Meet the author

Articles by author

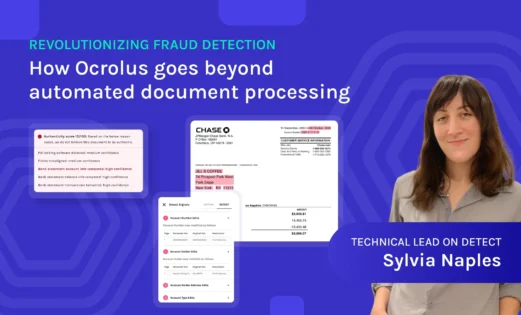

Revolutionizing fraud detection: How Ocrolus goes beyond automated document processing

The digitization of documents has transformed how businesses operate, particularly within the financial sector, where accuracy, speed, and efficiency are paramount. Automated document processing solutions like Ocrolus enable lenders to accelerate reviews and scale on demand. However, in an increasingly digital environment, fraud has also accelerated, leading to significant losses if undetected, making accurate fraud detection an essential component of automated document processing. Techniques such as using online template generators to create artificial documents and tampering with authentic documents to misrepresent information have become increasingly prevalent. At Ocrolus, our goal is to enable lenders to make decisions quickly and confidently…

Harnessing the Power of Machine Learning to Detect Fraud

Machine learning automation is emerging as a powerful risk management tool that mortgage lenders and fintechs can use to identify fraud and improve the accuracy of lending decisions. I’m fortunate to be on the leading edge of this transformation in the financial services sector. Automated fraud detection specifically is an exciting and impactful field, and Ocrolus has the data, infrastructure, and engineering talent to be a leader in the space. Over the past year, I have led a cross-functional team of engineers working on Detect, a new fraud detection solution we developed to help detect financial fraud on bank statements,…