Automate lease agreement processing to close loans faster

Ocrolus’ Human-in-the-Loop document automation solution captures and extracts data from lease agreements to help you optimize loan decision-making.

Why should lenders use Ocrolus for lease agreement data capture and processing?

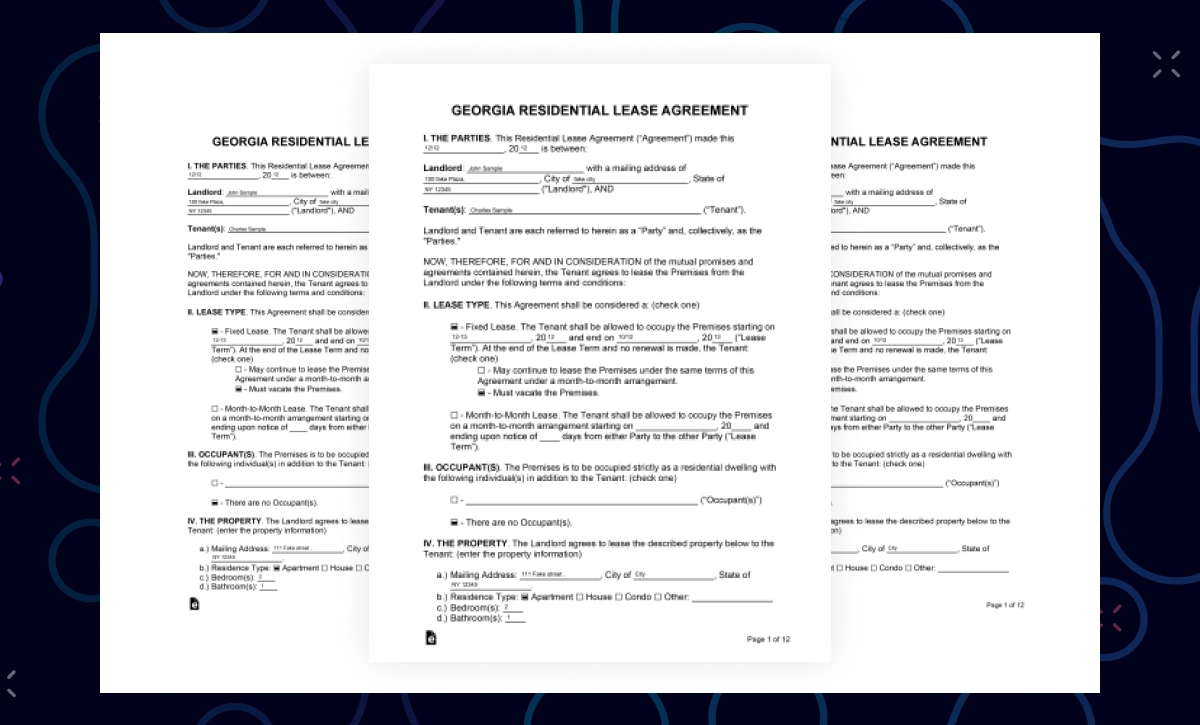

Lease agreements document the terms that property owners and their tenants must abide by. This includes information regarding payment terms, lease length, and other property details. Loan underwriters use the information held in lease agreements to help assess a landlord’s or tenant’s income and outgoings and, consequently, the size of the loan they can lend them. There is no standard template for a lease agreement and they can be delivered to the loan underwriter via hardcopy or through multiple file formats via email or various smartphone apps. Without a reliable intelligent document processing solution, lending professionals can spend hours manually retrieving data held in lease agreements and inputting this into their systems. This can lead to mistakes that can impact loan approvals.

Ocrolus’ automation solution lets you capture, review, and analyze data from lease agreements in real-time. It accurately captures key data to optimize loan processing.

Advantages of Ocrolus’ lease agreement processing

Accurately retrieve data from lease agreements regardless of format or quality. With Ocrolus you can:

- Optimize loan processing time

- Process lease agreements with over 99% accuracy

- Quickly verify a customer’s financial history

- Identify suspicious activity and potential fraud with tampering detection

Ocrolus' document processing stats

financial pages analyzed

documents flagged for suspicious activity

business loan applications analyzed