This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Adapting to the Rise of Non-Traditional Borrowers with Alternative Lending Options

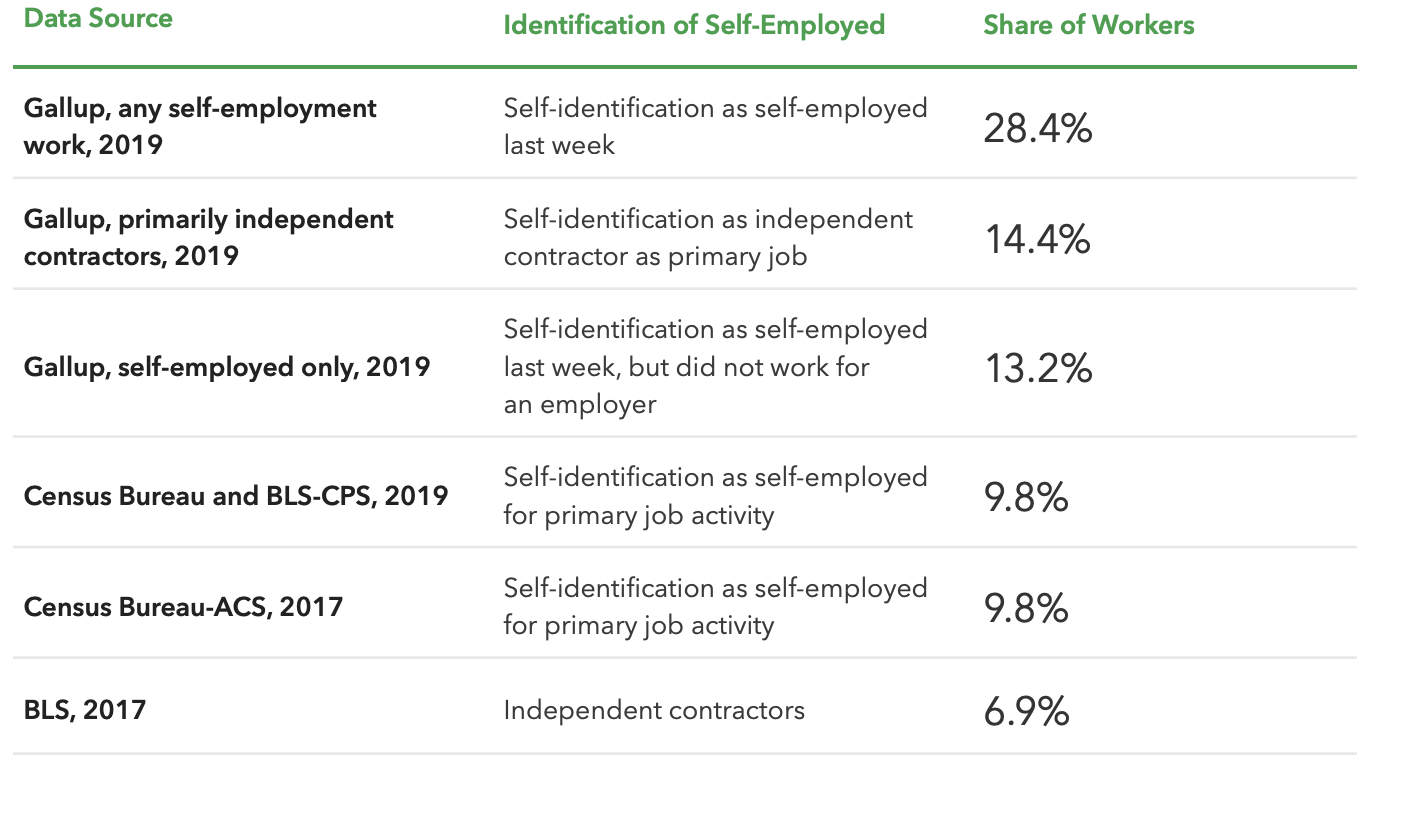

The gig (economy) is up! New research shows self-employment and gig economy working in the U.S. is on the rise. In a collaborative study, Intuit Quickbooks and Gallup found that self-employment is at an all-time high, with a record-breaking 44 million self-employed professionals in the U.S. That’s nearly 30% of Americans. The report also states that from 2000 to 2017, there was a +722% growth in sole proprietors, and this trend shows no sign of slowing.

With more and more Americans supporting themselves as non-traditionally employed workers (and with about 40% of gig workers reporting an excess of $50K), it’s time for mortgage lenders to look more closely at how they can serve this market of non-traditional borrowers.

Source: The State of the Self-Employed

Through my discussions with mortgage experts on this topic, it’s evident that many professionals are experiencing the same pain point around analyzing income analysis for self-employed borrowers. They are reluctant to lend to them because it’s more difficult to get to their goal; that is, turning data into one usable calculation to determine how much of the self-employed person’s income can be applied towards their monthly income.

Recently, I had a conversation with the Head of Operations at a major lender. When I asked what the company’s process was for handling non-traditional income analysis, he stated that, if he gives a group of underwriters the same self-employed income file, he’ll get three different calculations back. The need for a consistent and automated approach to self-employed income is there, and with mortgage rates at an all-time low, more of these non-traditional borrowers are applying for home loans.

In order to enact consistent underwriting treatment of self-employed income, lenders should develop a uniform consensus around the way to approach self-employed borrowers. Without technology, underwriters might push a non-traditional loan application with fifty pages of tax returns to the bottom of the pile. With the right technology partner, mortgage lenders can address this under-served market by automating document-driven processes for qualifying non-traditional borrowers.

Automation in Action: Self-employment income analysis

Ocrolus recently partnered with HousingWire to share our solution for self-employment income analysis & verification with their forward-thinking community of mortgage professionals. I had the pleasure of collaborating with our former Mortgage Product Manager, Christine Ponder-Stern, to show how lenders can make smarter, faster loan decisions on self-employed borrowers with the help of our automated solution.

Watch the demo below to learn more about how we help mortgage lenders analyze self-employed income.

View our Events page to catch us at an upcoming virtual mortgage event, including NEXTFALL22, Digital Mortgage, ACUMA, and the MBA Annual Expo.