This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Fintech Lending: 2022 Market Map and 5 Trends Shaping the Industry

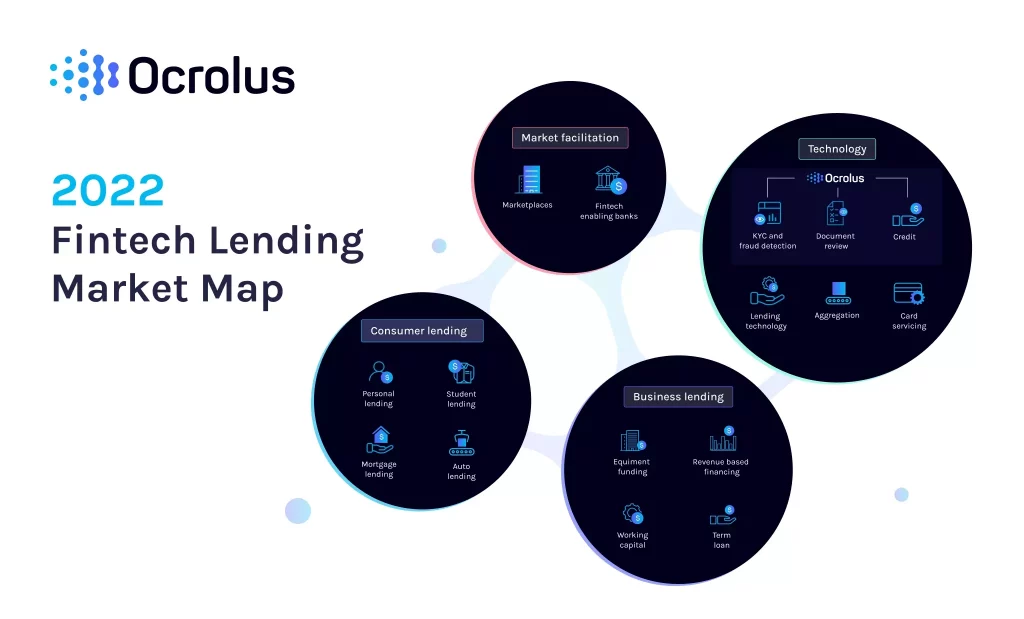

Our third annual Fintech Lending Market map provides a detailed consumer and business lending ecosystem overview. The map features four main sections: sourcing, consumer lending, business lending, and technology.

The sourcing and consumer lending landscape shows the most change compared with last year. By contrast, the business lending and technology categories have remained relatively stable.

Five trends shaping the marketplace include the mortgage market slowdown, higher demand for automation, increasing use of artificial intelligence (AI) by fintechs, continued interest in fraud detection technology, and an easing of volatility in the automotive sector.

Disclaimer: Hover over the icons to see the detailed map

Mortgage market slowdown

Rising interest rates and economic volatility cooled the mortgage market in 2022. Both the Mortgage Bankers Association, and ATTOM, a leading curator of real estate data, reported significant drops in residential mortgage lending. According to ATTOM, new mortgage volume declined by 32% in the first quarter of 2022 compared with the same period a year earlier.

Despite the market volatility, more than a dozen new companies were added to our mortgage map in 2022, while fewer were removed. The latest additions include ARC Home Loans, Deephaven, Divvy Homes, EasyKnock, Flyhomes, GoodLeap, Guaranteed Rate, LoanSnap, Newfi, On Q Financial, Reali, Regions, Resource Financial Services, and Staircase.

While the 2022 map reflects a robust consumer lending ecosystem, many mortgage companies feel the economic headwinds. According to Fannie Mae, loan origination volume was expected to fall by 47% this year, prompting belt-tightening by mortgage lenders. Loan volume dropped from $4.57 trillion in 2021 to a projected $2.44 trillion in 2022. Fannie Mae also forecasts a 16.25% drop in total home sales for the same time period, from 2021 to 2022.

Many mortgage companies with historically high volumes in 2020 and 2021 initiated layoffs in 2022. There also has been some disruption due to business re-alignments and closures.

The consumer mortgage market has historically been characterized by boom/bust cycles. Layoffs and cutbacks in 2022 were similar to the industry contraction in 2017/2018 when reduced home buying demand cooled the market. Continued volatility into 2023 could create conditions in the housing market similar to those following the 2007/2008 financial crisis.

More demand for automation

Increasing volatility underscores the need for mortgage lenders to use automation to provide more flexibility and scalability. Laying off well-trained staff is costly in terms of lost human equity and the expenses associated with severance, unemployment benefits, and re-hiring. For example, the average cost to lay off and rehire a loan officer is $27,000.

Automation is a cost-effective way for mortgage companies to mitigate the need for massive changes in staffing volume in response to markets getting softer or stronger. Total loan production costs in the United States are about $11,000, with personnel costs accounting for more than $7,000. Automation that reduces employment volatility and increases productivity ultimately benefits the bottom line of mortgage lenders

The relative stability of the technology section of our lending map indicates the continued strong demand for automation solutions. Both consumer and business lenders use automation for everything from managing lending workflows and credit card servicing to document review and fraud detection.

Increasing use of artificial intelligence by fintechs

Fintech technology is rapidly evolving, and in terms of the lending market, several fintechs gained traction in 2022, including Bancorp, Cross River, Green Dot, and Stride Bank.

AI is helping fintechs increase productivity and accuracy while reducing staffing volatility. Machine learning, in particular, facilitates document processing automation, improves the accuracy of lending decisions, and enables fintechs to identify potential fraud more efficiently.

Automation powered by machine learning also is emerging as a robust risk management tool, allowing mortgage lenders and fintechs to identify fraud and improve the accuracy of lending decisions. AI enables documents―such as bank statements, paychecks, and W2s―to be automatically parsed, processed, and analyzed.

Continued interest in fraud detection technology

Another trend gaining traction is the use of automation for fraud detection. That category on our 2022 map remains unchanged this year thanks to solid demand from fintechs for technology to help improve loan due diligence. Moreover, a recent study by Ocrolus found that fraud detection automation helped lenders identify 20% more fraud than a conventional review. It also cut review time by 30 minutes per application―reducing loan processing overhead for lenders.

In general, fraud detection technology―and automation solutions―give fintechs the ability to harness big data for lending decisions. Automation streamlines the review process and makes it easier for human experts to analyze loan applications for anomalies and potential fraud.

Less volatility in the automotive sector

While mortgage lending is impacted by market volatility, the automotive sector stabilizes. As our 2022 map suggests, the consumer automotive lending sector is recovering from supply chain problems and a leveling-out of supply and demand. Five new fintech lenders were added to this year’s map, including BECU, Honda Financial Services, Navy Federal Credit Union, PenFed, and Westlake Financial.

The automotive lending market is slowly returning to pre-pandemic levels. However, higher interest rates may slow growth over the coming year. Demand for new cars slowed during the pandemic due to a combination of more work-from-home and higher prices resulting from a shortage of automotive computer chips. The availability of government stimulus incentives helped consumers mitigate higher costs and shored-up demand during the pandemic.

Looking ahead, automation will enable lenders to make faster, more accurate decisions―with fewer employees in the loop. In the mortgage market, machine learning automation should prove especially beneficial to fintechs as they balance reduced staffing with the need for due diligence and efficiency.

If you know of a company that should be considered for inclusion in our Fintech Lending Map, please share their information with us at: marketing@ocrolus.com.

Wondering why the world’s top fintech lending companies rely on Ocrolus technology to deliver streamlined and automated financial services to their customers?

Schedule a demo today to find out more.