In the Loop: New Models for Fraud Prevention Part 2

Four fintech leaders discuss key issues in addressing financial fraud

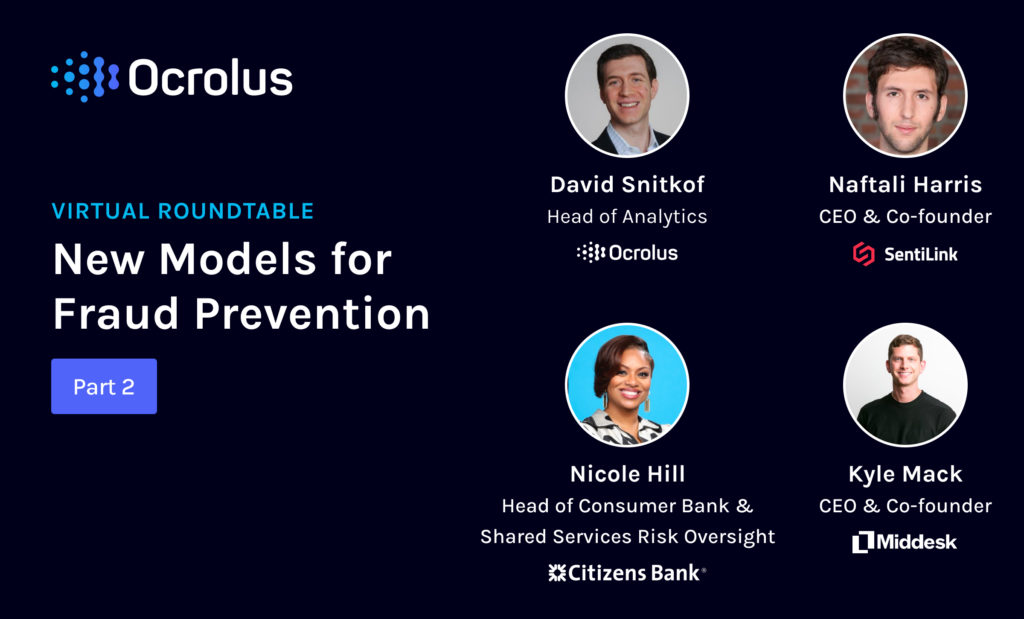

Welcome to this recap of the Ocrolus virtual roundtable discussion on fraud prevention. Ocrolus’ Head of Analytics David Snitkof leads a lively discussion with Nicole Hill, Head of Consumer Bank & Shared Services Risk Oversight with Citizens Bank, Naftali Harris, co-founder and CEO of Sentilink, and Kyle Mack, CEO and co-founder of Middesk. This week we’re presenting part two of their conversation.

David Snitkof:

As everything changes so quickly, if you’re a forward-thinking provider of financial services, how can you build a learning system? I think you can’t have a static broad strategy or risk strategy. You really need to learn, constantly be collecting data, constantly detecting, adapt to changes in the various behavior, any tips or ideas on doing that or where you’ve seen that succeed in the past?

Nicole Hill:

So, David I’ll take that, best practice sharing. I’ll be very honest with you, the risk SMEs and the fraud SMEs, we learn by sharing and sharing more of, this is what we’re seeing at round tables, also being part of new technology and infrastructure that’s being developed like SentiLink, for example, there’s white papers that come out, we can never stop learning.

Of course, looking at manual processes and saying, “What can we do to automate?” And so really getting to a point where you say, “I’m never going to stop learning because guess what? The fraudster is always learning a way to circumvent a system or tool, an individual, a beneficial owner, a business owner.” And so you got to take the approach of, “What’s out there today? What’s going to be out there tomorrow?” And looking at all avenues. And then the other key item I would say is, the goal for every company is to grow even within financial services, fintech, and businesses that are outside of fintech in financial services.

The fraud experts in the company have to be at the table with the growth and strategy experts of the company. So when they want to launch innovative payments, or cryptocurrency, or whatever it may be, we need the fraud people at the table to be able to say, “Okay, if you do that, we’ve got to make sure we check AML, we got to make sure we look at money-laundering, we got to add different infrastructures and tools so we can stay ahead.

Nicole Hill:

But if we come behind after you deploy it, then that’s when you have that fraud ring or that fraud attack, and you’re trying to run more to the race versus being at the table before the race happens.

Naftali Harris:

Yeah. I think Nicole is absolutely right about this. It involves a continual effort and continual investigations and to discover what the fraudster’s doing because they are adapting and they are changing. And so, I think this concept of combining the manual part of it, to always be looking, always be investigating, always be trying to find new stuff with the automated technology is really how you build a scalable solution that nonetheless reflects the latest insights about what fraudsters are looking like today.

