Creating a better borrower experience for small businesses

Small business lending is entering a more restrictive phase, creating both pressure and opportunity for lenders to stand out. With the SBA winding down key lending programs and banks stepping back from the market, small business lending faces new challenges. In Q1 2025, a record 76% of small businesses in Ocrolus and OnDeck’s Small Business Cash Flow Trends Report bypassed banks entirely when seeking credit.

This shift is reflected in the numbers: bank loan inflows dropped 34% year-over-year, while fintech inflows rose only 1%. As competition intensifies and focuses on speed and convenience, lenders have an urgent opportunity to differentiate through superior borrower experience, not just capital access.

Today’s small business borrower demands tech-enabled, responsive lending experiences

Small business owners are no longer choosing funders solely based on access to funds. In a market with multiple options, they prioritize speed, clarity and partnership.

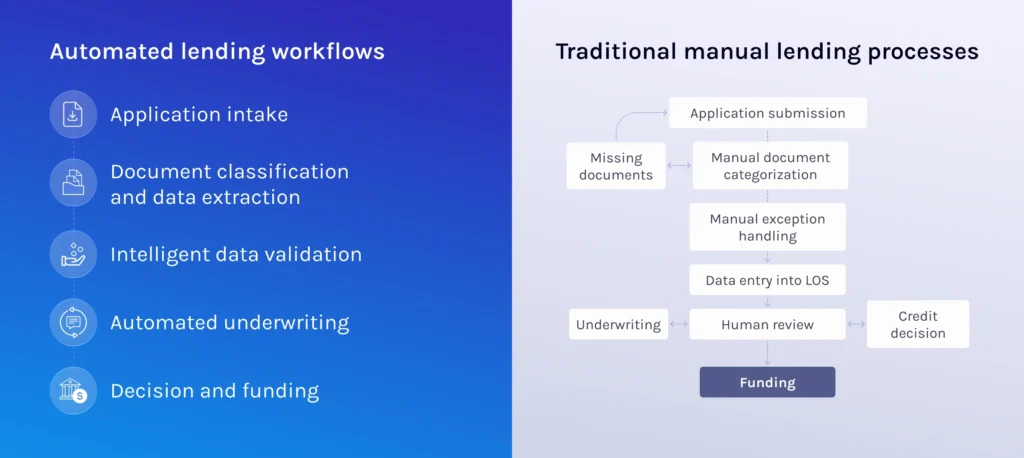

Traditional application processes that run long, lack transparency or contain errors simply can’t compete anymore. SMB lending must evolve to meet modern expectations through automation that streamlines these critical workflows.

Today’s small businesses run on technology and expect their financial partners to do the same. They want responsive, tech-enabled workflows that mirror how they operate their own businesses – efficient, transparent and user-friendly.

Successful lenders understand that small business borrowers need quick decisions and smooth experiences. Those that can’t deliver risk losing applicants to competitors who can.

Lenders need to build for speed and transparency

As lending standards tighten and credit access narrows, small business borrowers apply with greater urgency. Many have already faced rejection elsewhere and seek lenders who can deliver fast answers with minimal friction.

Manual document reviews and inconsistent data handling create bottlenecks throughout the application and underwriting process. These inefficiencies frustrate borrowers and slow down decisions when speed matters most.

Lenders that invest in automation and real-time financial insights can deliver cleaner files, faster decisions and stronger borrower relationships. AI-powered cash‑flow analytics for lenders and intelligent document automation enable teams to identify issues earlier and reduce back-and-forth with applicants.

How Ocrolus helps SMB lenders compete through experience

With Ocrolus, Flinks enabled lenders to implement a customizable docs + digital experience that supports both digital bank connections and document uploads. This flexibility gives small business borrowers greater choice in how they provide financial data.

This integrated approach helps lenders reduce turnaround times, limit funnel drop-off and deliver high-quality, standardized data to inform lending decisions, regardless of source. The results speak for themselves: docs + digital adoption quadrupled in the past year, driving faster and more borrower-friendly workflows.

Ocrolus also enabled Nova Credit to help lenders use real-time cash flow analytics to assess small business financial health, even without strong credit bureau data. By analyzing live bank transactions, income patterns and recurring expenses, lenders gain a near real-time view of small business financials to support more accurate underwriting.

These AI-powered lending tools help lenders expand SMB credit access, reduce risk and deliver a smarter, more inclusive digital lending experience to underserved small businesses. Schedule a demo to see how automation can transform your borrower experience.

Key takeaways

- Small business lending is tightening, with bank loan inflows down 34% year-over-year, creating opportunity for lenders who can deliver superior borrower experiences

- Today’s small business borrowers expect tech-enabled, transparent lending processes that deliver quick decisions

- Docs + digital approaches that combine document automation with bank connectivity quadrupled in adoption over the past year

- Real-time cash flow analytics enable a more accurate assessment of small business financial health beyond traditional credit data

- Lenders who invest in automation can reduce friction, speed decisions and create a competitive advantage through a superior borrower experience

For more insights on how AI is reshaping the lending landscape, explore our AI lending resource center.