Lender analytics: Examining trends in small business cash flow

Once a prohibitively time-consuming task, leveraging bank statement data for cash flow analysis has been made more accessible through automation.

With AI-driven document automation and analysis, Ocrolus has the ability to dive deep into bank statements to help small business funders truly understand applicants’ financial health.

To uncover the insights from cash flow analysis, we dug through data from small business funders who used Ocrolus in the second half of 2024. Our findings highlighted several key trends funders will want to keep their eye on in 2025.

Common types of small businesses applying for funding

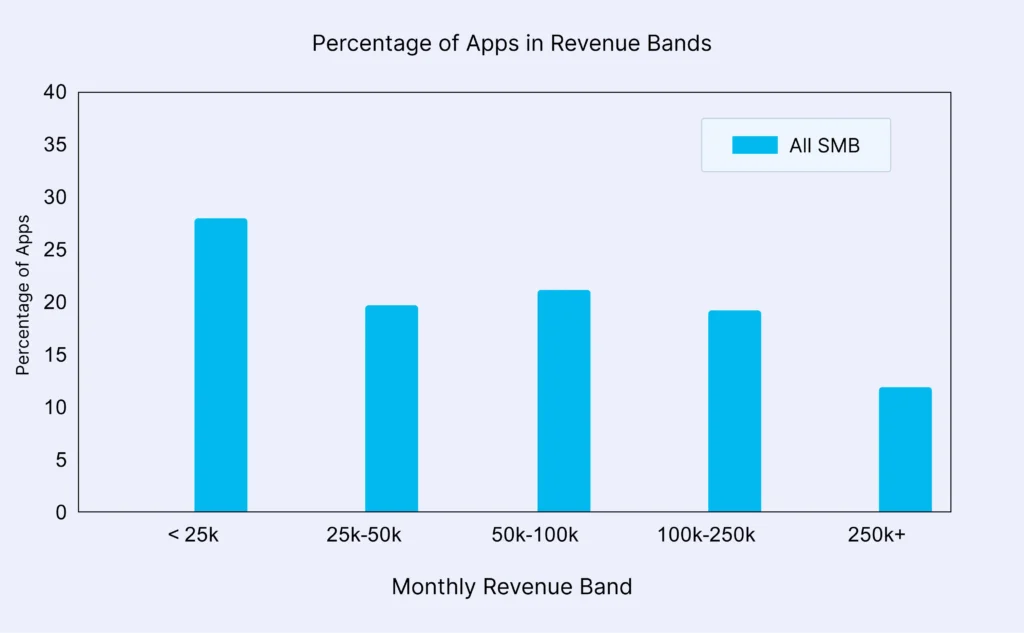

From July to December 2024, Ocrolus processed nearly 900,000 applications for small business funding, which included more than 2.7 million bank statements. Of these applications, nearly 30% came from businesses with less than $25,000 in monthly revenue – an insight discovered through Ocrolus’ lender analytics.

While the remaining 70% of applications were relatively evenly distributed across revenue bands, those with over $250,000 in monthly revenue accounted for just over 10% of applicants.

These stats demonstrate that most small businesses operate at relatively low revenue levels. Many of these businesses may tap a line of credit to support operations. While this could potentially damage businesses’ credit scores, this does not necessarily mean that they are unhealthy businesses. Cash flow analysis digs beyond traditional credit scores to parse healthy and unhealthy businesses based on real-time business performance.

Using payroll transaction tags within Ocrolus’ cash flow analytics solution, we can also use bank statement data to understand businesses’ short-term obligations and determine if a small business is a sole proprietorship.

We found that sole proprietorship is the most common structure of small businesses applying for funding. Each month, from July to December 2024, between 55-60% of small business funding applications we processed came from sole proprietors.

Identifying fintech loan obligations

A critical factor in a small business’ ability to repay a new loan is its existing or additional loan obligations. Obligations to non-traditional fintech lenders can go under the radar when funders rely on traditional underwriting metrics to gauge creditworthiness.

