This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

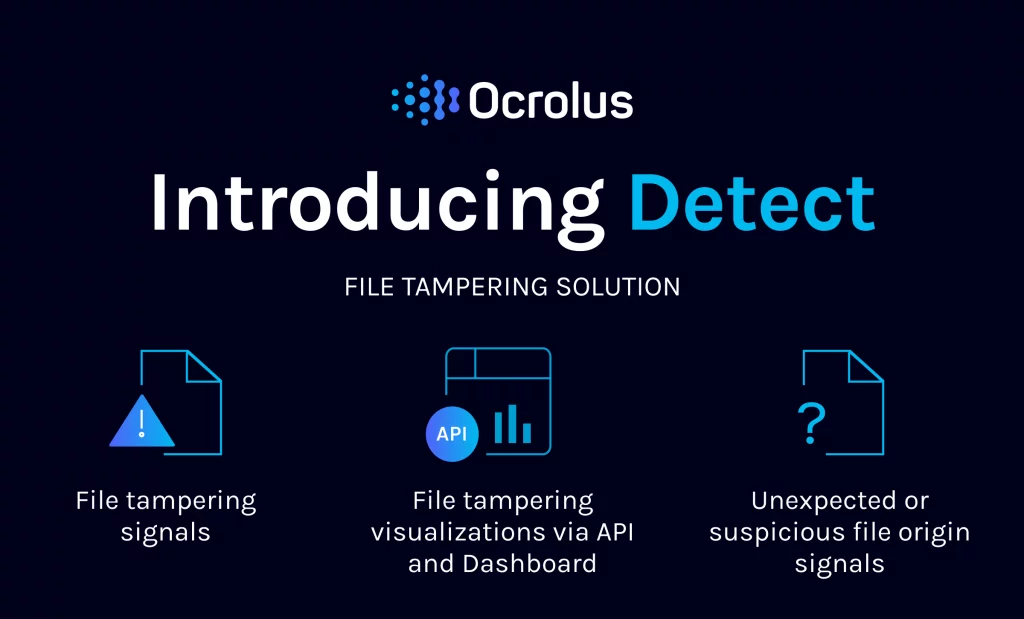

Detect From Ocrolus: Start Identifying File Tampering Easier Than Ever

Fraud is on the rise. In fact, the FTC estimates that fraud cost Americans $5.8 billion last year. While many businesses have started to implement protection measures, the truth is fraudsters are only getting more and more sophisticated, and businesses need to put policies and technologies in place to help protect them against the growing threat.

To help address these concerns, Ocrolus has introduced Detect. Detect uncovers document fraud and provides high-quality, decision-ready data that helps lenders minimize risk and prevent unnecessary losses. Best of all, this product is fully integrated into the Ocrolus solution and available through our Dashboard and via API, allowing you to streamline and automate your workflows. In its trial period, users reported that Detect helped lenders identify 20% more fraud than they would have otherwise and saved upwards of 30 minutes of review per application.

What is Detect?

By coupling Ocrolus’ vast document database with its unique machine learning (ML) capabilities, Detect processes submitted files and provides users with file origin signals, file tampering signals, and file tampering visualizations. Together, these tools enable fraud analysts to make quicker lending decisions and confidently process more loans.

Fraud detection features

File origin signals identify where a document has originated, allowing lenders to evaluate if it should be considered authentic or not.

File tampering signals provide information about how a document has been modified after it was created, helping lenders uncover how and where key pieces of information may have been changed. By providing details on name, monetary amount, transaction description, or even date changes, these signals enable lenders to have the right level of context for evaluating a case.

File tampering visualizations make it quick and easy to recognize instances of file tampering on each document and also provide lenders with the ability to review original documents and tampered documents side-by-side.

Interview with David Snitkof, Ocrolus’ VP of Product, Analytics

Hear from David as he explains the significance of this product release and why he believes it can help alleviate the financial burden of fraud across lending verticals.

What have been lenders’ traditional options for fraud detection?

DS: Fraud is an unavoidable problem in lending, and it can be challenging to stay ahead of fraudsters. The most well-prepared lenders employ a combination of tactics, ranging from vendor solutions to proprietary algorithms, but they are always looking to expand their arsenal. Unfortunately, these solutions haven’t traditionally focused on document fraud, which has increased in prevalence over the past few years.

How has Detect changed from its first iteration?

DS: We’ve completely rebuilt Detect from the ground up, leveraging our massive document library and unique machine learning capabilities. Most importantly, our team has taken the time to work with clients and understand which fraud cases are most challenging for them to identify and where Ocrolus can provide the most support. Thanks to that insight we were able to develop Detect to not only tell whether a document has been tampered with, but to contextualize exactly what fields were tampered with and often how they were altered.

What feature in Detect makes you the most excited?

DS: For our customers, I’m excited to offer them the opportunity to catch more instances of file tampering than ever before. Detect features a seamless integration between a fully-automated, API-driven fraud detection solution and a highly-usable interactive dashboard, meaning it’s not only accurate but extremely easy to use. More specifically, the ability to visualize a tampered document side-by-side with its reconstructed original version is also a ‘wow’ moment for our clients and paints a vivid picture of how fraud is taking place.

What kind of impact can Detect users expect to see on their workflows?

DS: Detect runs automatically within Ocrolus, allowing lenders to generate signals of potential fraud without adding time, complexity, or manual steps to their existing processes. Working with our clients in the development of this product helped reinforce our understanding of fraud as an exceptions-based process, where lenders will ultimately need to weigh the fraud signals on a document that has been flagged against their own risk tolerance, operational practices, and desired customer experience. The combination of a simple, comprehensive API, an intuitive visual dashboard, webhook notifications, and email alerts gives clients the ability to tailor Detect to meet their needs.

What’s coming next?

DS: Detect is one of our key investment areas at Ocrolus, and clients can expect to see a fast cadence of enhancements and expansion. Without spoiling any surprises, future releases will increase the scope, detail, and precision of our ability to detect potential fraudulent behavior in document-centric lending workflows.

Interested in trying out Detect for yourself? Book a free demo now and add automated fraud detection to your workflow.