“Building Trust and Efficiency” – Excerpt from eBook: Building a Trusted and Efficient Automated Mortgage Workflow

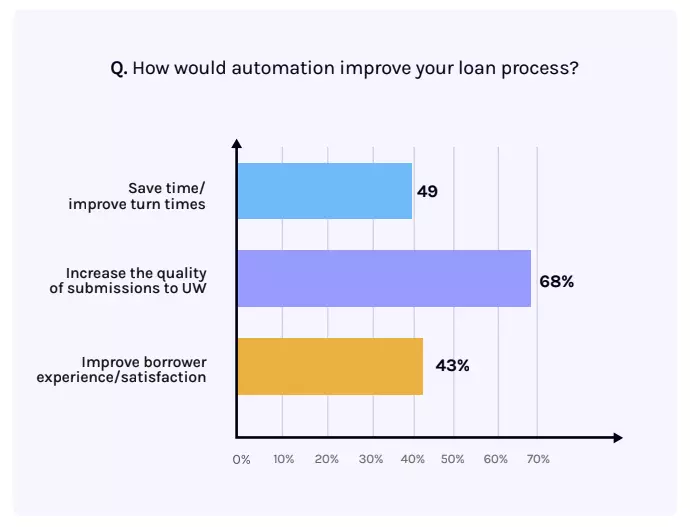

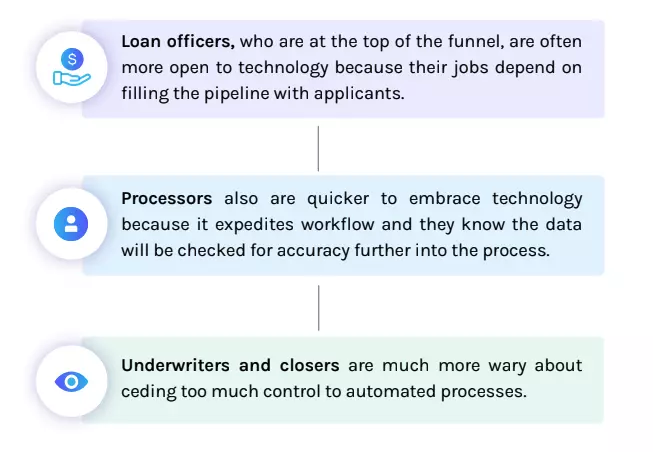

The lifeblood of mortgage loan processing is accurate data. The more technology can help to ensure data accuracy, the faster it will be embraced by sales, underwriting, and closing teams. Facilitating accuracy also will improve the quality of submissions to underwriting and improve borrower experiences.

The criteria for trust changes depending on what stage of review a mortgage is in. But all key stakeholders rely on a trusted process:

Each typo or missing piece of information can be seen as a major failure when 100% accuracy is required. There is very little wiggle room to make corrections once a mortgage goes from closing to funding. A mistake that needs to be rectified past the funding stage can be very costly and time- consuming to rectify. One of the important internal selling points for technology is that it can help prevent these types of errors from turning into expenses.

Successful mortgage lending requires that key stakeholders trust each other, the borrower and loan information, and the analysis at each step in the process. Accuracy is mission-critical for performing analytics; making loan decisions and building trust entails both workflow transparency and actionable data.

“Automation is good, but a lot of manual entries are still required for accuracy.” Another underwriter added: “The industry has very little tolerance for errors.”

Underwriters

Automation that reduces errors and improves quality will help build trust. For example, underwriters will be more open to automation if they can clearly see that it improves the accuracy of the information they receive from loan processors.

– excerpt from Ocrolus ebook Building a Trusted and Efficient Automated Mortgage Workflow