This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Ocrolus Update – 9/29/19

Welcome to your weekly Ocrolus Update – 9/29/19!

Here’s a curated list of industry news, recommended reads, fundraising announcements, and some laughs. Please drop us a line if you have any tips or content that you want to see in the future.

Industry News

SoFi is beta testing a crypto trading feature with bitcoin, litecoin, and ether (The Block): SoFi has begun rolling out a beta version of its cryptocurrency trading service to current members with three initial assets: bitcoin, litecoin, and ether. The firm is partnering with Coinbase to complete trades. Cryptocurrency trading through SoFi Invest will be available in 36 states. Users will not be able to withdraw their cryptocurrencies to an external wallet. Maximum orders will be limited to $50,000 per user per day.

Student Loan Refinancing Rates Down Sharply (Credible): Homeowners aren’t the only ones who can take advantage of falling interest rates to refinance their debt. After hitting a post-recession peak a year ago, rates for borrowers refinancing student loans have fallen dramatically. Although there’s been explosive growth in student loan refinancing, only a fraction of borrowers who might benefit have taken the plunge. Using methodology developed by Goldman Sachs analysts, Today, roughly 8.14 million borrowers could refinance $295.8 billion in student loans at lower rates.

Fintech’s small-business lending plan will rely on banks, credit unions (American Banker): Community banks and credit unions will soon have another option for making unsecured loans. StreetShares, a peer-to-peer lender that has moved into small business lending, is set to debut a platform to allow lenders to make small-dollar loans without collateral. While banks and credit unions continue to act as the loan originators, StreetShares provides software that handles risk-management, underwriting, and funding. Clients can use the platform to make unsecured small business loans between $3,000 and $250,000.

The Coming Currency War: Digital Money vs. the Dollar (Wall Street Journal): The future of money might be a digital version of the cash that’s already in people’s wallets, potentially upending the currency system that the world has known for many decades. Central bankers and governments, the entities that cryptocurrencies’ backers hoped to render obsolete, are increasingly warming to the idea of “digitizing” their own national currencies. That is, they would issue money that would exist only virtually, without a paper or coin equivalent, as a universally accepted as a form of payment. The move could undercut one of cryptocurrency’s current core advantages.

London just overtook New York for fintech investment, research shows (CNBC): London has beaten New York in luring the largest amount of fundraising deals for financial technology companies so far in 2019, fresh research shows. The U.K. capital’s fintech sector attracted a total of 114 deals worth a record $2.1 billion in the first eight months of the year. While San Francisco still tops London in terms of total deal value – start-ups in the Californian city raised $3 billion – outfits in the U.K. capital won the most amount of funding rounds. New York firms snagged 101 fintech deals, while San Francisco saw 80.

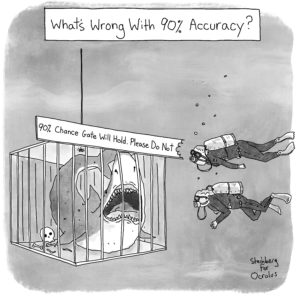

Cartoon of the Week

Fundraising Announcement of the Week: Railsbank

Congrats to Railsbank (tech eu) for securing $10 million in Series A funding! Railsbank enables developers and product managers to prototype, build, launch, and scale a financial services business, in one country or globally. Headquartered in the UK, Railsbank will use the funding to establish an office in Singapore as a gateway for expansion into Southeast Asia, and continue to boost the development of its API-based platform.

Recommended Reads

An AI learned to play hide-and-seek. The strategies it came up with on its own were astounding. (Vox): OpenAI released their latest project: an AI that can play hide-and-seek. It’s the latest example of how, with current machine learning techniques, a very simple setup can produce shockingly sophisticated results. Over the course of 481 million games of hide-and-seek, the AI seemed to develop strategies and counterstrategies, and the AI agents moved from running around at random to coordinating with their allies to make complicated strategies work. It’s the latest example of how much can be done with a simple AI technique called reinforcement learning.

France’s $5.5 billion startup fund is a bid for digital sovereignty (VentureBeat): The global startup race is often measured by quantitative markers, like venture capital or unicorns. But the more intangible measure of sovereignty is increasingly on the minds of policy makers outside the U.S. and China. France recently started a $5.5 billion startup to ensure digital independence from the more dominant tech countries. While concerns are partly economic, there is a cultural component, a fear that the everyone-for-themselves ethos of the U.S. or the authoritarian centralization of China will be permanently imposed on other nations via critical technology.

Apple’s New Mac Pro to Be Assembled in Texas After Tariff Waiver (Bloomberg): Apple said the next version of its high-end Mac Pro desktop computer will be assembled in Texas after the company received tariff waivers on key components. Manufacturing of the new model was “made possible” after the U.S. government approved Apple’s request for a waiver on 25% tariffs on 10 key components imported from China. The company was granted exclusions on several parts, including processors, power components, and the computer’s casing.

Ocrolus News

Come check out Ocrolus at the Global Artificial Intelligence Conference on Tuesday, October 1st at the Boston Convention Center! We’re co-hosting a panel with Socure: “Leveraging AI and Technology to deliver a best in class user experience in Financial Services.”

Elizabeth Sabbatini, Ocrolus Director of Customer Success, and Josh Goldenberg, Global Head of AI at Ocrolus, will speak on the panel. See you there!

Thanks for reading, and see you next time!