This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Ocrolus On-Site: Bank Automation Summit

On March 1-2, 2022, Team Ocrolus is headed to the Bank Automation Summit in Charlotte, North Carolina. This event promises to help financial services professionals discover new use cases and technologies that are helping to accelerate automation in banking.

We’re excited for the opportunity to exhibit and connect with potential and current clients while attending some of the great sessions.

Automation Ideas with Ocrolus

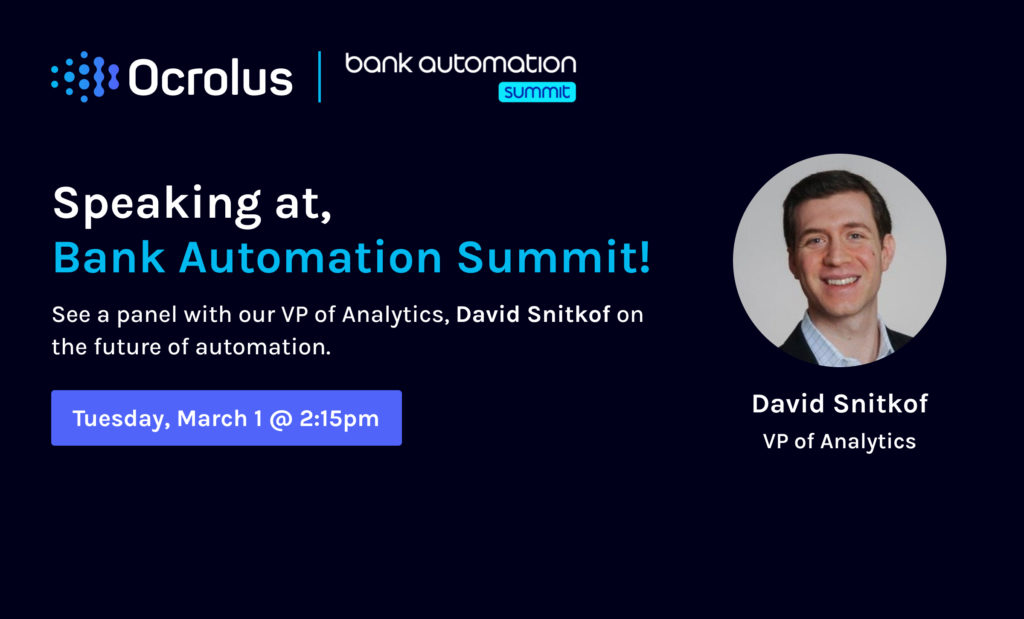

Our VP of Analytics, David Snitkof, will be speaking on the panel, Automation Ideas: Moving Financial Institutions Rapidly Into The Future, focusing on what lenders can expect in the future with automation. Automation is a crucial tool that forward-thinking financial institutions would be wise to utilize to improve their workflows and customers’ access to credit.

David contributed heavily to a study with NYU Stern School of Business, which analyzed publicly available data on PPP loans to assess racial bias in lending. The study, which looked at data regarding the $806B Payment Protection Program (PPP), found that overall, fintech lenders were responsible for 53.6% of PPP loans to Black-owned businesses, while only accounting for 17.4% of all PPP loans in the sample.

If you’re at the summit, make sure to attend his session on Tuesday, March 1st at 2:15 PM.

What we’re attending

The schedule is packed with standout sessions; here are a couple we’re most excited about:

Session Three: Modernizing Commercial Lending Through Automation

Tuesday, March 1st at 3:45 PM

When thinking about automation in lending, most people jump straight to retail lending. However, automation is shaping up to have a huge impact on the commercial space as well, leading to advances in the loan origination processes, credit underwriting automation, and the digitalization of compliance and risk.

Session Six: Strategies For Automating Payment Processes Panel

Wednesday, March 2nd at 11:15 AM

This panel, which features leaders from Capco, Cross River (an Ocrolus customer), Citizens Bank, and Red Hat, will focus on the power of payment data and what’s being done to automate the process. Highlights include:

- Analyzing distributed ledger technology for cross-border transactions

- Implementing real-time transaction processing

- Understanding embedded payments and regulatory compliance

Learn more about our work with Cross River in a case study that covers how automation helped them become a top-four PPP lender.

Connect with Team Ocrolus

Ocrolus will host a booth for the duration of the summit. Make sure to say hi to Team Ocrolus and pick up some Ocrolus swag at booth #4.

We look forward to seeing some new faces and spreading the word about what automation can do for accelerating workflows and increasing employee retention rates. In a time when staffing for underwriting positions is becoming increasingly difficult, we’re excited to talk about automation as a potential solution.

We hope to see you there!