Automate IRS Form 1120 processing to speed up loan approvals

Ocrolus’ Human-in-the-Loop document automation solution captures and extracts data from IRS Form 1120 to help you make smarter, faster, and more accurate lending decisions.

Why should lenders use Ocrolus for IRS Form 1120 data capture and processing?

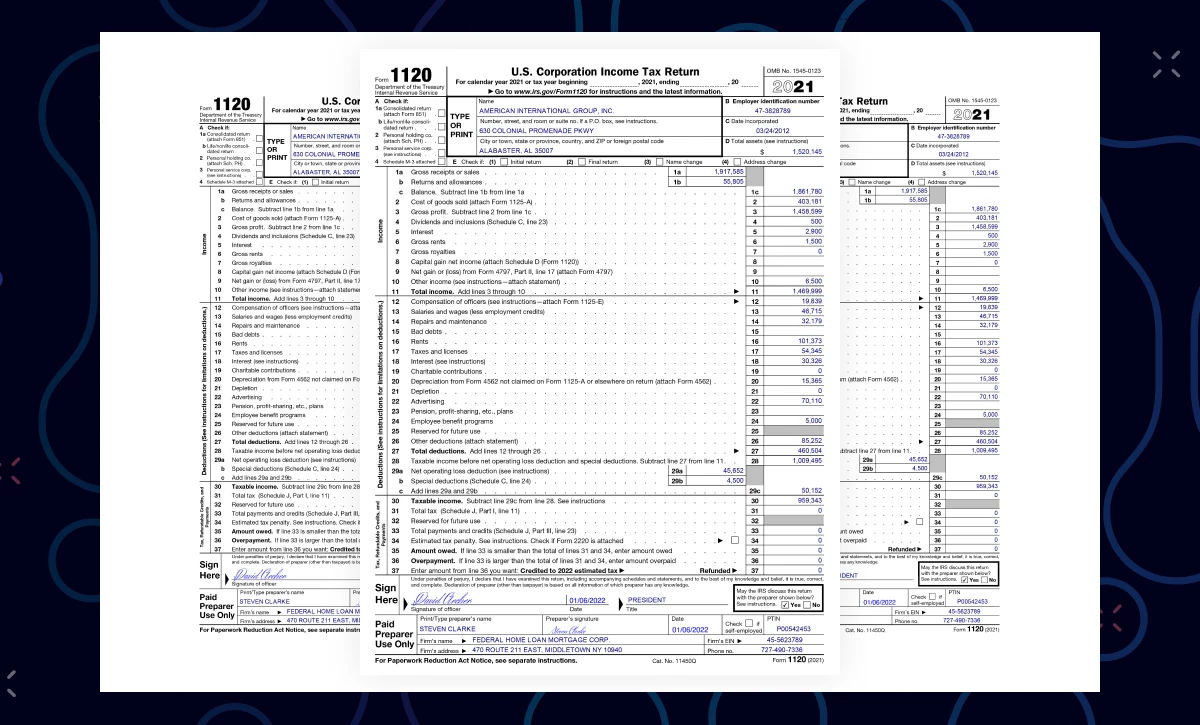

IRS Form 1120 is used to report the income, gains, losses, deductions, and credits of a corporation and calculate its income tax liability. Loan underwriters use the information provided in IRS Form 1120 to help verify an organization’s financial status. These forms can be delivered via hardcopy or digitally in multiple file formats. This poses a challenge for traditional OCR solutions. Without a reliable intelligent document processing solution, lending professionals can spend hours manually processing IRS Form 1120 data. This can lead to human error, delayed loan decisions, and even loan refusals.

Ocrolus’ automation solution lets you capture, review, and analyze data from IRS Form 1120 in real-time. It accurately captures key data and identifies potential fraud, enabling quick, accurate data-driven decisions.

Advantages of Ocrolus’ IRS Form 1120 processing

Retrieve data from IRS Form 1120 regardless of format or quality

- Cut turnaround time

- Process multiple IRS Form 1120 documents with over 99% accuracy

- Quickly verify an organization’s financial status

- Reduce the risk of fraud

Ocrolus' document processing stats

financial pages analyzed

documents flagged for suspicious activity

business loan applications analyzed