This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Taktile and Ocrolus partner to unlock real-time underwriting for small business lenders

In the landscape of small business finance, it is common for small businesses to approach multiple lenders and accept the first offer they receive, making speed a crucial factor for B2B lenders. Traditionally, enhancing the speed of underwriting decisions has often meant compromising on quality and accuracy—until now.

Taktile and Ocrolus are transforming small business lending through a new partnership, leading the race to equip small business lenders with real-time underwriting and data at scale.

“Ocrolus and Taktile are transforming the way small business lenders have historically operated,” said Sam Bobley, co-founder and CEO of Ocrolus. “By integrating trusted data and analytics with advanced AI capabilities, we enable lenders to make smarter, faster, and more accurate lending decisions.”

Imagine a world where you can instantly gain a holistic view of an applicant’s financial situation by analyzing their documentation with over 99% accuracy. Enter Ocrolus, the leading document AI platform that bridges the gap between manual and digital document review processes for lenders. Ocrolus accelerates application processing with exceptional accuracy and supports a wide array of document types, including bank statements, pay stubs, tax forms, and more.

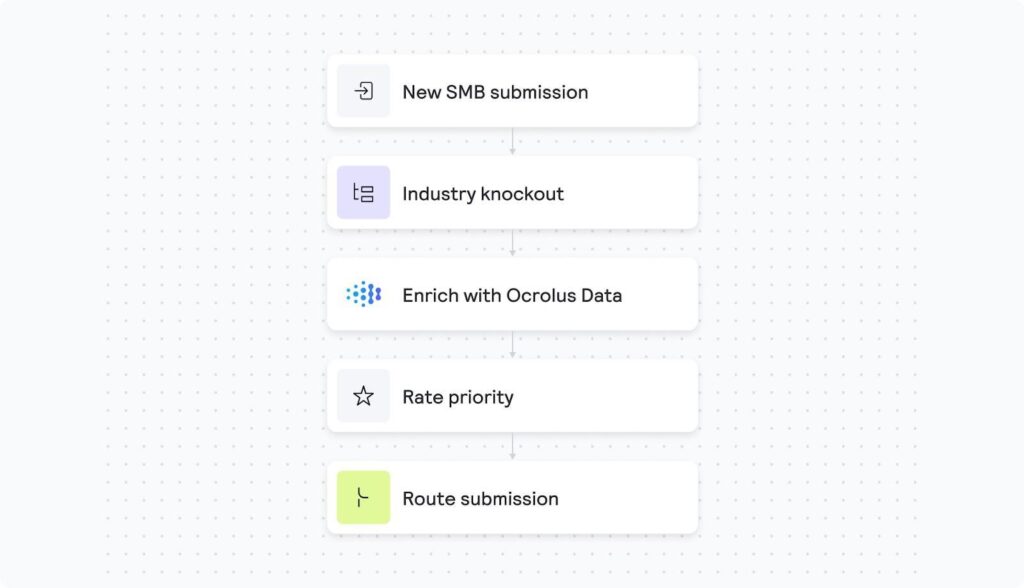

Now, imagine if this capability was seamlessly integrated into a single, unified platform that streamlined every decision point of your underwriting process. Taktile, a next-generation risk decision platform, makes this a reality for lenders by giving their credit, risk, and product teams superpowers.

On Taktile, teams can rapidly build, run, and experiment with streamlined, automated underwriting decisions regardless of their expertise. They can also tap into a rich marketplace of pre-built integrations with cutting-edge data providers and analytical tools like Ocrolus.

“Our partnership with Ocrolus is a game-changer for lenders wanting to make more efficient lending decisions without sacrificing accuracy and risk appetite,” says Maik Taro Wehmeyer, CEO and Co-Founder of Taktile. “By combining our solutions, lenders instantly gain a more comprehensive understanding of applicants plus the ability to seamlessly scale their operations to meet the evolving demands of today’s lending environment.”

Unlock an AI-driven, holistic view of your borrowers’ financial health

Accurate financial data is the cornerstone of any lending decision, yet extracting actionable insights from this data is often the most time-consuming and complex challenge lenders face.

Ocrolus’s advanced AI-driven document analysis streamlines this process, significantly reducing manual processing time while enhancing your ability to detect and assess risks accurately. It extracts critical insights—such as cash flow, income, address, employment, and identity data—enabling you to evaluate the risks associated with potential borrowers quickly.

Borrowers can submit banking information through bank data feeds, PDFs, or cell phone images. Ocrolus ingests all financial data formats, providing a consistent output schema that supports detailed cash flow analysis and risk modeling, accommodating the most comprehensive possible range of borrowers.

Streamline your data integration process to save time and cut costs

A Taktile survey of lenders worldwide found that most want to improve their risk assessment capabilities by adding new data sources. However, their current infrastructure often prevents them from doing so promptly.

Eliminating the need for extensive in-house engineering support and maintenance to integrate new data sources and analytical tools can accelerate your path to better financial insights and business growth.

Taktile enables you to instantly connect to Ocrolus via a pre-built and fully maintained API connection, making it effortless to build, run, and experiment with automated decisions that leverage Ocrolus data.

Boost approvals and improve conversion rates with Taktile and Ocrolus

Taktile and Ocrolus combined enable lenders to augment complex and lengthy manual underwriting processes with powerful automation, eliminating bottlenecks in decision-making.

Ocrolus allows you to rapidly classify, capture, detect, and analyze key financial insights about a borrower. Taktile then seamlessly integrates these insights into automated or semi-automated underwriting decisions.

This more precise and streamlined approach to risk assessments makes growing approval rates much easier. Additionally, an accelerated decision-making process leads to higher conversion rates, unlocking the potential for real-time underwriting and giving you a strong competitive edge.

In an industry where these factors are now crucial, the partnership between Taktile and Ocrolus represents a significant leap forward for small business underwriters. Join us in the race to real-time.