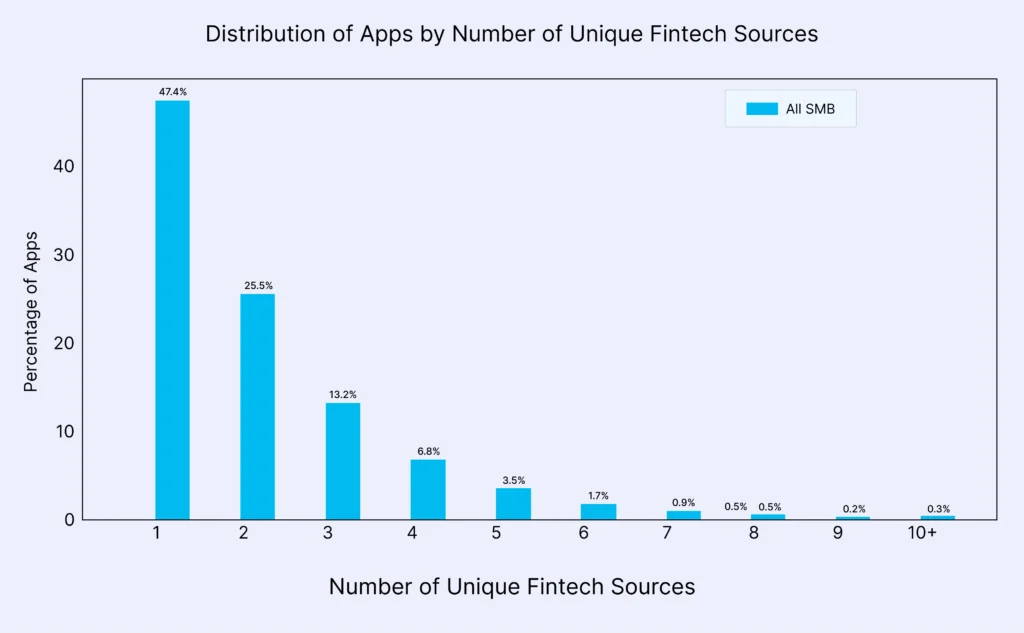

By identifying and entity-resolving transactions to and from fintech lenders, Ocrolus can determine how many unique funding sources are contained in an applicant’s bank statements.

In most applications where fintech lenders were identified in bank statement data (86.1%), Ocrolus found three or fewer unique funding sources from fintech lenders. Meanwhile, just 47.4% of applications reviewed included only one unique funding source. However, the remaining 13.9% had four or more unique fintech sources—and for some, as many as 10.

To make informed financial decisions, small business funders should be aware of existing obligations – a critical insight into a business’ health, creditworthiness and ability to repay.

Top revenue sources for small businesses

Analyzing the wealth of cash flow data within bank statements, we can draw some interesting conclusions on not just how much revenue small businesses earn but how they receive it.

While cash still represents the largest portion of revenue for small businesses at 45.6%, wire transfers are also a significant revenue source, accounting for 31.6%.

Modern payment platforms are continuing to gain ground in transactions. Merchant service revenue from sources like Zelle, Square, or other nontraditional sources accounts for 13.5% of small businesses’ revenue. On the other hand, checks are less frequently used, at just 9.2%.

With Ocrolus’ counterparty detection, funders can understand the specific sources of revenue and gain insights into the stability and diversity of revenue streams. Additionally, Ocrolus provides funders with a better understanding of where and how they spend money.

We continue to see an increasing number of small businesses transacting with cryptocurrency as the technology becomes more prevalent. Similarly, we are seeing a rising number of transactions with gambling platforms.

While these types of transactions are not always red flags, they should be examined more closely during the funding decision-making process. While some of these businesses may simply be a part of gambling or cryptocurrency industries, others with significant transactions in these categories may present a greater risk of inability to pay back loans.

To learn how Ocrolus cash flow analytics can help you better understand applicants and make more informed funding decisions, book a demo today.

Key takeaways

- With cash flow analysis, small business funders can identify valuable trends that can be used to make informed financial decisions.

- Funders can gain insights into small businesses’ monthly revenue, existing financial obligations and revenue sources through cash flow analysis.

- Analyzing bank statement data can identify potential red flags among small businesses, such as transactions with gambling and cryptocurrency platforms or an excessive number of existing loan obligations.