Accelerate the mortgage journey through application, loan processing, underwriting and closing with AI-driven document automation

Onboard borrower documents with Ocrolus for faster decisions and process transparency

Fluctuating mortgage demand challenges lenders to automate processes and adapt to industry volatility.

Ocrolus provides automated review and analysis of borrower documents, returning accurate results into your loan origination system. Empower loan teams with capabilities to classify financial documents, capture key data fields and pre-populate income calculations, enabling faster, data-driven mortgage loan processing.

Automatically index and extract data from borrower documents with confidence

Eliminate manual data entry

Create structured data from the outset of the borrower journey

Deliver data natively within your point-of-sale or loan origination platform

Income calculation for wage earners, self-employed borrowers, rental properties and bank statement loans

Automate analysis of borrower income documents following GSE guidelines

Leverage income calculations across multiple borrower and property types

Import calculations into Encompass® by ICE Mortgage Technology® with transparency and confidence

Analytics for the modern mortgage lender

Reduce risk of fraudulent mortgage documents through advanced AI

Enable powerful analytics via structured data

Embed compliance analysis into workflows

Building a Trusted and Efficient Automated Mortgage Workflow

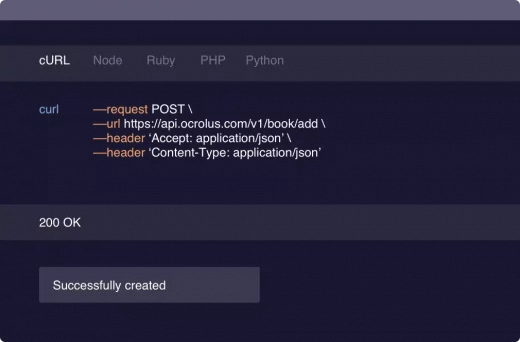

Explore our API

Review our API documentation, including guides, references, and tutorials, and see what it’s like to work with Ocrolus.

Ready to go?

Connect with one of our mortgage automation experts to find out how Ocrolus can help you manage fluctuating demand with ease.

Frequently asked questions

Mortgage process automation is an intelligent technology-driven process built to improve efficiencies in the mortgage lending process. Automation helps to minimize resources and improve document verification and processing, enabling faster, data-driven mortgage loan processing.

Robotic process automation (RPA) is a form of automation technology replicating the actions customarily carried out by humans in the mortgage lending process. It uses algorithms and software to automate repetitive tasks that involve structured data or rule-based processes. RPA doesn’t require extensive programming knowledge, making it easier for non-technical personnel to use. RPA can be adjusted as needed, allowing lenders to tweak the automated task’s timing and effectiveness.

Optical character recognition (OCR) is the ability of machines to convert images of typed text into machine-readable data. Ocrolus’ system takes OCR further in mortgage by intelligently selecting the extraction or OCR tool, which results in very high raw accuracy, then layers in proprietary pattern recognition and machine learning models.

Regardless of document quality, mortgage lenders can use Ocrolus to process and verify many types of mortgage documents such as bank statements, pay stubs, W-2s, IDs, and much more. You can view our full list of supported documents here https://ocrolus.com/supported-documents/.