How Automation Can Help Detect Fraud Faster

For financial organizations, the cost of fraud increases every year, as the costs to detect, investigate, and recover losses continue to grow. In fact, a recent LexisNexis study reported that every $1 of fraud loss costs U.S. financial services firms $4, a staggering amount to overcome. While fraudsters are becoming increasingly savvy, financial institutions have had to work to keep pace, developing innovative and efficient , automated tools to help in the fight against fraud.

For example, while automation is used frequently in the financial industry for processes like income and asset verification, and mortgage originations, many financial professionals can also use these automation processes to help detect and prevent fraud.

While the types of fraud vary across institutions and use cases, automation can be most useful in helping to detect document tampering and suspicious activity. While these may not always be signs of fraud, they can significantly increase a company’s ability to identify those acting in bad faith and stop it before it can become an overwhelming financial burden. In fact, Ocrolus research has demonstrated that loan applications containing documents that reveal signs of tampering are more likely to be fraudulent documents than those that do not. When customers submit documents, file tampering detection software can automatically evaluate them for signs of tampering or missing information, flagging edits that were made after the document was created and highlighting areas where changes have occurred.

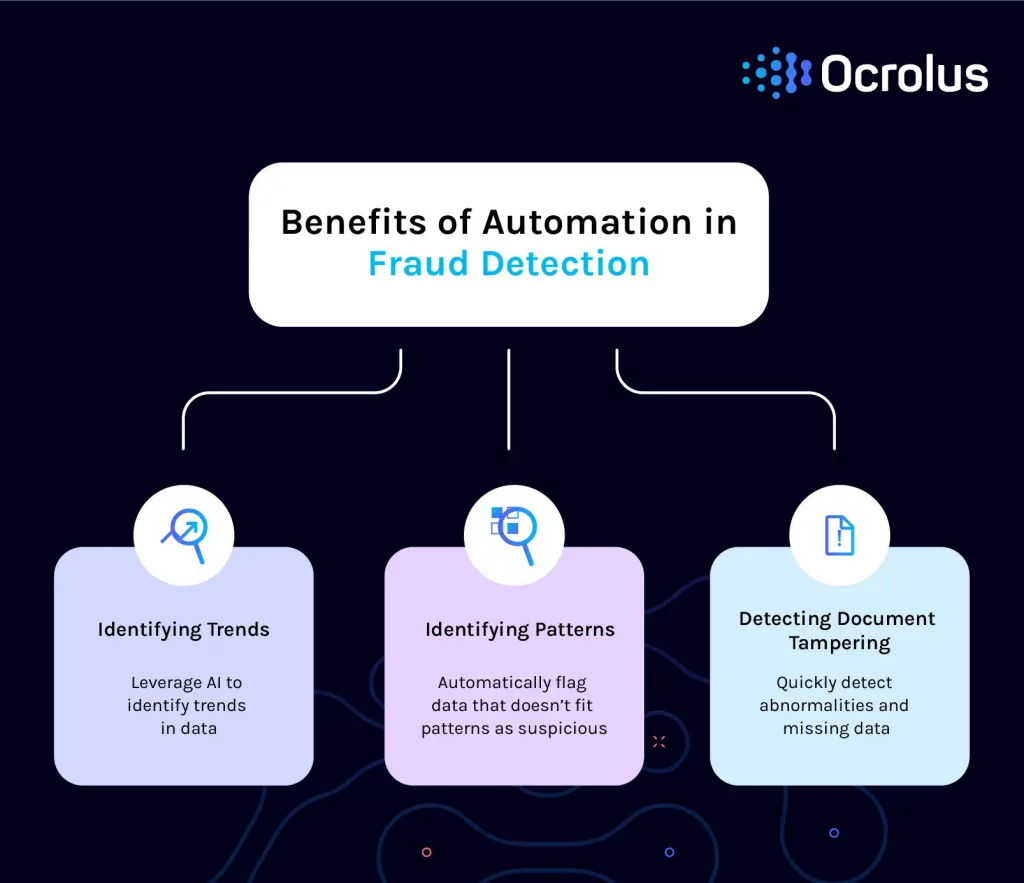

Automated fraud detection solutions like this can be transformational for financial institutions that want to protect their customers and their bottom lines by detecting and preventing fraud at scale. There are a number of different automated processes available. If you’re looking for automated solutions to help root out fraud, look for applications that will manage three important tasks: identifying trends, identifying patterns, and detecting document tampering.

Identifying Trends

Automated processes that leverage the power of artificial intelligence (AI) can identify trends in data. For example, intelligent document processing (IDP) uses machine learning to filter data from various document types and sources including PDFs, W-2’s, and other nonstandard documents—and turn it into a structured format that makes it easier to manage and more useful for insights.

But IDP can do more than just recognize and extract information from different formats. It can also find value in the data and reconstruct it into a standardized format, which makes it easier to compare to other documents and track trends. IDP can also easily help identify purchase behaviors or expenses within financial documents. If a transaction doesn’t align with these established trends, an IDP solution can flag it as suspicious. Examples of suspicious activity might include a massive purchase or an unusual influx of funds in an account. Human workers are alerted and can investigate the transaction, helping to stop any potential fraudulent activity in its tracks.

Identifying Suspicious Patterns

Over time, as the automation solution’s algorithms become more sophisticated and identify certain behaviors as suspicious, it recognizes those certain behaviors and learns to flag them as suspicious, thereby improving future scans. This may also allow it to determine whether or not a data point fits an existing pattern. If the new data does not fit the existing pattern, the application can learn to mark it as suspicious and flag it.

For example, if transactions that occur online after midnight are often fraudulent, over time the automated fraud detection tools will learn to start flagging transactions that occur online after midnight. Instead of human workers checking every transaction for fraud, they can be prioritized based on patterns that may reveal fraud. As a result, it may be easier to investigate potential fraudulent transactions and help prevent fraud from occurring. This ability to learn behavior is one of the key benefits of an automation solution wielding AI.

However, it’s important to remember that even the most sophisticated technology is only flagging things it thinks may be suspicious, it’s up to the user to decide what’s really going on.

Detecting Document Tampering

An automated document tampering solution can quickly detect the abnormality when documents have been tampered with or are missing data altogether. For example, a business involved in loan stacking could apply for a loan by submitting altered application documents and loan histories. A fraud detection automation solution with algorithms that have been trained to detect these types of inconsistencies can quickly flag the documents for further investigation. It can also identify and flag potentially false identities, which may make it easier for financial institutions to stop document fraud early.

As the financial industry continues to evolve and adopt new and innovative technologies, would-be fraudsters are evolving right along with it. Financial institutions looking to avoid the costs and repercussions associated with financial fraud can stay ahead of those acting in bad faith by using automation processes to help detect and prevent fraud. If you have initial questions about fraud detection and automation, read our FAQs and Glossary to learn more.

Explore how Ocrolus’ automated solutions can help lenders detect document tampering and suspicious activity.