The mortgage underwriting shift: From document review to decision intelligence

TL;DR: Mortgage underwriting is not slow because underwriters lack expertise. It is slow because teams spend too much time reconciling borrower documents, application data and LOS fields, then discovering issues late when they become conditions. Decision intelligence pairs audit-ready borrower analytics with human judgment so discrepancies are surfaced earlier, conditions drop and loan quality improves.

Mortgage underwriters are hired for decision-making, but too often they are forced into clerical work. They bounce between PDFs, spreadsheets and LOS screens to answer basic questions: Does the pay stub match the stated income? Do deposits line up with the asset story? Are liabilities complete and consistent?

When that reconciliation happens too late, the file does what files always do. It grows conditions. It adds touches. It creates rework. Borrowers experience it as repeated requests and shifting timelines. Underwriters experience it as cognitive overload that chips away at consistency.

Long cycle times are not a new phenomenon in the mortgage industry, and when timelines stretch, borrower satisfaction suffers. The fix is not faster processing. It is changing how underwriting consumes borrower data.

Underwriters are decision-makers, not data processors

Most underwriting delays do not come from risk assessment. They come from the task load: manual data entry, duplicative calculations, document chasing and rechecking the same figures after the file changes.

That work is expensive because it steals attention from the work that only an underwriter can do: applying policy, evaluating layered risk and making a defensible decision. When underwriters are buried in reconciliation, two things happen at once. Cycle times rise and judgment becomes less consistent across teams and channels.

Decision intelligence is not verification or extraction

Document verification answers, “Did we get the document?” Data extraction answers, “Can we pull fields from it?” Decision intelligence answers, “What does this borrower’s financial story mean, and where does it conflict with the application, supporting evidence or policy?”

Here is the practical difference:

- Verification confirms a pay stub exists.

- Extraction pulls the employer name, pay frequency and gross pay.

- Decision intelligence compares pay stub income to the borrower’s stated income, checks continuity across supporting documents, flags mismatches and ties each finding back to source evidence so an underwriter can take action.

That last step is where conditions are prevented. It is also where timing matters.

Timing is the difference between fewer conditions and more work

Discrepancies are not the enemy. Late discrepancies are.

If issues are surfaced at intake or early in the file’s lifecycle, teams can resolve them before the underwriter has already reviewed the file, before the borrower has been asked three different ways and before the processor has created a condition chain that now needs tracking and clearing.

In other words, insight before conditions, not after.

Ocrolus approach: Regulatory-grade analytics with humans in control

Ocrolus is an AI-powered workflow and data analytics platform that transforms messy documents and digital data into regulatory-grade decision intelligence. For mortgage teams, this means turning borrower documents into structured, contextualized data, then applying analytics that are traceable back to source evidence, with human-in-the-loop validation for accuracy on complex files.

That AI foundation is what enables decision intelligence to show up where it matters: inside the workflow that underwriters already use. Ocrolus Inspect analyzes borrower document data alongside Encompass 1003 application data to uncover discrepancies and surface insights that support file review. It also supports a closed-loop conditioning motion, including linking conditions to specific discrepancies and syncing them back into Encompass workflows.

This is not about taking judgment away. It is about eliminating busywork so judgment can be applied sooner, with better context.

Income, asset and liability analysis that drives consistent signals

Decision intelligence becomes tangible when it standardizes the most variance-prone parts of underwriting:

- Income: Calculations change by borrower profile and documentation. Consistent, transparent analytics reduce spreadsheet dependence and reduce rework when the file evolves.

- Assets: Beyond “funds present,” underwriters need clarity on large deposits, gaps and sourcing questions that predict future conditions.

- Liabilities: Mismatches between borrower-stated liabilities, credit data and application fields create conditions that often appear late and require multiple touches to clear.

The win is not only speed. It is consistency across underwriters, branches and channels, which is also a compliance advantage.

Compliance and capital markets confidence start with consistency

Mortgage quality is judged downstream, and post-purchase reviews serve as a reminder that defects are often manufacturing problems, not intent problems. Fannie Mae’s Quality Insider content regularly highlights defect trends from post-purchase file reviews, enabling lenders to strengthen their QC programs and reduce risk.

Decision intelligence helps here because it creates repeatable, evidence-backed signals. When every file is evaluated with the same analytics and the same discrepancy checks, lenders reduce intra-team variance, lower the odds of overlooked conflicts and build cleaner, more defensible files.

Cleaner files are not just a compliance story. They are a capital markets story, supporting more predictable delivery and fewer post-close surprises.

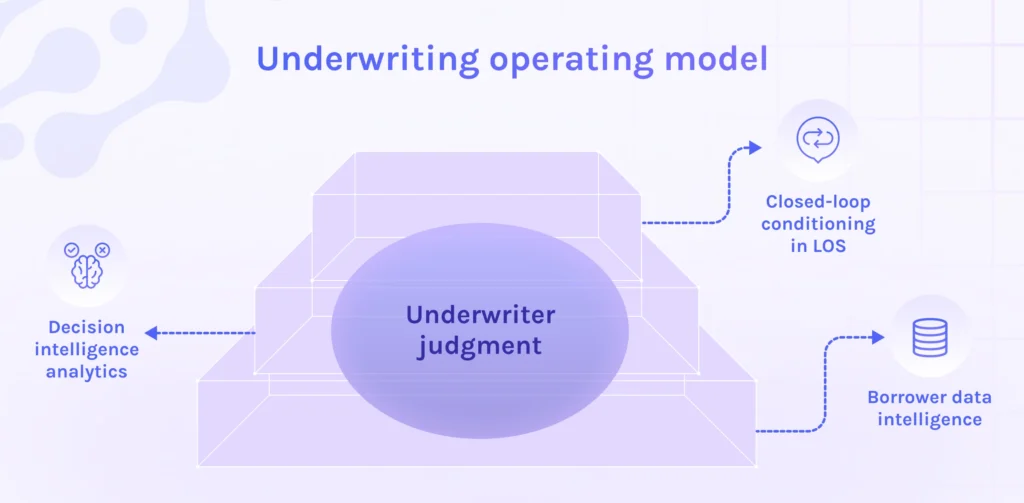

The strategic shift: Decision intelligence as the underwriting operating model

The future of underwriting is not a collection of point tools. It is an operating model where:

- Borrower data is structured and traceable early

- Discrepancies are surfaced before they become conditions

- Conditioning is closed-loop inside LOS workflows

- Underwriters spend their time deciding, not reconciling

That is human and machine collaboration done correctly. The machine standardizes, compares and routes. The underwriter interprets, escalates and decides, supported by decision intelligence that makes mortgage underwriting more consistent, scalable and defensible.

Key takeaways

- Underwriting drag is often caused by reconciliation work and late discrepancy discovery, not a lack of expertise

- Decision intelligence differs from verification and extraction because it compares, contextualizes and ties findings to evidence

- Timing matters: Insight before conditions reduces touches, rework and borrower frustration

- LOS-integrated, human-in-the-loop analytics improve consistency, compliance posture and downstream confidence

- Decision intelligence is becoming the next underwriting operating model, not just another automation tool