Manage risk better with machine learning and Human-in-the-Loop document processing for flood certificates

Ocrolus’ Human-in-the-Loop document automation solution captures and extracts data from flood certificates to help you make more accurate lending decisions faster.

Why should lenders use Ocrolus for flood certificate data capture and processing?

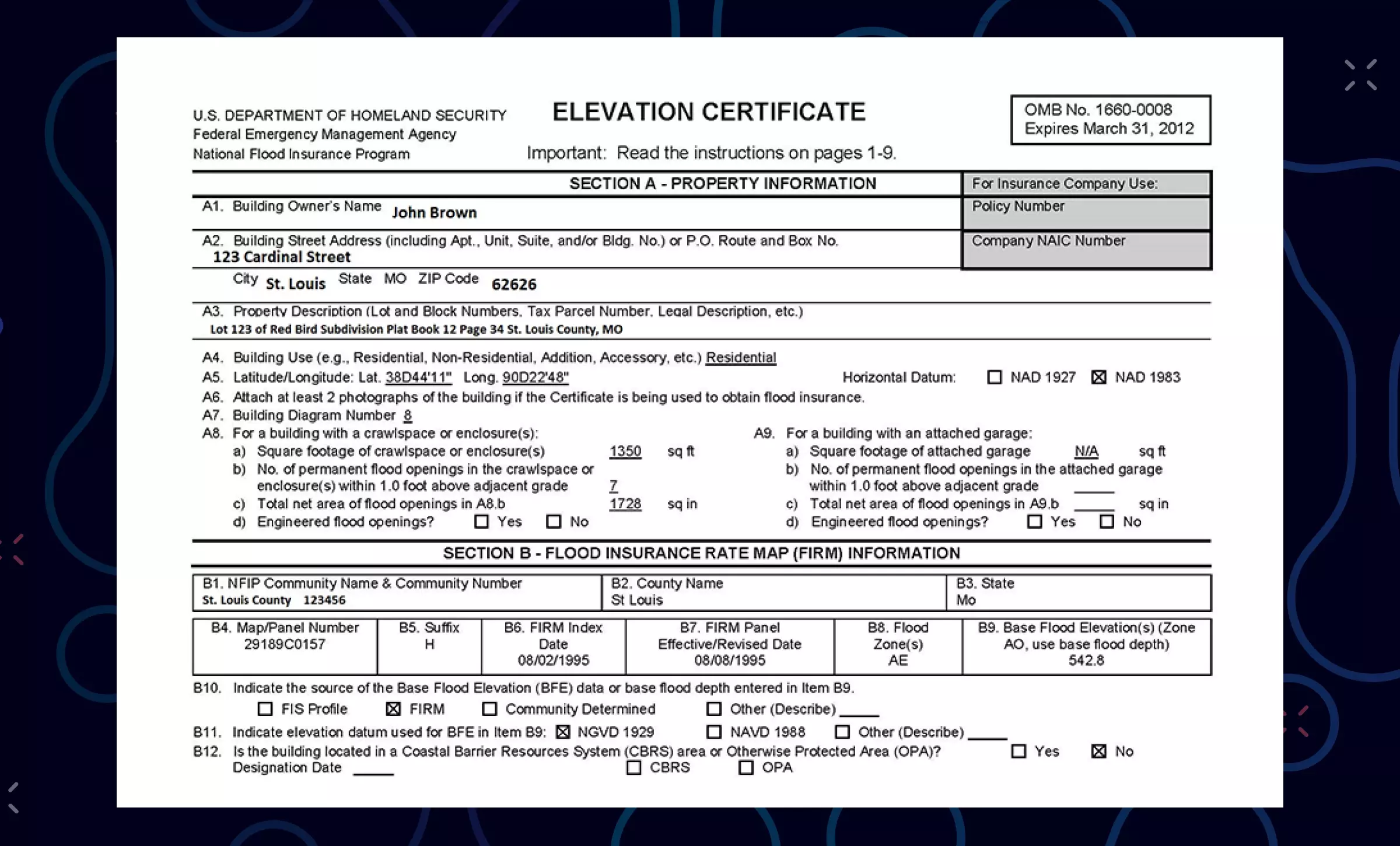

Flood certificates detail whether a property is at risk of flooding. With climate change affecting rainfall patterns, many areas of the U.S. are now at increased risk of flooding, and lenders are requiring flood certificates, as well as flood insurance. The layout and format of flood certificate submissions can vary based on the providers’ specifications. This can pose a problem for traditional OCR solutions, and without a reliable intelligent document processing solution, lending professionals can spend hours manually processing flood certificate data. Not only is this tedious and time-consuming, but it can also lead to human errors arising, which further delay loan approvals and can even lead to loan rejections.

Ocrolus’ automation solution lets you capture, review, and analyze flood certificate documents in real-time from multiple formats. It precisely captures key data and identifies any potentially suspicious activity, enabling fast, data-driven loan decision-making.

Advantages of Ocrolus’ flood certificate processing

Retrieve data from flood certificates regardless of format or quality. With Ocrolus you can:

- Speed up loan processing time

- Process multiple flood certificates with over 99% accuracy

- Quickly verify a property’s risk of flood

Ocrolus' document processing stats

financial pages analyzed

documents flagged for suspicious activity

business loan applications analyzed