Docs-to-digital in the Dashboard: Highlights from our September Product Pulse

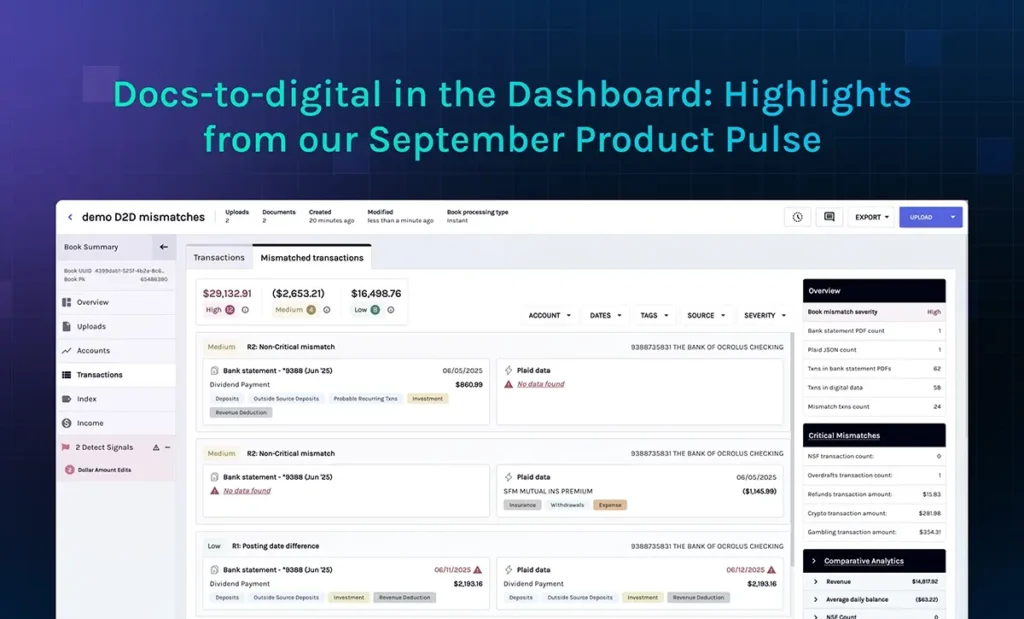

TL;DR: Ocrolus—an AI-powered data and analytics platform—brought Docs-to-Digital into the Dashboard so every underwriter can compare PDF bank statements with digital sources like Plaid, review mismatches by severity, and triage risk without APIs or spreadsheets. Early users report saving 30 minutes or more per matching task in high-volume periods while improving fraud detection by reconciling against immutable digital data. Beta is open now with general availability targeted for mid-November 2025.

In our September Product Pulse, Ocrolus showed how Docs-to-Digital moves from a powerful reconciliation engine to an everyday underwriter experience inside the Dashboard. Led by Anneika “Nike” Patterson, Director of Product (SMB), and Lokesh Borkar, Senior Product Manager, the 20-minute session focused on how teams can spot mismatches faster, triage risk with less effort and keep loans moving without extra headcount. If you missed the session, check out the replay below:

What we showed

The session began with a brief refresher on Docs-to-Digital, which automates matching between borrower-submitted PDF bank statements and digital transaction data sources, such as Plaid. The goal is simple: eliminate manual reconciliation, surface discrepancies quickly and cut review time, especially during busy periods. Customers see time savings of 30 minutes or more per matching task in high-volume scenarios, stronger fraud detection by reconciling against immutable digital data and reduced need for surge staffing when demand spikes.

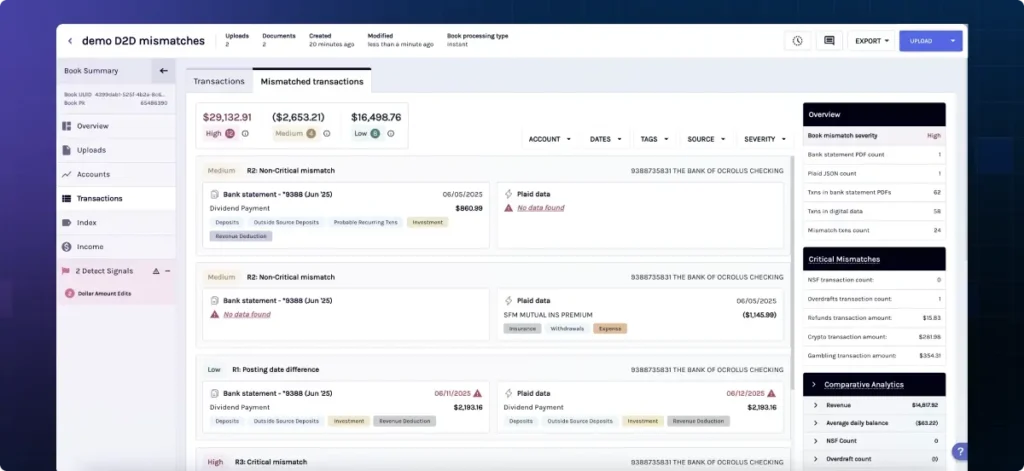

Then we moved into what’s new: Docs-to-Digital is now available in the Dashboard. Underwriters can upload Plaid JSON directly, review mismatches in a dedicated tab with severity scoring and use filters and tags to prioritize the riskiest items first. The interface adds visual triage via summary cards, comparative metrics and roll-ups across categories like NSFs, crypto and refunds so that reviewers can orient quickly without spreadsheets or API calls.

How underwriters use it

Nike framed the everyday workflow succinctly: compare what the borrower submitted with what the digital source shows, then resolve deltas. With the Dashboard experience, every underwriter, regardless of technical setup, can run the check, scan the severity-ranked list and click into the transactions that matter. That consistency reduces handoffs and accelerates decisioning. The capability is purpose-built to automate the manual, time-consuming process of comparing bank statements with Plaid transaction data and to streamline pre-funding checks while reducing fraud risk.

Lokesh highlighted how this pairs with cash flow analytics to move evaluation earlier in the funnel without losing rigor. When exceptions surface, underwriters can validate quickly instead of starting an ad hoc spreadsheet, and managers get a clearer picture of where risk clusters across files.

Live demo moments

Three moments resonated for most attendees during the demo:

- Severity-driven triage: The mismatched transactions tab classifies differences as high, medium or low, so reviewers start with the most material items. It’s a small UX choice with a big impact on time-to-decision.

- Visual roll-ups: Summary cards and category roll-ups (NSFs, crypto, refunds) provide an at-a-glance risk profile before diving into line items, making it easier to explain rationale in audits.

- Faster setup: Direct upload of Plaid JSON eliminates the need for waiting on integrations. Teams can standardize reconciliation immediately inside the Dashboard.

Availability and what’s next

Docs-to-Digital in the Dashboard is open through the Ocrolus Beta Program, with general availability targeted for mid-November. If your team is preparing for seasonal volume or staffing constraints, early use can help shave review time while strengthening fraud resilience. If you’re interested in joining the Beta, please reach out to your account manager!

If you rely on digital data sources like Plaid and receive borrower statements as PDFs, this is a fast path to standardize reconciliation and get a repeatable, explainable process that scales.

Key takeaways

- Docs-to-Digital now lives in the Dashboard, bringing automated reconciliation to every underwriter without APIs or spreadsheets

- Teams save 30+ minutes per matching task during high volumes while improving fraud detection with checks against immutable digital data

- Severity scoring, filters, tags and visual roll-ups enable faster, more consistent triage and clearer audit narratives

- Beta is available now, with GA expected mid-November