David Snitkof:

We are in the golden age of customer service and I think that’ll actually increase because there’re so many consumer applications and particularly outside of the digital services where the customer experience bar has been set so high, I don’t think a typical consumer, or business owner who’s just a person, really, is going to draw a distinction between their bank service provider and any other service they use. They’re going to expect a very, very high degree of service and a high degree of personalization which is a great thing. It’s a generally great thing.

I also think it’s going to create a whole set of second-order behaviors that you can’t necessarily see today that we’re going to have to think about. One thing that comes to mind as they review consumer behaviors, work from home, social distancing, more e-commerce, less than person in Congress, all those different things, some of those behaviors in a way, are driving people to put themselves at risk in different ways.

Whether it’s sharing things on TikTok, you shouldn’t be sharing or whatever, do we actually see anything like that?

Nicole Hill:

I know today in the world of being stuck at home, we all use our phone probably more than what we ever have. I know at the end of 2019, it said about 80% of consumers use their phone for business transactions, paying their bills versus logging onto a laptop, or actually being at a desktop computer. So the evolution of being on an iPad or a smartphone is the new norm, and we are using our technology and our phone more often than none.

And so, it’s interesting as we have been looking at what are some of the new fraud threats? Especially, the cyber concerns are more around your location services, you’re showing everyone where you live and, we as financial services and fintech, we’re looking at that and saying, “Hey, don’t tell anyone where you live at because when you zone into your location, you’re actually giving them your address, which is part of your identity.”

Nicole Hill:

And so that’s been a common discussion point for our investigators when they’re going through a claim and they say, “Hey, my bank account is zero.” We go in and we say, “Well, did you go on TikTok, or Instagram, or all the other, Twitter and you just put your location and you made everyone aware that you lived in California, San Francisco on 183rd street?” Just as an example.

Nicole Hill:

And so we have to be a little bit more cognizant, what you share is available to everyone on social media. And it’s okay to share, pictures and all the other great things that you have, but once you tell them where you are, or you went on vacation, and you’re going to be gone from your home and your previous posts, when you posted your location, they now have access to where you live, they can go into your mailbox and grab your mail. And so now they have real intelligence of who you are. And those are some of the old school scams that are coming back to light because we tell a lot on social media and sometimes we’re not quite aware that we’re telling too much. And so I think that’s something that we have to take in consideration as we get smarter in parallel with the fraudster is we got to sometimes educate the consumer on things to not do.

Naftali Harris:

I think that’s especially true combined with just how antiquated a lot of identity verification systems are right now. So, I think Nicole, you alluded a little bit to KBA Knowledge Based Authentication questions, and you just think, look well, you take a picture and okay, so now people know what city you live in. And so when the KBA question says, “Which of the following cities you’ve lived in.” Now, you take a selfie on your vacation, that you were driving your car and they say, “What model is your car?” Well, now they know. Your friends wish you happy birthday on Twitter or something, well, now everyone knows what your birthday is. Just like that, three out of your five KBA questions, you can already answer.

Naftali Harris:

And I think, it’s a relatively sophisticated form of fraud, it probably only makes sense against higher value targets. But it just goes to show you, with all the information that’s now available online, not even to mention the stuff that’s available in breaches, but even just the stuff people are sharing about themselves on social media. I mean, even just a little bit of info, there’s quite a bit you can do in terms of doing account takeovers and other things like that. I think of it as a specialty where it’s just because of how antiquated a lot of the existing systems are.

David Snitkof:

Has legislation or regulations changed any of the landscape around this or, for you or your clients, do you think any of that is going to change or advance or not, once the new administration takes office?

Nicole Hill:

That’s a great question. I think we’re all waiting to see if there will be material change in terms of the legislation. I do think we have to partner to Naftali’s point, partner closely with the government until there may be definitely more exams around CFPB and that’s making sure we’re protecting the consumers because of course that’s our prime across the world, is taking care of the consumer, but then it’s also making sure we’re not letting bad consumers come in.

Nicole Hill:

So there’s definitely going to be change. What does that look like? I think we’re all waiting and anticipating to be able to prepare for that.

David Snitkof:

One thing I think about, and this gets to an interesting part of our conversation, which is that, just of our identity in general. The identity for people, identity for businesses, and this whole industry taxonomy, is based on the idea that there are companies and that most people work for a company. And in this new world, plenty of people work for a company, but maybe especially when people are remote, many people work in new ways.

They work in the gig economy, they work in the entrepreneurship economy, people in businesses, people in business identities merge in a way; you’re a person, but you’re also for business.

Kyle Mack:

Yeah. I mean, I do think it’s interesting to think about what that maturity curve looks like over time, I mean, the gig economy has just changed the way that people work. And I do wonder as people start to step across many platforms and that becomes an increasing way that they manage their finances and their earnings, how that shapes what it looks like to be a sole proprietor. We talk about this idea of the grey area between an individual and a business, there’s a lot of people operating in this 1099 area. And I think more recently there’s been some studies on the rate of new entity formations right now.

