This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Automated Income Verification at Scale

Mortgage lenders in today’s competitive landscape should examine their business’s scalability by determining the speed of their underwriting process and closing rate. It’s simple math – the more borrower applications you’re able to process successfully, the better it is for business.

With income verification being one of the most robust, yet critical elements of executing a loan, automated income verification technology can take the time and stress out of this step, especially for non-traditional applicants.

What is income verification?

Simply put, income verification is a process that allows a lender to ensure that the borrower is able to pay their mortgage payment each month. This means that examining a couple of years worth of pay stubs, tax returns, and W2s all fall within the types of documents that a lender requires when considering a borrower’s application.

For lenders, going through income verification documents is equally important as it is time-consuming. The traditional method of manual underwriting has been the de facto method for many lenders, despite its long-winded nature. Today, however, automating the process helps lenders increase efficiency and verify income documents at scale.

What is automated income verification?

As the name implies, automated income verification leverages technology to speed up the income verification process. Rather than taking hours, days, or weeks to verify income and manually underwrite a loan, automated income verification technology has the ability to process, digitize, and categorize an application for the lender in minutes.

By utilizing income verification automation through Ocrolus, lenders also receive a report that provides an analysis of the potential borrower. This only helps further the support the underwriting team receives for the many applications they are responsible for.

What type of documents can be verified?

Lenders understand that no two borrower applications are created equal. Each potential borrower, whether traditional or non-traditional, will have nuances in their application that should be considered. With the ability to assess many types of documents common to traditional applicants, and those that are uncommon or non-traditional, a lender can feel confident that they’re receiving the same level of thoroughness and accuracy – just at a faster pace.

The most common documents that can be verified for income include, but are not limited to:

- Traditional

- Paystubs

- W2s

- Tax returns

- Pension award letters

- Social security award letters

- Non-traditional (e.g. self-employed)

- Bank statements

- Profit and loss reports

- Disability award letters

Find out how you can simplify income calculations at scale from our Free Checklist: How to Streamline and Automate Borrower Income Calculations.

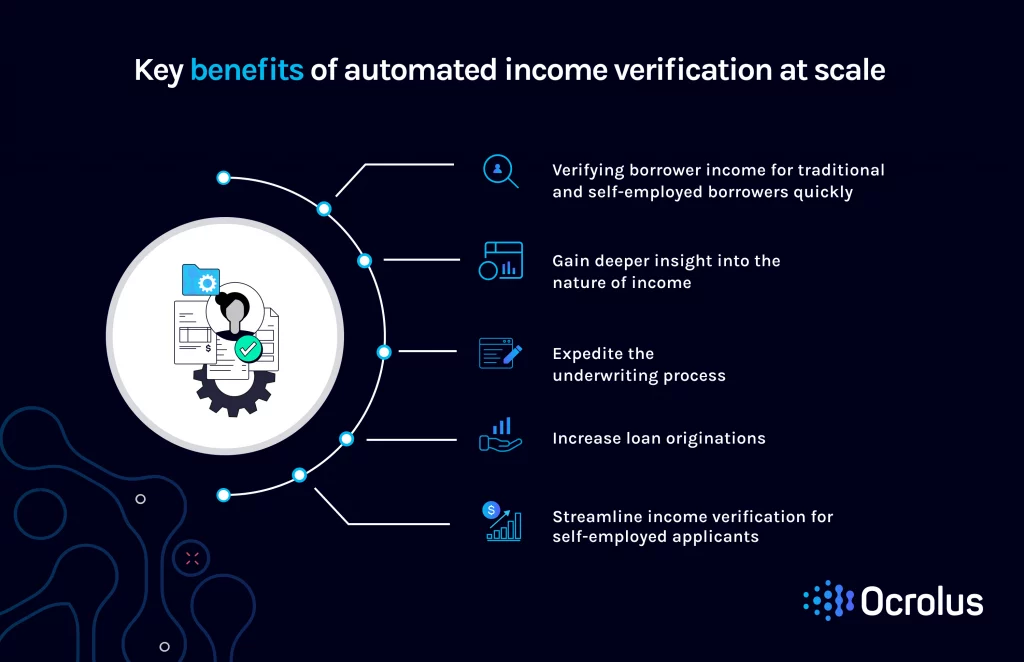

Key benefits of automated income verification at scale

Lenders who are able to scale their business through automated income verification can benefit from the rewards of increased efficiency, including:

Verifying borrower income for traditional and self-employed borrowers quickly

What used to be a multi-week process can now be done in minutes. Significantly increase the number of applicants your business can review through automated income verification.

Gain deeper insight into the nature of income

From salaried employees to independent contractors, there is no type of applicant that can’t have their income accurately verified through automation.

Expedite the underwriting process

Automated income verification technology can move at speeds that not even the best, most efficient loan underwriter can match.

Increase loan originations

Improve your business’ capacity to work with more borrowers that require loan origination by decreasing the amount of manual labor in the application review process.

Streamline income verification for self-employed applicants

Automate up to two years worth of verifying bank statements for self-employed applicants. Serving non-traditional borrowers has traditionally been a pain point for lenders due to the complexity of their income portfolio.

Automate Income Verification with Ocrolus

If you’re ready to leverage income verification automation, Ocrolus can help. We offer the latest in income verification and intelligent document processing technology and take it a step further for our customers by providing an analysis of a potential borrower’s creditworthiness. We take the heavy lifting off of your lending team, and help scale your business by enabling you to verify borrower income faster. Watch our demo to see for yourself.