This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

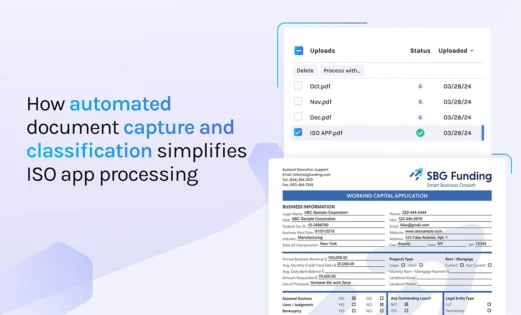

Streamline your ISO application review with document automation

Optimize ISO application intake and streamline processing and enhance risk management with early ISO application review

When small business lenders handle applications from Independent Sales Organizations (ISOs), they face several challenges. These include comparing ISO criteria with their own standards, checking that documents are accurate and real, following rules and regulations, managing a lot of paperwork, and correctly evaluating credit risks.

Ocrolus lets lenders combine an ISO Application and supporting documents into one book for quick sorting. Ocrolus automatically processes and extracts data instantly from the ISO Application in this file. Within seconds, lenders can then examine the important details collected from the application and decide if they want to convert any documents in the book individually or in groups.

Preliminary risk assessment

By reviewing the ISO application first, lenders can conduct an initial risk assessment to determine if the organization meets their basic criteria for partnership before investing time and resources into reviewing more detailed documentation.

Efficiency and cost-effectiveness

Lenders can filter out applications that do not meet their minimum requirements early in the process with cost efficiency to only process documents needed for evaluation.

Strategic decision making

ISO information can be valuable for lenders in making strategic decisions about whether to pursue a relationship with the ISO, based on factors like market potential, strategic fit, and the lender's risk appetite.

Instant is great - it not only speeds up our processes, it’s also reliable and cost-effective. In a competitive industry like ours, the ability to process data and get offers out to customers as quick as possible is crucial. Instant has allowed us to do just that, closing deals faster and giving us the edge we need to stay ahead of the competition.”

Frequently Asked Questions

The ISO workflow is a way to more effectively process ISO applications and their related documents. In ISO Flow books, the ISO application gets processed fully via Instant, and all other documents are only classified via Instant. This allows for reviewing the ISO application details and making an initial decision before even processing any related documents like bank statements. This helps in speeding up the process on decisioning ISO applications while also cutting down on costs, as you don’t have to process the other documents if you see something in the ISO application itself that leads you to reject the application.

You can upload any type of document you are configured for to an ISO workflow book. All non-ISO application documents will be classified via Instant and can then be upgraded to full Instant or Complete from there. All ISO application documents will be classified and captured via Instant and can be upgraded to full Complete as needed.

Yes, ISO Flow books use all of the same endpoints as other book types, including book creation, document upload, book update, document update, and all classification, form data, analytics, and detect endpoints.

Yes, ISO Flow books can be created in the Dashboard like all other book types.

Yes, there’s a guide to working with ISO Flow books via the API and via the Dashboard on the Ocrolus Docsite.