When you think about the industry of a business an industry could be something like retail, what’s the nature of that though? There’s many, many layers, and so, I think, again, it all gets back to being able to evaluate these things in real time, being able to share learnings, best practices across what folks are doing.

Nicole Hill:

I would agree. I don’t think we’re quite there yet, but I could say, just based on what we’re seeing, if you think of retail, a retail shop in terms of a boutique or a clothing store, they were at a standalone brick and mortar. They had to come a hundred percent remote, so now, their items are inside their garage. Small business makes up a big volume of the economy in the world. And so, the better we can get to know those good businesses sooner, it can help us differentiate the difference between maybe a peculiar one that may have a red flag, or a fraught one where we need to shut down immediately.

It’s a growing pain for financial services and fintech. And we got to get there.

David Snitkof:

Do you all foresee some widely adopted verifiable credential standard in the near future? Something that is either centralized or decentralized, but that you can rely on and what’s, if there’s a 10 year trend that gets started today, what does that look like?

Naftali Harris:

I do. I think it actually is, in some respects, actually inevitable. I think the way that we verify identities in the United States is just so incredibly broken, inefficient, fragmented, there’s so much duplicated work across institutions. The data that you would want is in so many different places that I just don’t think that that can really continue as a sustainable thing.

Naftali Harris:

And so, I don’t think it’s not going to happen this year or next, I’m very negative on the concept of it happening with something like a blockchain or something like that, but I do think that 10 years from now, we’re verifying identities in a much different way than we’re doing it today. To use an economic term, I don’t think we’re in the Nash equilibrium of how identity verification actually works. I think it’ll be very, very different in the future.

Nicole Hill:

Yeah, I would agree. I think all of us, especially in financial services in fintech, we all use different tools and different variables across different channels. And there’s not a 360 view of us being able to look at it at a one-stop shop. So we definitely have some work to do to make it easier for an analytics team, a data analytics view, to be able to capture that quicker, sooner, faster and we’re going to have to get there because the life that we’re moving towards to your point, David, the future, is we have to be quicker, sooner and faster. Otherwise, we’re going to be behind and it’s going to create friction for that good customer and we’re going to have some false positives when it comes to detecting fraud.

Kyle Mack:

And I think, we’re at this interesting inflection point in the history of the consumer internet and adoption of technology where you see this in the social media, free speech debates. There’s, definitely over the last 10 years, there’s this idea that, okay, most social media sites think of themselves as a platform, people post all things there just like sometimes people say good things or bad things in public, in person, sometimes they say good things or bad things on social media, and it’s not the problem or responsibility of the maker of the tool, and I think you’re seeing a lot of cultural pushback to that orientation right or wrong, our financial services firms going to intensify their compliance efforts to go beyond just preventing things that are explicitly illegal.

Kyle Mack:

So, also preventing things that might be reputationally distasteful for them, and what might that look like. And then do we see some actual fragmentation of financial service adoption based on what you want to do and what a financial services firm will allow themselves to be represented is letting you do.

Naftali Harris:

Yeah. I mean, I’m curious, Nicole’s thoughts on this one, but I don’t think there’s a question that reputational risk is growing. The expectation of just simple public perception of what a business stands for, and the types of clients that they take on, and therefore, the types of services they provide for those businesses to grow and to thrive, I don’t think there’s a question that there’s a heightened focus on this, but I am curious to hear how Nicole, you all, think about this idea of reputational risk and how that might be changing over the coming years.

Nicole Hill:

So, great discussion topic. Reputation risks is number one in financial services as well as in fintech, because, if we’re publicly displayed as a bank of not trust or a fintech without trust, then it’s a concern for the sediment of the consumer. And so, as part of just the compliance management program in general, reputational risk is a foundation pillar. And so that’s on the forefront.

Nicole Hill:

We have to review complaints, we have to understand what’s keeping our consumers up at night, and then we also have to be able to differentiate a fraud complainer versus a real consumer that’s actually complaining. And all of us in the financial service companies have to take reporting and themes and understand, what would this do? I know all of the fintech and financial service companies on the phone consent orders are increasing. And when they increase, it’s our responsibility as a financial service company, to make sure we have controls and the button-up reporting and data, to be able to make sure that doesn’t happen.

Nicole Hill:

And so, reputation was number one in any, and everything because it helps you grow, it helps us hit our strategic goals, and it also helps to lay the foundation of the next phase of iteration of growth within any company, especially in banking.

Naftali Harris:

Couldn’t agree more.

David Snitkof:

Thank you for an incredibly fascinating conversation. As I said to the panelists beforehand, this could have been a four-hour podcast and we could have kept talking forever, but super fascinating. So, thank you all for sharing your insights.

If you’re interested in learning more about how Ocrolus is constantly innovating for fraud prevention, schedule a free demo.