This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

How to Spot Fake Paystubs Using Automation Software

Income fraud increased by 27.3% from 2021 to 2022, according to CoreLogic’s Annual Mortgage Fraud Report. Most industry experts and risk managers say the increase in income fraud risk is their number one concern, CoreLogic reports—and one of the chief methods of committing income fraud is through doctored paystubs.

Lenders often require mortgage borrowers or other loan applicants to supply two recent paystubs to verify their income. As rental and mortgage fraud continues to rise, submitting fake paystubs is one of the ways that would-be homebuyers are committing fraud. When loan applicants submit fake paystubs to lenders in an effort to get approved for mortgages for which they may not qualify, they put lenders at risk.

It’s important for lenders to be able to quickly and effectively detect fake paystubs in order to keep the lending process effective and successful. Rather than relying on flawed manual processes, automation software can quickly process documents and spot fake paystubs, protecting lenders from fraud and freeing them to spend their time on more strategic tasks.

How Can Lenders Spot Fake Paystubs?

With advanced technology and creative fraud strategies, fraudulent borrowers have improved their techniques in doctoring existing paystubs or creating totally fictitious paystubs. Online sites offer mortgage applicants the option to create customized pay and employment records, reports The Washington Post. Some fake paystub providers will even provide phone confirmation of employment when a lender calls to verify. Technology also makes it easier for fraudsters to create fabricated documents, such as paystubs, that closely mimic the real thing. As a result, it’s becoming increasingly difficult to differentiate between authentic paystubs and fake paystubs because, to the human eye, they can look very similar.

As fraud techniques become more advanced and readily available, lenders should consider leveraging the latest automation technologies to detect signs of document tampering. Doing so will help them to catch would-be fraudsters in the act more quickly and cost-effectively.

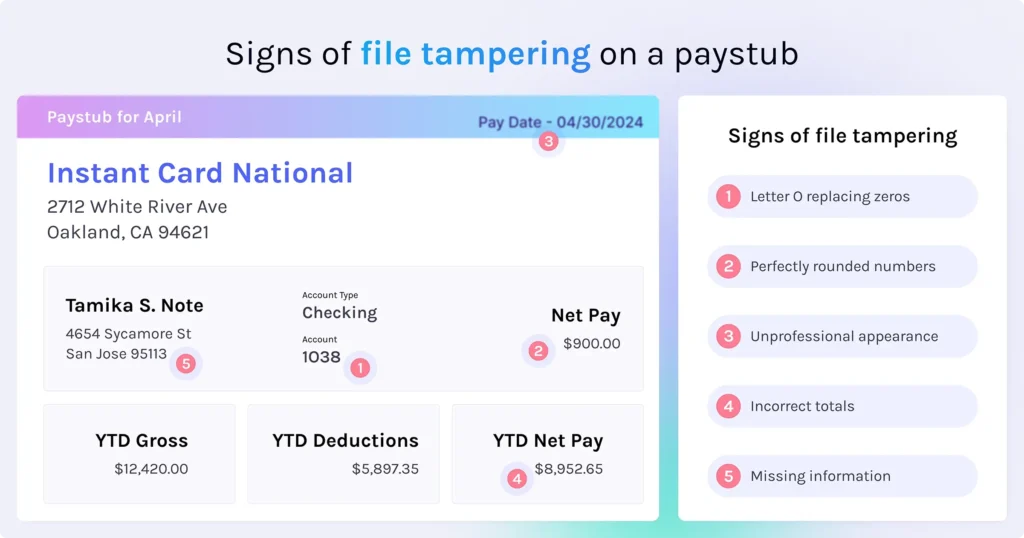

5 Signs of File Tampering on Paystubs

While fraud has become more sophisticated, there are still several telltale signs of fake paystubs that can be spotted manually. When lenders see any of these common signs of file tampering, it’s a good idea to flag the paystub for further investigation.

- Letter O replacing zeros. If you see the letter O where there should be a number 0, that’s a sign that the paystub you view may be fraudulent. No self-respecting payroll department would use a letter instead of a number, but a person creating a fake paystub might.

- Perfectly rounded numbers. The amounts listed on a legitimate paycheck—total wages, taxes withheld, and gross payment amounts—are hardly ever round numbers (ending in .00). If you’re reviewing a paystub that includes rounded totals, it may be a fake.

- Unprofessional appearance. Authentic paystubs almost always have a standard, professional look. It may be fraudulent if a loan applicant submits a paystub that has blurred text, unusual fonts, or is improperly aligned.

- Incorrect totals. Check the math when reviewing a paystub for income verification. If it’s fake, the math may be incorrect. For example, the gross income amount should equal the net income plus any withheld amounts, and the tax amounts should equal standardized and predetermined percentages

- Missing information. A legitimate paystub will always include gross pay, withheld amounts, and net pay, as well as the wage earner’s name and mailing address and the employer’s name and mailing address. In most cases, it will also include figures for all income earned and withheld amounts for the calendar year. If any of this information is missing, consider it a red flag for potential fraud.

A manual review process can spot these common errors, but humans are prone to errors, especially after reviewing numerous documents. Also, as fraud becomes more sophisticated, the signs of document tampering are becoming less readily detectable to the human eye without special analysis tools. Performing these checks and calculations can be tedious and time-consuming. In this environment of increasingly sophisticated fraud, automated and advanced AI solutions are the best way to spot fake paystubs.

How Do Lenders Verify Paystubs?

Lenders often require mortgage borrowers or other loan applicants to supply two recent paystubs to verify their income. Some lenders review the paystubs manually, with one or more reviewers studying the documents and calling employers to verify their legitimacy. These manual reviews can take hours, require multiple touchpoints and multiple people in the process, and can rely on employers being willing and able to confirm information, all of which can result in long waits, human error, mistakes, and inaccuracies.

However, increasing numbers of lenders rely on automated processes and automation software to review and verify paystubs submitted by loan applicants. For example, Detect from Ocrolus uses advanced signals and visualizations to detect signs of document tampering. With algorithms that have been trained on more than 100 million pages of documents, Detect can evaluate a document’s origin, inspect it for signs of tampering, and illustrate exactly where any tampering has occurred on the document.

Book your demo

See how to spot fake paystubs with Ocrolus

Process and Verify Paystubs with Ocrolus

Regardless of a paystub’s format or image quality, Ocrolus can retrieve data to

- Verify borrower income in minutes.

- Develop robust, data-driven income assessments.

- Increase originations with an expedited underwriting process.

- Identify suspicious activity and potential fraud with tampering detection.

When lenders use automation software, like Ocrolus, for paystub verification, they can process and verify paystubs and other documents instantly or in minutes. This allows lenders to speed up their lending and approval processes, uncover more fraud, make more informed decisions, avoid costly losses, and streamline application reviews.Connect with one of Ocrolus’ automation experts to find out how Ocrolus can help you spot fake paystubs faster and more accurately. Book your free demo today.