Optimize your ability to analyze documents and make financial decisions with 1040 Schedule E (2021) document processing

With Ocrolus’ intelligent document processing technology, lenders can easily capture and extract data from IRS Form 1040 Schedule E (2021) in minutes with unparalleled accuracy.

Why should lenders use Ocrolus for IRS Form 1040 Schedule E (2021) data capture and form processing?

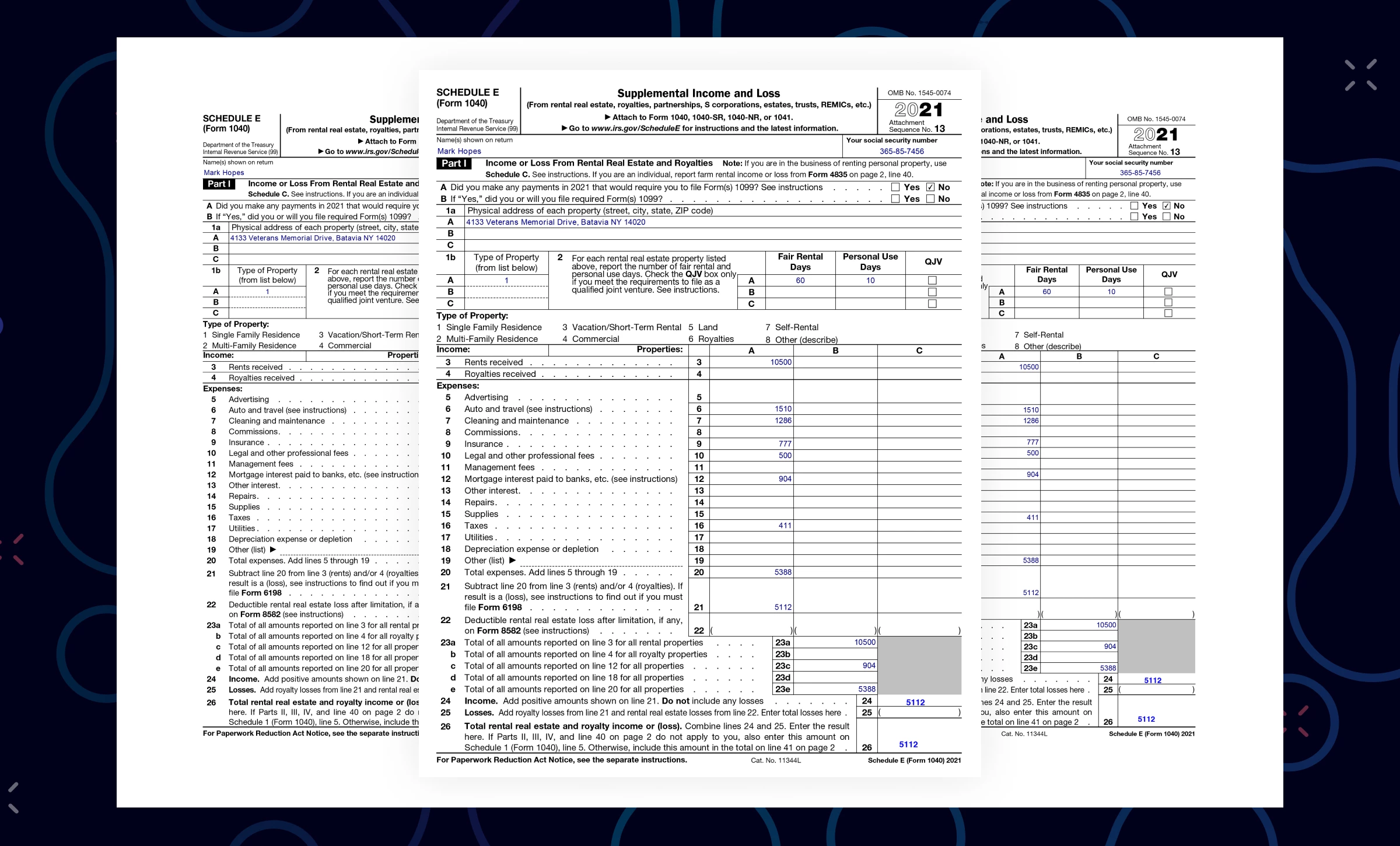

Loan underwriters process 1040 Schedule Es to verify income. IRS Form 1040 Schedule E (2021) reports income or loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in real estate mortgage investment conduits (REMICs).

Ocrolus’ end-to-end automated IRS Form 1040 Schedule E processing solution provides a better borrower experience by speeding up the entire underwriting process and empowering lenders to make smarter decisions with trusted, accurate data.

Advantages of Ocrolus’ automated IRS Form 1040 Schedule E (2021) processing

Retrieve data from 1040 Schedule Es regardless of format or image quality

- Verify borrower income in minutes

- Develop robust, data-driven income assessments

- Increase originations with an expedited underwriting process

Ocrolus' document processing stats

financial pages analyzed

documents flagged for suspicious activity

business loan applications analyzed