This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

How to Spot a Fake W2 Using Automation Software

During the application process for a personal loan or mortgage, a loan applicant might submit a W2 when asked for income verification. Because technology has made it easier for fraudsters to create fraudulent financial paperwork such as W2s with templates, altered documents, and doctored images, some loan applicants will provide fake W2 forms to try to get loans for which they may not qualify. For lenders, it’s important to be able to quickly detect fake W2s to avoid approving loans based on false information. Lenders must be able to review and verify W2s either manually or with the help of intelligent automation software.

How to Identify Fake W2s

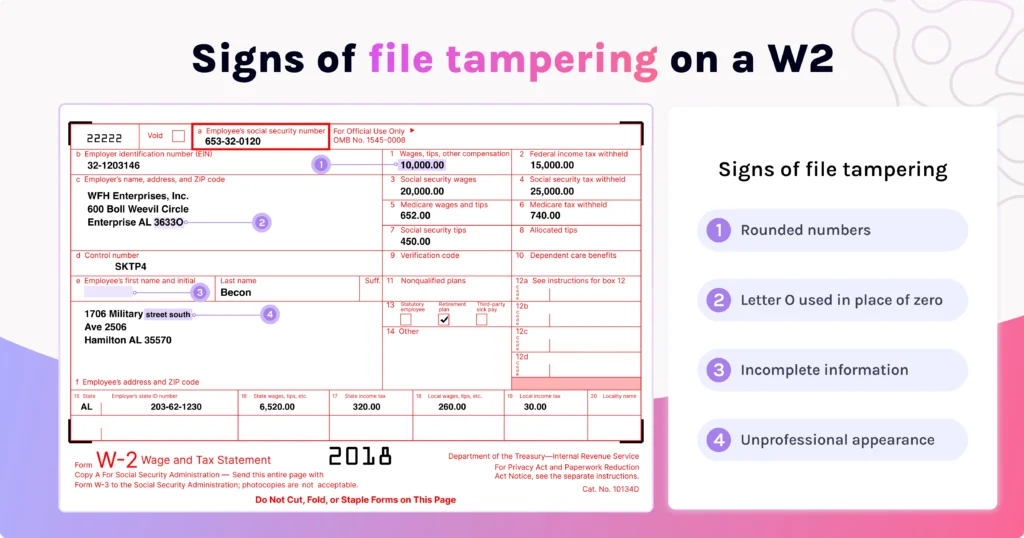

A fake W2 can often look very similar to the real thing. As fraudsters become more creative, detecting the signs of tampering becomes increasingly difficult for lenders and financial institutions with dwindling resources to double-check the legitimacy of W2s. Although fake W2s may look authentic, several common differences can help lenders spot a counterfeit. A W2 might be fake if it includes some of these basic signs of file tampering:

- Letter O used in place of zero. If the letter O is used where there should be the number 0, the document may be fraudulent. The letter O and the number 0 look similar, but eagle-eyed bookkeepers or accountants can typically see the difference.

- Rounded numbers. W2s report a person’s total wages from a specific employer for a particular year—and that figure is hardly ever an even amount, like $80,000. Perfectly rounded numbers on a W2 should be a red flag for lenders working to detect fraud.

- Unprofessional appearance. A W2 that includes unusual fonts, varying font sizes, improper alignment, or blurry text may be fraudulent. A bona fide W2 will look like an official document with a standard, professional layout and consistent font sizes and types.

- Incomplete information. If a W2 is legitimate, it will include the total income earned for the calendar year, taxes withheld, and benefits provided. The W2 will clearly display the wage earner’s name and mailing address and the employer’s name and mailing address. W2s lacking this information may be fraudulent and should be investigated further.

In today’s world, advanced AI solutions and automation are the best way to spot fake W2s. Automation is used successfully in other lending processes. As fraudulent loan applications increase, intelligent automation software is the solution for lenders who want to spot fake W2s and manage document fraud detection quickly and reliably.

How Do Lenders Verify W2s?

Lenders typically verify W2s through a manual review process. That process includes one or more sets of eyeballs scanning the document and looking for any of the common signs of fraud mentioned above. Some lenders go further, verifying employment by contacting the employer listed on the W2. Unfortunately, some fraudulent document services will provide falsified employment information when a lender calls. Lenders sometimes also ask loan applicants to supply their tax returns in order to verify that the income included on their W2 matches the totals on their tax returns. However, an applicant who creates a fake W2 might also create a matching fake tax return.

Manually reviewing and approving W2s often involves multiple reviewers and can be costly and time-consuming, limiting the number of loan applications that can be accepted and reviewed. In addition, humans are prone to fatigue and errors, especially after reviewing many similar documents.

While human staffers play an important role in verifying financial documents, automated fraud detection can alert humans when a document contains red flags for fraud that the human eye may miss. With hybrid Human-in-the-Loop and automated solutions, Ocrolus can help process and analyze W2s with the highest accuracy. For example, using automation and machine learning, Ocrolus supports data extraction and fraud detection for W2 forms for faster, more accurate lending decisions.

Book your demo

See how to spot fake W2s with Ocrolus

Spot Fake W2s with Ocrolus

Although some common signs of fraud are easily detectable through manual document review, trusting fraud detection to the human eye alone poses a considerable risk to financial institutions. Not only are humans prone to error, but it takes a lot of time for multiple people to closely review each W2 or other financial document submitted. As fraud becomes more sophisticated, it’s increasingly difficult for human reviewers to detect fraud or document tampering without special tools for analysis.

Ocrolus can help to catch the more sophisticated forms of tampering on W2s by:

- Finding misaligned fields. The Ocrolus model finds fields that are misaligned based on their location on the document and relative to other similar fields. Misalignment can be found down to just a few pixels, which can be very difficult for even the most trained sets of eyes to catch.

- Determining if fields have been added or edited. Ocrolus can determine whether fields and their values are original to the document or have been added later. In many cases, fraudsters will use the same font already on the document or the most similar font they can find, which might fly under the radar when reviewing visually, but Ocrolus can identify these edits at the machine level and alert reviewers.

- Detecting if editing software has been used. When documents are tampered with, the software used to make the edits leaves behind clues in file information that aren’t perceptible by looking at the document. Ocrolus finds these breadcrumbs left behind by these types of software and notifies users.

- Checking the document source. Not only will fraudsters alter existing documents, but they may also even create totally new and fictitious documents. Ocrolus can determine if the W-2 has been created by software that doesn’t match expectations – something that is not possible with the naked eye.

In today’s world, advanced AI solutions and automation are the best way to spot fake W-2s. Automation is used successfully in other lending processes. As fraudulent loan applications increase, automation software is the solution for lenders who want to spot fake W2s and manage document fraud detection quickly and reliably. With Ocrolus automation, lenders can analyze and verify W2s, bank statements, pay stubs, and other documents almost instantly, more in-depth, and more consistently, relieving human staffers of rote work and freeing them up to investigate documents that have been flagged for potential tampering. Ultimately, using automation improves accuracy and speeds up lending and approval processes.

Speak with one of Ocrolus’ automation software experts to find out how Ocrolus can help you spot fraudulent W2s faster and more accurately and save you from costly losses down the line. Book your free demo today.