This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

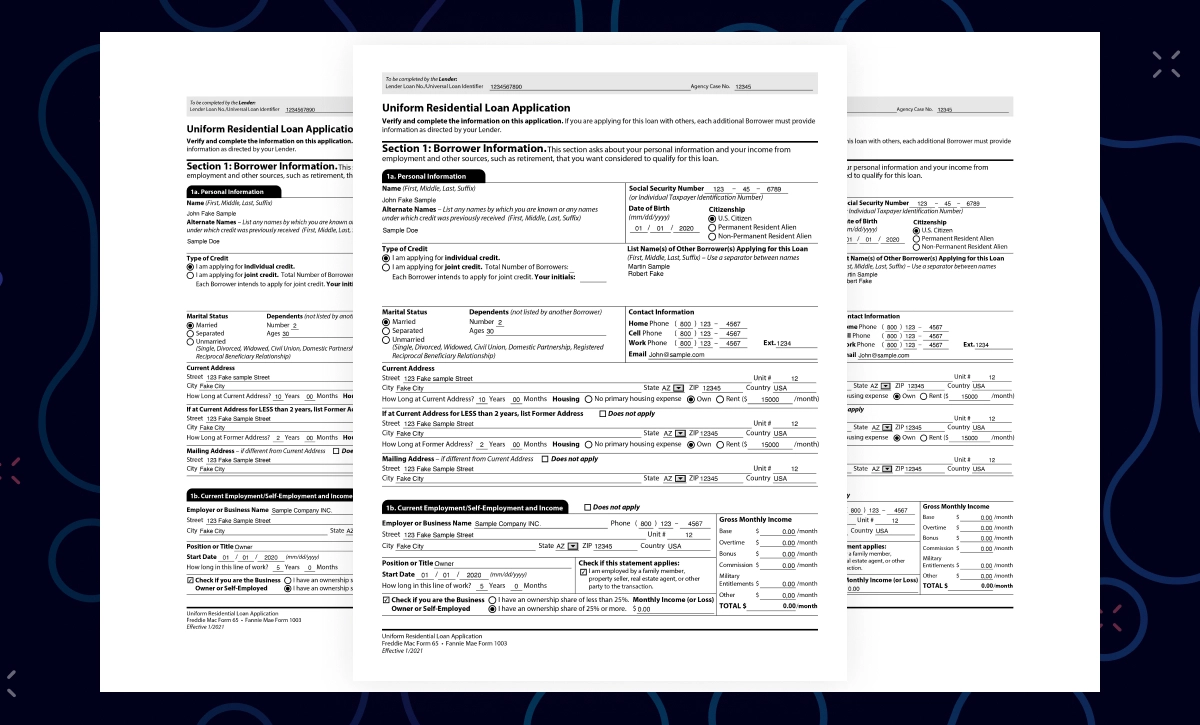

Quickly and accurately assess an individual's eligibility for a home loan with automated Form 1003 processing

Ocrolus’ Human-in-the-Loop document automation solution captures and extracts data from Form 1003 to help you process loans faster.

Why should lenders use Ocrolus for Form 1003 data capture and processing?

Form 1003, or the Uniform Residential Loan Application form, is something that everyone needs to fill out when they apply for a residential mortgage in the U.S. Lenders use the information provided in this form to assess an individual’s eligibility for a loan. These forms can arrive in multiple formats, including as hardcopies or online via email or mobile app. Sometimes, if the form has been handwritten, the information input can extend outside the form fields. This poses a challenge for traditional OCR solutions, and without a reliable intelligent document processing solution, lending professionals can spend hours manually inputting data from Form 1003 documents. This slows down the loan application process and, if mistakes are made, can lead to loan refusals.

Ocrolus’ automation solution lets you capture, review, and analyze Form 1003 data in real-time from forms delivered in multiple formats. It precisely captures key data, highlights potential wrong doing, and significantly speeds up loan decision-making.

Advantages of Ocrolus’ Form 1003 data processing

Retrieve data from Form 1003 documents regardless of format or quality. With Ocrolus you can:

- Speed up loan processing

- Process Form 1003 documents with over 99% accuracy

- Quickly verify an individual’s eligibility for a loan

Ocrolus' document processing stats

financial pages analyzed

documents flagged for suspicious activity

business loan applications analyzed