This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

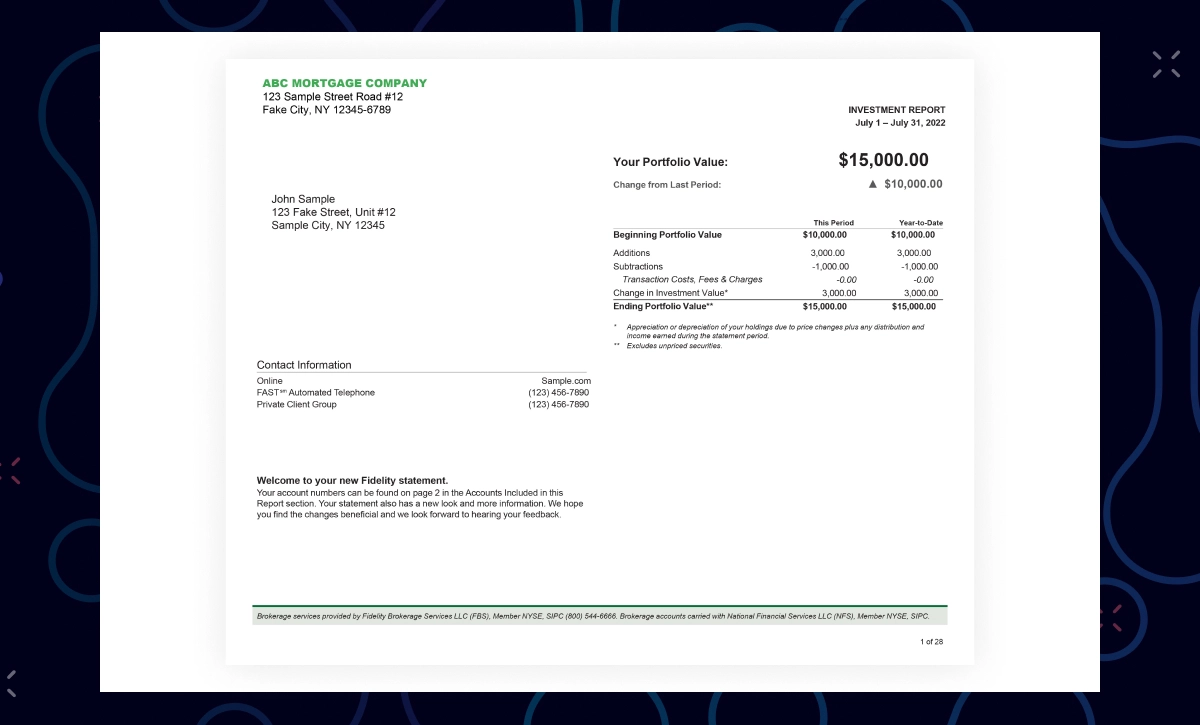

Retrieve data from brokerage statements regardless of format or quality

Ocrolus’ Human-in-the-Loop document automation solution captures and extracts data from brokerage statements to help you make more accurate lending decisions faster.

Why should lenders use Ocrolus for brokerage statement data capture and processing?

Loan underwriters process brokerage statement data to assess and verify borrowers’ assets and investments. A brokerage statement is issued by an asset manager, brokerage, or bank to an individual and it provides detailed information about that individual’s assets or investments. The layout and template for brokerage statements vary based on the providers’ specifications. This poses a challenge for traditional OCR solutions, and without a reliable intelligent document processing solution, lending professionals can spend hours manually processing brokerage statement data. Not only is this tedious and time-consuming, but it can also lead to mistakes being made, which further delay asset valuation and loan approval.

Ocrolus’ automation solution lets you capture, review, and analyze brokerage statement data in real-time from statements delivered in multiple formats. It accurately captures key data and identifies potential fraud, enabling rapid, data-driven decisions.

Advantages of Ocrolus’ brokerage statement processing

Retrieve data from brokerage statements regardless of format or quality. With Ocrolus you can:

- Reduce turnaround time

- Process multiple brokerage statements with over 99% accuracy

- Quickly verify a customer’s assets and investments

Ocrolus' document processing stats

financial pages analyzed

documents flagged for suspicious activity

business loan applications analyzed