The New Ocrolus Encompass Integration and Product Suite

After years of overpromising and underdelivering, mortgage automation appears to be gathering momentum. While many mortgage originators are now embracing digitization, automated workflows still encounter resistance and worries about the potential for error and risk. However, progressive lenders know they must embrace automation in order to stay competitive in a rapidly changing market, one in which traditional 30-60 day loan cycles have millennial borrowers looking at modern, cloud-oriented lending options.

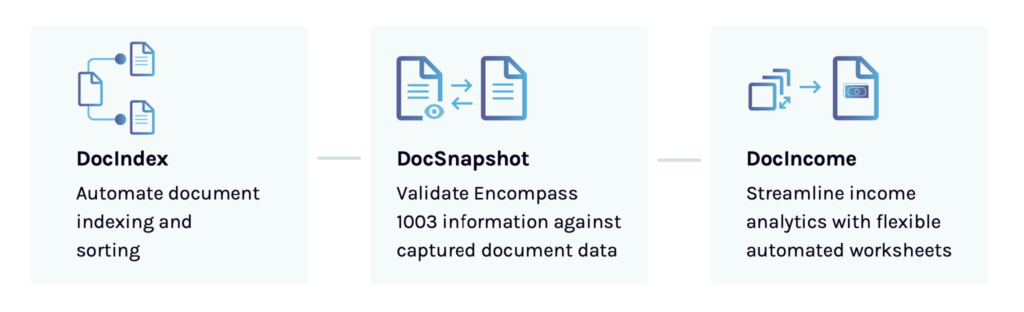

To help address mortgage originators’ concerns, Ocrolus has introduced the Encompass Product Suite. This product includes three applications: DocIndex, DocSnapshot, and DocIncome, which together can help lenders accelerate mortgage approvals with more confidence in borrower-supplied documents and data. These apps can be called directly from within Encompass, helping all mortgage professionals improve review cycles, and create workflows that both mitigate risk and encourage humans to work with technology, rather than against it.

DocIndex will help to speed up loan processing times with automated document indexing. You’ll be able to automatically identify document types, break collated files into separate documents, and push individual documents to corresponding containers.

DocSnapshot will help you easily verify and identify potential data discrepancies in the URLA form within Encompass. You’ll be able to view side-by-side comparisons of existing borrower 1003 information with data extracted from loan documents by Ocrolus.

DocIncome will help you streamline income calculations with an automated, transparent, and flexible worksheet. You’ll be able to save time from manual income calculations and avoid human errors earlier in the process.

Suzanne Ross, Ocrolus’ Director of Product in Mortgage, explains the significance of this product release and why she believes the mortgage industry is ready for a process change.

- What makes you think mortgage lenders are ready to automate?

SR: The industry has shifted dramatically over the past couple of years thanks to a variety of factors including, the pandemic, the purchase boom, the refinancing boom, and a new generation of borrowers. However, it still remains a largely manual process. Even so, other industries have automated their services significantly, and the world is getting used to more touchless, efficient buying processes across every purchase. The current loan closing timeline of 45-60 days is an eternity for this generation’s borrowers and lenders are taking notice. Already, lenders who have started to automate and provide instant borrower services are seeing lift while the rest of the industry is stalling out.

There is a “Darwinism” in the mortgage industry that happens every 10 years or so, and I think the next wave will be focused on who is able to automate and provide a better experience for their borrowers. However, this automation will have to be balanced with the strict need for accuracy and compliance that allows for the sale of loans on the secondary market.

- What was the inspiration behind the development of these products?

SR: Automation in mortgage lending is a very difficult undertaking because even with the most qualified borrowers, there is a lot of risk that lenders are asked to take on. Furthermore, the nature of mortgage lending in an ever-changing market with a diverse portfolio of loan types and guidelines, makes it difficult for machine learning to keep pace. Thus, our goal became to create a solution that instead of completely replacing the human decision-makers, found ways to automate repetitive tasks and shorten the loan life cycle while keeping humans focused on critical decision making.

- The new Encompass product suite is set up to address the demand for automation in the mortgage industry, specifically by Encompass users. What is new about the Ocrolus Encompass product suite that supports those needs for Encompass users?

SR: The Encompass product suite offers automation support through simple and intuitive interfaces that are accessed seamlessly within Encompass. Furthermore, each application can be used multiple times for multiple purposes throughout the loan life cycle. The best part, however, is that the functionality relies on actual data extracted from the borrower loan documents rather than the typical data input workflow offered by Encompass (or any LOS) on its own. With this integrated interface, Encompass users will be able to shorten turnaround times and move forward with peace of mind.

- Which part of the product suite makes you most excited?

SR: It’s honestly hard to pick! Different types of lenders will benefit most from different products, so I’d have a different answer depending on who’s asking. However, I will say each of the products offers a ton of flexibility and can be used in different ways and multiple times across the lending process, offering much-needed support and functionality to a variety of roles. For example, the way a Loan Officer uses DocIncome will be completely different from how an Underwriter uses it, but by simply being used, the application will build more efficiency, reliability, and transparency into the lending process.

- What results can Encompass users expect to see?

SR: The benefits could go on indefinitely but most importantly it will provide transparency and efficiency to the mortgage lending process. In terms of transparency, each feature used will provide automated output forms that load into the efolder to capture historical information and store it for reference. In terms of efficiency, the products will provide hours back to Encompass users by processing exponentially more documents, faster while also extracting the key information within one screen. For additional transparency and peace of mind, users will be able to immediately edit or override the loan file data within the 1003 without having to toggle back and forth.

Overall, Encompass users can expect to think of the Ocrolus Encompass integration as an essential part of their workflow to reduce risk and errors, speed up processes, and improve the experience of both employees and borrowers as the strain of manual data entry is eliminated.