry, making it easier for businesses to access credit and secure funding to grow their operations. Digital platforms, mobile applications and other innovative tools have streamlined the lending process, allowing borrowers to submit applications online and lenders to process them in real time.

One of the most significant advantages of modern lending technology is the ability to leverage data analytics paired with powerful artificial intelligence (AI) and machine learning (ML) models to make more informed lending decisions. By utilizing these technologies to analyze borrower creditworthiness, assess risk and identify growth opportunities, lenders can reduce the risk of defaults and improve overall portfolio performance.

Adopting a modern lending tech stack also provides businesses with a competitive advantage. With more lenders embracing digital platforms and innovative tools, companies that fail to manage risk are falling behind. By leveraging data analytics and ML to complete their lending technology stack, businesses can make more informed decisions, scale their operations and position themselves for long-term success.

What is a lending technology stack?

The term “lending tech stack” refers to the ecosystem of technology, tools and services that modern lenders use to manage their overall lending operations. This includes everything from loan origination and underwriting to servicing and collections on the backend. The tech stack’s primary purpose is to remove roadblocks to success while streamlining the lending process.

The concept of a lending tech stack has emerged in response to the growing need for lenders to leverage technology to streamline their operations and remain competitive. In the past, developing these processes required teams of finance and technology experts, which could be overly expensive for many lenders.

However, the rapidly growing number of fintech companies and software providers has made it possible for lenders of all sizes to build lending tech stacks more easily.

A lending tech stack typically includes a range of tools and services, such as:

Loan origination platforms: Digital platforms that allow borrowers to apply for loans online, with integrations enabling lenders to introduce document automation within the application process to classify and capture information quickly and accurately.

Underwriting tools: Software that leverages data analytics and machine learning algorithms to assess borrower creditworthiness and risk.

Loan servicing and collections software: Platforms that help lenders manage loan payments, collections and account management.

Compliance and regulatory tools: Software that helps lenders ensure compliance with relevant laws and regulations.

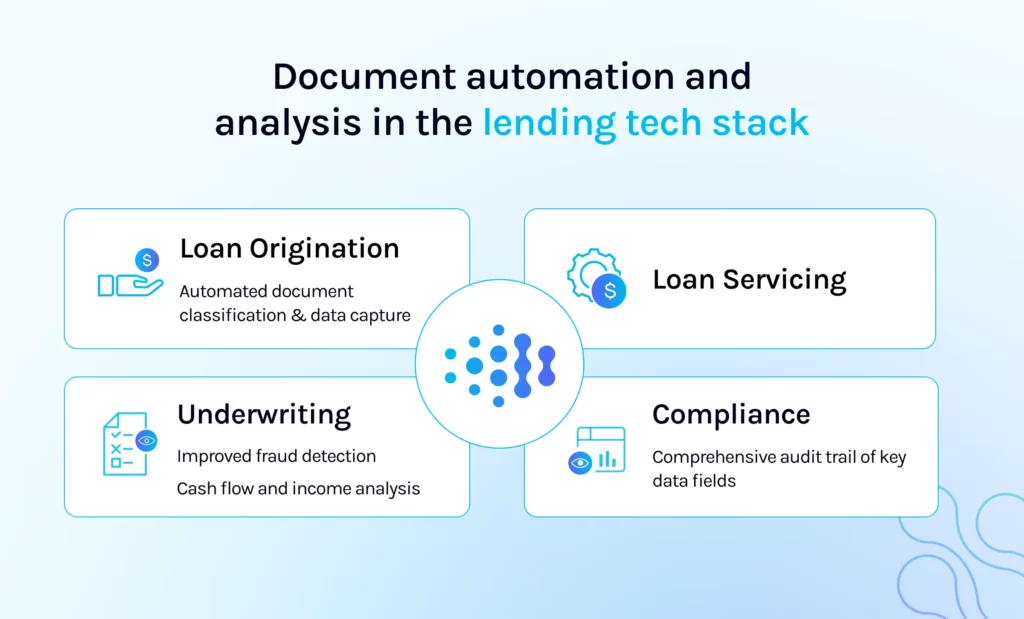

Ocrolus technology helps complete this stack with document automation, analysis and fraud detection. By building a complete lending tech stack, lenders can streamline their operations, reduce costs and improve their ability to make informed lending decisions. This can help them stay competitive in an increasingly crowded lending marketplace and position themselves for long-term growth and success.

What parts of a lending workflow should a complete lending tech stack cover?

By leveraging technology tools and solutions throughout the lending workflow, lenders can streamline their operations, reduce costs and improve their ability to make informed lending decisions at every stage of the lending workflow.

The lending workflow can be broken down into several key stages, each of which can be covered with a combination of tools and solutions.

The key stages of the lending process workflow are:

-

Customer acquisition: This stage involves acquiring new borrowers and collecting information about their financial history and creditworthiness. This can be done through digital marketing campaigns, online loan applications and other channels. At this stage, it’s important lenders leverage technology to collect and organize lender information.

Ocrolus’ key capabilities in this stage include document classification and data capture, which help accelerate this process by capturing and classifying all types of documentation submitted by applicants, including parseable PDFs, scans, and smartphone images. Our approach yields a structured output of labeled and indexed documents, enabling lenders to quickly notify borrowers of incorrectly submitted or missing information.

Loan underwriting: This stage involves assessing the creditworthiness of borrowers and making informed decisions about whether to approve or deny their loan applications. This process can involve various factors, including credit scores, income and employment history.

With models trained on more than 100 million pages of documents from thousands of financial institutions, Ocrolus’ premier document fraud detection solution helps lenders uncover 4x more fraud than other solutions and streamline application reviews with fraud Detect signals and tampering visualizations.

Loan servicing: This stage involves managing loans after they have been approved and disbursed. This can include processing loan payments, managing customer accounts and handling collections.

Where does document automation and lending analysis technology complete the tech stack?

Document automation and lending analysis solutions come into play at several stages in the lending process, particularly during loan origination and underwriting segments. These solutions can help streamline the loan application process, reduce costs and improve the accuracy and speed of decision-making.

A comprehensive document automation and lending analysis solution should cover several key functionalities, including data capture and classification, fraud detection and cash flow analysis. These functionalities can help lenders accurately assess borrowers’ creditworthiness and identify potential fraud or risk factors.

Ocrolus is a leading AI-driven document automation and lending analysis solution provider. We aim to leverage advanced data capture and analysis capabilities, real-time fraud detection and accurate cash flow analysis. These solutions offer a range of functionalities, including document classification, data extraction and data validation.

Our document automation and lending analysis solutions enable lenders to improve the accuracy and speed of their underwriting process by automating manual data entry and extraction tasks, reducing the risk of human error and freeing up underwriters’ time to focus on more complex tasks.

By utilizing Ocrolus as part of their comprehensive technology stack, lenders can improve their loan origination and underwriting processes, reduce costs and make more informed lending decisions. Lenders risk falling behind in an increasingly competitive lending marketplace without such a solution.

Covering all the key stages in the lending workflow, such as customer acquisition, loan underwriting, and loan servicing, building a complete technology lending stack is vital. But for lenders who want to maintain a competitive advantage in an increasingly crowded market, building an intelligent technology stack is even more essential.

By leveraging an AI-driven document automation and lending analysis solution – like Ocrolus – lenders can improve the accuracy and speed of their underwriting process, reduce costs, and make more informed lending decisions.

Book your demo to discover how Ocrolus helps financial services providers efficiently manage risk, avoid fraud and make informed decisions through intelligent document analysis.